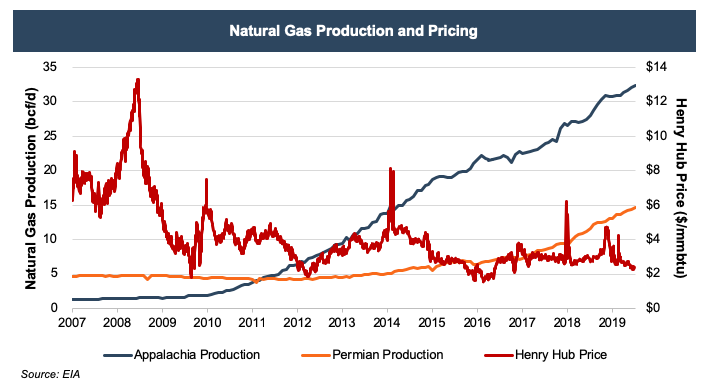

Appalachia and the Permian are responsible for much of the United States’ surging natural gas production, resulting in relatively low benchmark prices.

However, difficulties capturing, storing, and transporting natural gas mean that large regional price differentials can occur.

However, difficulties capturing, storing, and transporting natural gas mean that large regional price differentials can occur.

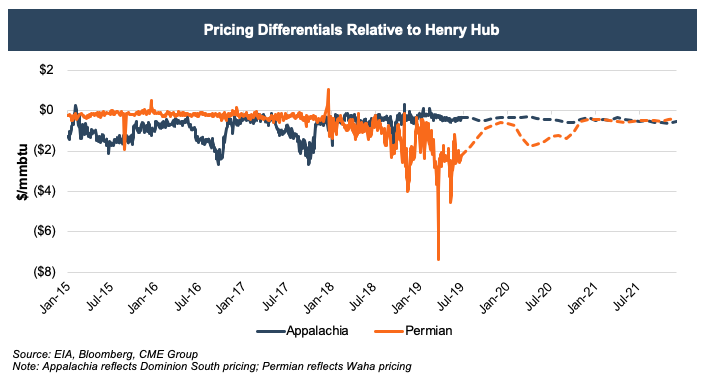

While Appalachia price differentials have narrowed significantly, Permian pricing differentials have widened, often resulting in $0 or sometimes negative realized prices.[1] Going forward, futures prices imply a modest widening of the Appalachia basis over time, while the Permian basis will not stabilize until 2021.

While Appalachia price differentials have narrowed significantly, Permian pricing differentials have widened, often resulting in $0 or sometimes negative realized prices.[1] Going forward, futures prices imply a modest widening of the Appalachia basis over time, while the Permian basis will not stabilize until 2021.

Appalachia Takeaway Constraints Easing – Northeast Supply Constraints, Not so Much

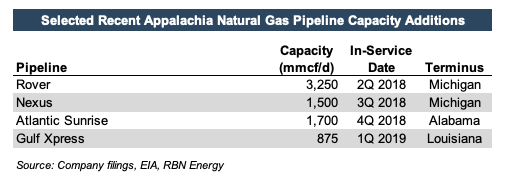

Appalachia natural gas takeaway capacity constraints have eased significantly over the past several years as new pipelines have come into service. RBN Energy estimates the total excess takeaway capacity out of Appalachia at approximately 4 bcf/d. However, the new pipelines are largely moving volumes to the Gulf Coast and Midwest rather than nearby population centers in the Northeast.

Proposed pipelines that would connect the gas-rich Marcellus and Utica plays to East Coast cities have faced intense pushback. The PennEast Pipeline would transport natural gas from northeast Pennsylvania to New Jersey, but has been targeted by multiple environmental and community groups and still awaits approval from various regulatory bodies, including the New Jersey Department of Environmental Protection. A federal appeals court vacated permits issued by the U.S. Forest Service for the Atlantic Coast Pipeline, slated to cross two national forests and the Appalachian Trail in order to transport up to 1.5 bcf/d of natural gas from West Virginia to Virginia and North Carolina. The pipeline’s primary backer, Dominion Energy, has appealed the ruling to the Supreme Court. And The Williams Cos. has battled with the state government of New York for years over water quality certifications needed to move forward with the 125-mile Constitution Pipeline, which would transport gas from northern Pennsylvania.

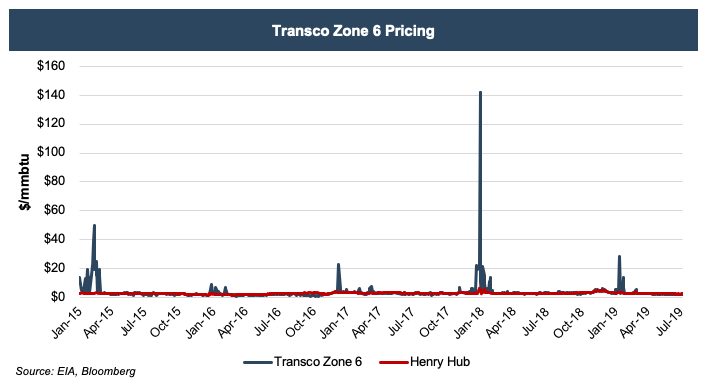

These various hurdles mean that cities are struggling with supply during winter and some natural gas utilities are not accepting new customers, as recently reported by the Wall Street Journal. Without the ability to hook into natural gas lines, certain new real estate developments are on hold or being shelved. And those customers with access to natural gas sometimes pay dearly, with Transco Zone 6 (servicing New York and New Jersey) prices exceeding $140/mmbtu in January 2018.

Proposed pipelines that would connect the gas-rich Marcellus and Utica plays to East Coast cities have faced intense pushback. The PennEast Pipeline would transport natural gas from northeast Pennsylvania to New Jersey, but has been targeted by multiple environmental and community groups and still awaits approval from various regulatory bodies, including the New Jersey Department of Environmental Protection. A federal appeals court vacated permits issued by the U.S. Forest Service for the Atlantic Coast Pipeline, slated to cross two national forests and the Appalachian Trail in order to transport up to 1.5 bcf/d of natural gas from West Virginia to Virginia and North Carolina. The pipeline’s primary backer, Dominion Energy, has appealed the ruling to the Supreme Court. And The Williams Cos. has battled with the state government of New York for years over water quality certifications needed to move forward with the 125-mile Constitution Pipeline, which would transport gas from northern Pennsylvania.

These various hurdles mean that cities are struggling with supply during winter and some natural gas utilities are not accepting new customers, as recently reported by the Wall Street Journal. Without the ability to hook into natural gas lines, certain new real estate developments are on hold or being shelved. And those customers with access to natural gas sometimes pay dearly, with Transco Zone 6 (servicing New York and New Jersey) prices exceeding $140/mmbtu in January 2018.

The recent infrastructure build-out has helped Appalachian E&Ps, but Northeast end-users will likely continue to be subject to significant seasonal spikes until connectivity to Marcellus and Utica production is improved.

The recent infrastructure build-out has helped Appalachian E&Ps, but Northeast end-users will likely continue to be subject to significant seasonal spikes until connectivity to Marcellus and Utica production is improved.

Permian Natural Gas Takeaway Capacity to Remain Constrained in the Near Term

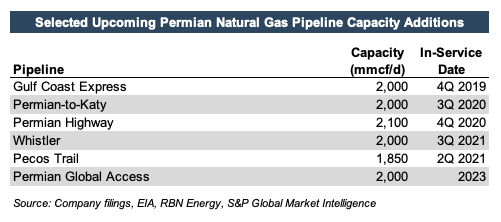

While Appalachia takeaway constraints have largely been alleviated, the same cannot be said for the Permian. Much of the infrastructure build-out designed to service surging hydrocarbon production in the Permian Basin was focused on higher-value crude, with a significant amount of associated natural gas production simply flared. However, with increasing scrutiny on flaring and Waha natural gas prices falling as low as negative $8.50/mmbtu, midstream companies are finally starting to build meaningful takeaway capacity out of the basin.

And while the political and regulatory environment in Texas is much more amenable to pipeline construction, new pipelines have not been unchallenged. A group of landowners sued Kinder Morgan over the route of the company’s Permian Highway Pipeline. However, the lawsuit, filed in April 2019, was thrown out by a Texas court only two months later.

The new takeaway capacity should help with pricing, as indicated by Waha basis futures, but differentials will remain elevated until 2021.

And while the political and regulatory environment in Texas is much more amenable to pipeline construction, new pipelines have not been unchallenged. A group of landowners sued Kinder Morgan over the route of the company’s Permian Highway Pipeline. However, the lawsuit, filed in April 2019, was thrown out by a Texas court only two months later.

The new takeaway capacity should help with pricing, as indicated by Waha basis futures, but differentials will remain elevated until 2021.

Conclusion

Appalachian takeaway constraints have largely been alleviated, though incremental capacity largely takes volumes to the Gulf Coast and Midwest. As such, Northeast cities will likely still face supply issues despite being located just a few hundred miles from prolific natural gas production. Permian natural gas takeaway constraints remain, and will likely continue until 2021.

We have assisted many clients with various valuation needs in the upstream oil and gas space in both conventional and unconventional plays in North America and around the world. Contact a Mercer Capital professional to discuss your needs.

[1] Appalachia basis reflects Dominion South pricing. Permian basis reflects Waha pricing.