In previous posts, we have discussed the relationship between public royalty interests and their market pricing implications to royalty owners. Here, we will define our group of royalty interests which can be used to gain valuation insights. Specifically, we will look at mineral aggregators, natural gas focused trusts, and crude oil focused trusts and the statutory differences between them. We also consider how dividend yields and other public data can be used to imply value for private mineral interests while being judicious in our application of such metrics.

What is a Royalty Trust?

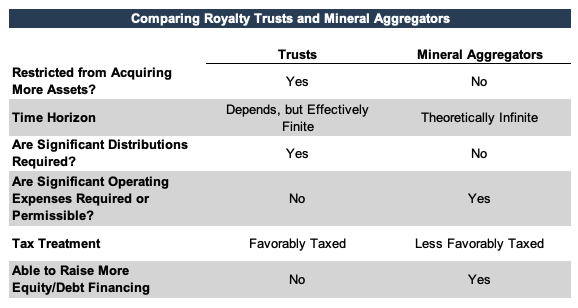

Historically, the most common way mineral interests have been structured for public investment has been in the form of a trust. The trust’s sponsor (frequently though not always the operator) conveys a percentage interest in specified properties, and the trust is prohibited from acquiring more interests. In some cases, the trust has a defined termination date, but this can also be based on a certain threshold of production, or there may be no specified termination at all.

The most common way mineral interests have been structured for public investment has been in the form of a trust.

Distributions are paid on an established schedule (monthly is the most common), and these distributions are based on commodity prices and the level of production. While the former depends on market forces, the latter tends to decline over time as the resources are drained from the specified properties. Thus, the stock prices of these trusts decline over time, and the return comes almost exclusively from the dividend yield, with minimal opportunity for capital appreciation.

Because they are structured as a trust, these investment vehicles are required to distribute a substantial portion of their income. However, trusts can withhold a certain percentage of cash flows to pay trust administrative expenses or create a reserve for future distributions. Because the interests in the specified properties are typically revenue interests, the trust is not required to pay for any expenses related to production, so expenses are relatively minimal.

What is a Mineral Aggregator?

The more popular investment vehicle for mineral interests recently has been the emerging sector of mineral aggregators. Aside from Dorchester Minerals, LP, which IPO’d back in 2003, the remaining five aggregators have gone public in the past five years, including Falcon Minerals and Brigham Minerals in the past twelve months.1 While aggregators also allow investors to gain exposure to the energy sector without investing directly in E&P companies or commodities, there are differences between aggregators and trusts, beginning with their structure.

Dorchester, Viper Energy Partners, Blackstone Minerals, and Kimbell Royalty Partners are all structured as MLPs, while Falcon and Brigham are corporations.2 Eschewing the trust structure provides certain benefits to these entities. Aggregators are not restricted from acquiring more interests, and as their name implies, they seek to reinvest their earnings into the acquisition of new properties. The value of units in a public royalty trust tend to decline with production over time, but aggregators stem the tide of these losses with their reinvestment, and they do not have the statutory termination present in some trusts.

They can also issue more common units, take on debt, and incur operating expenses in ways that royalty trusts cannot. While these make aggregators appear to be the better option, trusts by nature have beneficial tax treatment, and their yields tend to be higher and relatively more predictable given their distribution requirement, which mineral aggregators could decide to forego.

A table summarizing the primary differences between a royalty trust and a mineral aggregator is included below:

Market Data for Trusts and Aggregators

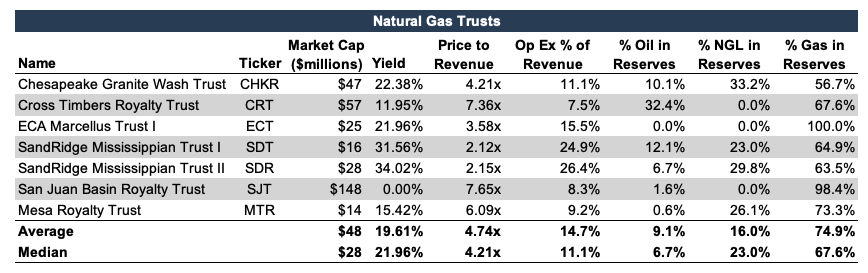

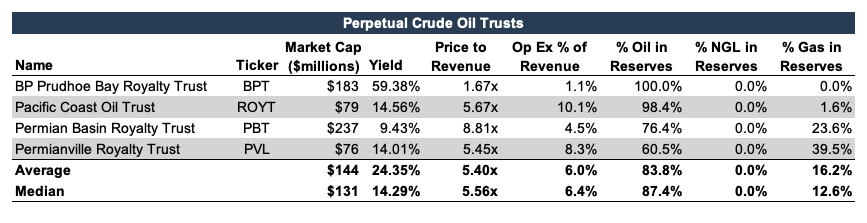

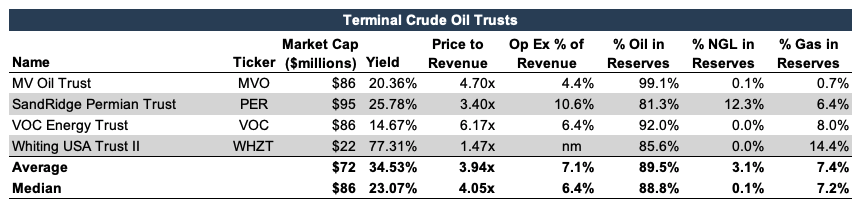

To gain a better insight into how these factors play out in the public marketplace, we should analyze the data. The following tables gives some critical market data for valuation purposes:

While these trusts are predominantly focused on natural gas, many also have oil and NGL reserves. These natural gas trusts have the lowest market caps and relatively high dividend yields. Compared to the crude oil trusts, these exhibit more diversity in product mix including notable amounts of NGLs.

Source: Capital IQ[/caption]

[caption id="attachment_27609" align="aligncenter" width="860"]

Source: Capital IQ[/caption]

[caption id="attachment_27609" align="aligncenter" width="860"] Source: Capital IQ[/caption]

Source: Capital IQ[/caption]

Compared to natural gas focused trusts, crude oil trusts tend to have relatively higher market caps with similar yield and pricing multiples, despite being based on a different commodity. The levels of operating expenses are comparable as well. For this post, we have further delineated between perpetual and terminal crude oil trusts. The latter have a specified end date, while the former do not. However, both groups ultimately will receive distributions related to crude oil prices and declining production, regardless, whether there is a statutory termination or not. Going forward, we do not plan to group these separately.

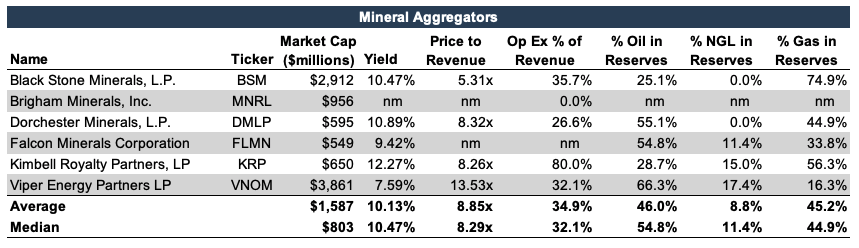

Mineral Aggregators

As noted previously, mineral aggregators have been the apple of certain investors’ eyes lately. They are not bound by distribution requirements, which allows aggregators to gobble up additional acreage. This provides investors an element of growth in what has historically been a declining, yield-only return play. Despite no statutory requirements to distribute, the below aggregators have offered an attractive yield to investors.

When compared to the trusts, aggregators are significantly larger in terms of market cap and have notably more operating expenses and product diversity. Also, they tend to trade at higher revenue multiples, with lower yields. While mineral aggregators may present an attractive option for investors, they are less functional as comparables for mineral interest owners. The lower yield, influenced by potential for return from future growth, and higher operating expenses render aggregators less comparable to traditional mineral interests.

Other Valuation Considerations

Now that we have the data to back up the differences between trusts and aggregators, one must delve deeper into the subject characteristics of the individual trusts to determine how one might use these to value their own private royalty interest. While tempting, drawing valuation conclusions simply by selecting the appropriate commodity mix would be shortsighted. There are plenty of other considerations and judgments that need to be made such as:

- Timing quirks related to market pricing and dividends

- Idiosyncratic issues with the operator

- Region/basin

One must delve deeper into the subject characteristics of the individual trusts to determine how one might use these to value their own private royalty interest.

Case in point(s): San Juan Basin Royalty Trust has not paid a dividend in the past year. That doesn’t mean there is no risk in their cash flows, it means there are no cash flows. On the opposite end of the spectrum, Whiting USA Trust II has a yield north of 77% as its quarterly dividends have nearly matched its prevailing market price. Again, this should not imply to a private mineral owner that their potential future revenue checks will carry this level of risk.

Another important consideration for utilizing trusts as comparables is the operator of the subject interests. Take the three SandRidge trusts for example. Trust distributions are a function of both production and price, and SandRidge has struggled to maintain production given its various woes. Comparing the risk of a private mineral interest to one whose operator is hemorrhaging is not prudent.

Finally, one must consider the region or basin. Geological factors distinguish the commodities produced in different plays and basins, and regional transportation dynamics also play a role. As a result, investors may pay a premium to be in a basin such as the Permian. SandRidge Permian Trust bears many of the idiosyncratic issues as the SandRidge Mississippian Trusts, but it is in a more desirable location and therefore is expected to command a higher multiple. Again, production and price determine the distributions, and certain basins such as the Eagle Ford may provide the opportunity for premium prices while others like the Permian may be more attractive for other reasons.

How These Factors Impact Valuations

To value a currently producing royalty interest under the income approach, a valuation professional must determine some indication of projected future cash flows and discount these back to the present. Given the declining nature of the production, total return comes almost exclusively from the yield. Thus, we can use yields on public royalty trusts to discount the projected future cash flows of the subject interest back to the present. As noted above, judgment is required in determining the relative risk and return characteristics of the subject interest. As we noted in our last post, the SEC prices reserves based on a present value factor of 10%. While this is less applicable to PUDs and similarly more risky assets, private mineral interests that have been delivering consistent cash flows in the form of monthly royalty payments are more likely to be around this 10% discount rate, even if current yields indicate something higher.

Conclusion

When investing in a public royalty trust or using it as a pricing benchmark for private royalty interests, there are many items to consider that are unique to each royalty trust. The commodity mix, operator/sponsor, region, termination (or lack thereof), and other key aspects make each of these investment vehicles unique. Further analysis is required to verify these provide meaningful valuation indications.

We have assisted many clients with various valuation and cash flow questions regarding royalty interests. Contact Mercer Capital to discuss your needs in confidence and learn more about how we can help you succeed.

1 Actual IPO of entity holding Falcon Minerals occurred in 2017, but it discontinued its Special Purpose Acquisition Company (“SPAC”) in 2018.

2 Viper and Kimbell have both elected to be taxed as C-corporations.