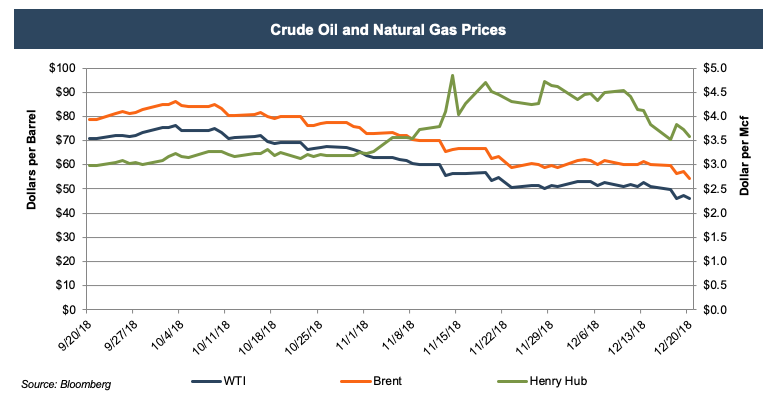

As the calendar turns to 2019, we turn our attention to the Appalachia region, and not by coincidence. Cooler temperatures in the winter months tend to lead to increased natural gas prices and consumption, and the Appalachia region is the largest natural gas producer in the country. Fourth quarter energy prices moved in opposite directions—crude prices declined steadily over the period and natural gas prices increased from about $3.0 to $3.5 per Mcf, peaking at over $4.8 in mid-November.

November Price Spike

In its December edition of the Short-Term Energy Outlook, or STEO, the EIA reported the price of Henry Hub averaged $4.15/MMBtu in November, up 87 cents, or 27% from October. It attributed this increase to colder temperatures and lower inventory levels. The EIA estimated that inventory in the U.S. stood at 3.0 trillion cubic feet at the end of November, which was 19% lower than the five-year average.

Increased production, spurred by the season and higher prices, has increased supply to meet demand to a degree.

Declining nearly 26% since its peak six weeks prior, the run-up in natural gas prices appears to have only been temporary. As we discussed with crude oil in our Q2 newsletter, higher inventory helps to smooth price volatility in the energy market. During this part of the year, natural gas inventories are drawn down as people fire up their heating units, but this year the initial draw down of inventories hamstrung as U.S. natural gas inventories began the season at a 15-year low. Increased production, spurred by the season and higher prices, has increased supply to meet demand to a degree. Milder weather forecasts and energy substitutes (coal) have reigned in prices as well.

As we alluded to recently, the price spike was also due in part to short covering by hedge funds in response to the rapid decline in crude prices. Worried investors diverted funds from oil to gas to compensate for accumulating losses in oil. Given the smaller nature of the gas market compared to oil, there was an uptick in activity and prices. Quickly rising prices led to an overbought market that subsequently corrected and has been trending downward with trading volume throughout the end of the year.

Appalachian Ethane Storage Hub

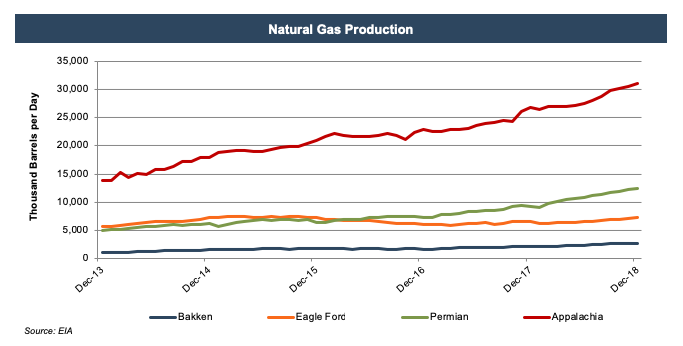

At the beginning of December, the U.S. Department of Energy published a report to Congress on the feasibility of establishing an ethane storage and distribution hub in the United States, specifically, the Appalachia region. The report noted that significant production growth is expected to occur in the Permian and Appalachia, though the latter trails the former in terms of current infrastructure (95% of ethane storage in the U.S. is located near the Gulf Coast). Storage hubs balance seasonal supply and demand variations, and are crucial to smooth volatility, as evidenced by the November activity. The report notes that a distribution hub near the Marcellus and Utica plays would help allay geographic concentration risk along the Gulf Coast that is susceptible to severe weather events (e.g. Hurricanes Harvey and Irma). While such a hub would provide a competitive advantage, the report crucially notes it would not be in conflict with further expansion of infrastructure in the Gulf Coast.

U.S. Secretary of Energy Rick Perry, who signed the report, said, “There is an incredible opportunity to establish an ethane storage and distribution hub in the Appalachian region and build a robust petrochemical industry in Appalachia.” While the report focused on the economic benefits of a hub, detractors note the lack of consideration of environmental costs. It remains to be seen how this will impact production and pricing in the region, but it would undoubtedly be a boon for the region and the industry.

Rig Counts and Production

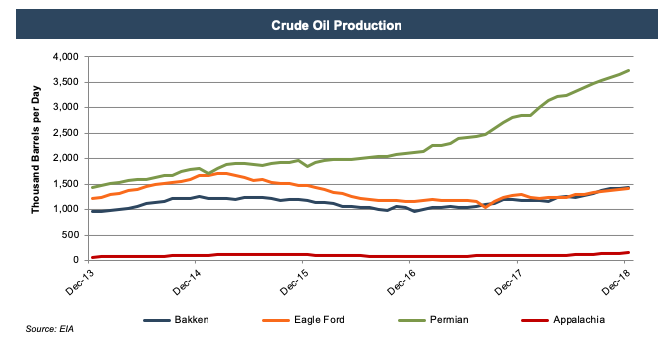

According to calculations based on data from Baker Hughes, rig counts in North America increased 2.9% in the last three months and 16.6% over the last twelve months. The Permian Basin led the way and currently has just fewer than 500 rigs, representing about 46% of total rigs in the U.S. By comparison, the Appalachia region has had below 80 rigs since July 2015 though it has remained relatively consistent, above 70 since last May.

Though production has spiked, Appalachia significantly lags the other regions in terms of total production.

Oil production in the Marcellus and Utica plays has increased by 45.1% in the past year, growth even higher than the Permian. Though production has spiked, particularly in the second half of the year (up 34.8% since June alone), it’s important to recognize the magnitude: Appalachia significantly lags the other regions in terms of total production.

Natural gas is the major focus of the region, where production has increased 15.5% in the past year, trailing both the Permian (34.1%) and the Bakken (25.1%). Again, size plays a role in these growth figures as Appalachia has about 2.5x the production than the next largest play, the Permian. A deeper dive into the DUCs tells a slightly different story, however, with the inventory of drilled but uncompleted wells declining 17% in the region over the past 12 months. This could temper the rate of growth for production for the region in 2019 if drilling in the regions doesn’t increase.

Valuation Implications

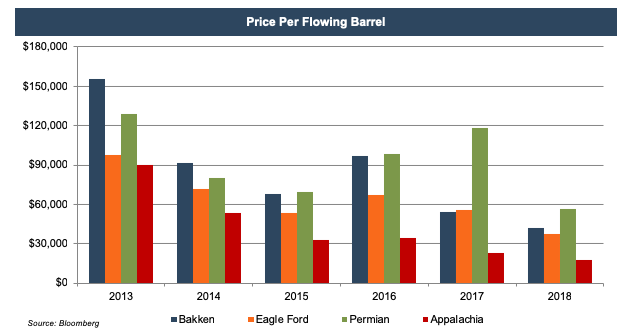

Appalachia has consistently lagged the other regions in terms of EV/production multiples, also known as price per flowing barrel. The Permian took center stage in 2017 but has retreated back to the rest of the pack. The lower multiple seen in Appalachia is largely due to declines in enterprise values, though increasing production has played a role as well.

Despite the recent increase in price, the EIA expects increased production in 2019 will cause the average price of natural gas to drop 6 cents, compared to 2018, to $3.11. This could explain why key players in the region are seeing lower stock prices.

Range Resources is the largest natural gas producer in the Marcellus, but it has not seen a positive impact from higher prices over the past few months. The company’s share price has dropped further than the overall market, but this cannot solely be attributed to swings in natural gas prices. While Range’s share price has dropped along with the recent slide, it did not get the same treatment when the market spiked in mid-November. Since its long-term debt obligations do not begin to mature until 2021, the drop in share price has had a significant impact on its enterprise value. Range is uniquely positioned with capacity on the Mariner East 1 pipeline that will allow it to tap into the rising global demand for NGLs, so there is potentially an upside to its current price.

Conclusion

Natural gas prices have followed a curious path in the past three months with index prices spiking at the Henry Hub, but gas being flared in record proportions and even given away at a loss in the Permian. While pricing will remain dynamic, there are certainly positives for natural gas producers heading into 2019 with the potential for an ethane storage hub in the Appalachia region and a ramp-up in production of NGLs to satisfy the global market.

We have assisted many clients with various valuation needs in the upstream oil and gas space in both conventional and unconventional plays in North America, and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.