Market Data for Trusts and Aggregators

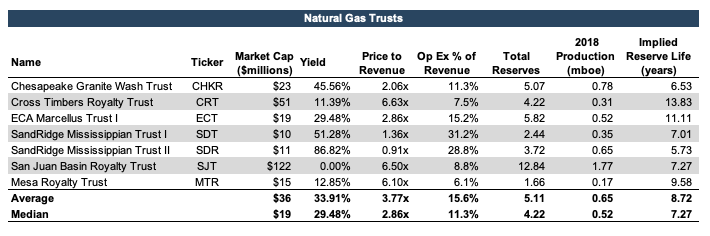

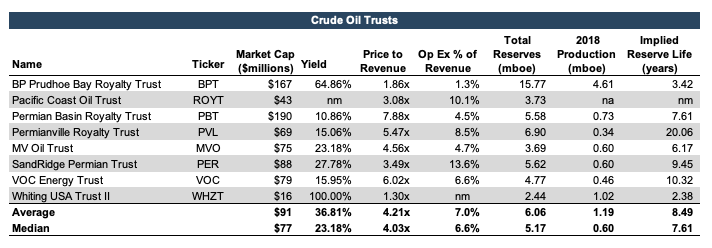

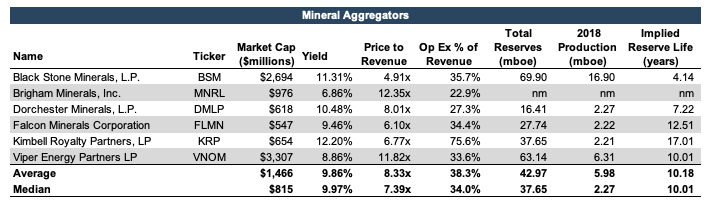

The following tables gives some critical market data for valuation purposes:

We note that the yields are significantly lower for mineral aggregators than the public royalty trusts, who also have significantly lower market caps. Previously, we’ve explained what a royalty trust is; however, to understand these recently elevated yields, we may need to back up and discuss why royalty trusts are started in the first place.

Why a Royalty Trust?

Royalty trusts represent a unique financing tool for E&P companies. Instead of holding onto wells and collecting revenue over a longer holding period, operators can monetize these wells upfront by selling the wells to a trust. This allows operators to reinvest the proceeds back into its operations in an industry where cash is key. Trust distributions are determined by the level of production of the wells and commodity prices. By selling the wells to a trust, the operator can avoid the need for hedging the price risk. Also, since production of the wells is expected to decline over time, operators can avoid the drawn out, declining marginal utility of the wells. This is particularly helpful considering a dollar today is worth more than a dollar down the road.

Potential Pitfalls of Public Dividend Yields as a Proxy for Risk

We’ve discussed the importance of scrutinizing each royalty trust individually in order to determine the comparability with private interests. Some of these considerations include:

- Commodity mix (oil vs natural gas)

- Idiosyncratic issues with the operator

- Region/basin

Some further considerations include:

- Stage of production

- Calculation method of the dividend yield

- Friction in equity market pricing

- Operating Expenses in a depressed commodity price environment

Where are you on the Production Decline Curve?

As oil and gas is extracted from a well, its production declines over time. As production declines, the yields tend to increase (more on this later). This can misrepresent the risk to reward opportunity as timing must line up. The value of a mineral interest that has been producing for an extended period of time should not be compared to a well that has just started production or is even still in the drilling or development stage. These situations are two different points on the production curve and represent different risk profiles. For a PDP (proved, developed, producing), there is less risk than any other stage (compared to PUD, P2 or P3). It is important to consider the relationship between these stages of production instead of simply looking to the public markets and being prisoners of the moment or uninformed of the differences between public trusts and a privately held interest. The stage of production and decline rate must reasonably reconcile to private interests to ensure that yields and commensurate risk are compared apples-to-apples.

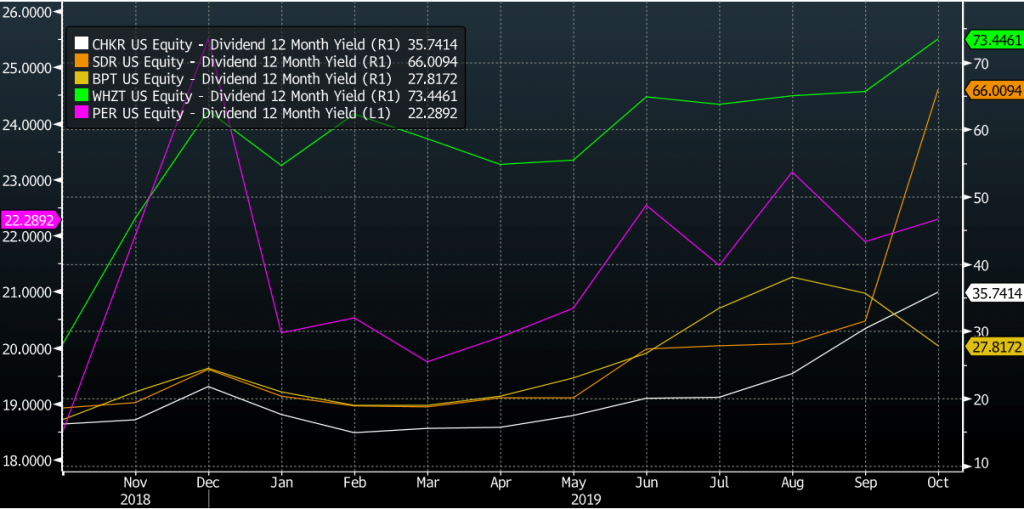

Trusts are frequently prohibited from acquiring additional wells to replace production, unlike E&P companies and mineral aggregators. With production declining, the share price of trust units tends to decline as well, and the return comes almost exclusively from the dividend yield, with minimal opportunity for capital appreciation. Yield is dividends divided by price, and a declining denominator can lead to higher yields. As production declines, the yields may begin to shift from a reasonable expectation of the risk associated with expected future cash flows to a reflection of the minimal life of the well.

Different Dividend Calculations Can Lead to Significantly Different Indications

The calculation of dividend yield can also be crucial to understanding risk. Taking the dividends paid in the past year may not be representative of future dividends. While annualizing the most recent dividend may cause issues with seasonality, it may be more appropriate given the commodity price outlook. Annualizing the most recent dividend causes a significant divergence in the implied yield for more than half of the royalty trusts, while the yields change by less than 2% for all of the mineral aggregators.

Take Prudhoe Bay (BPT) for example. Its 63% yield as of October 30th includes a $1 dividend per share in January 2019. However, distributions have only been only $1.23 in the next three quarters combined as its 10-K estimated a significantly declining outlook. Annualizing the most recent dividend of 34 cents per share drops the dividend yield closer to 28%, notably lower than 63%. While 28% may seem high even in the context of mature production, current commodity prices indicate the trust may cease payouts after January 2020. Calculating yields by annualizing more current dividends can help normalize yields to better indicate the underlying value of the trust’s production.

Public Equity Markets May Complicate Intrinsic Value of Royalty Trusts

In theory, trading in a public marketplace gives public royalty trusts an indication of market value. There is friction, however, between the stock market price and the intrinsic value of the trust. It is common for public royalty trusts to have relatively small share prices. Also, as they age and decline over time, they will become less productive, and investors would be less likely to want to incur the trading costs to build up a position in a stock with little to no residual value. Investing in a small stock creates the need to load up on shares to make a meaningful investment. Doing so, however, can cause the price to move unfavorably. This is particularly the case if the stock is thinly traded.

This problem can be compounded by float, that is, the number of shares actually available for trading. As an extreme example, Permianville Royalty Trust (PVL) has just over half of its shares free floating. These issues further complicate the ability to use yields from public royalty trusts as a proxy for risk for private interests.

Operating Expenses Become Increasingly Important

Since royalty trusts are not encumbered with production expenses, trust operating expenses tend to be fixed and minimal. However, revenue tends to be volatile with commodity prices. In the currently depressed commodity price environment, particularly for natural gas, these operating expenses become more pronounced. As we see with the SandRidge Trusts (SDT) (SDR) and ECA Marcellus Trust I (ECT), yields can be higher for trusts with higher operating expenses as a percentage of revenue. Lower prices make the sensitivity to operating expenses more apparent as margins are tighter.

Conclusion

When using it as a pricing benchmark for private royalty interests, there are many reasons to scrutinize the public royalty yields and their comparability. Further analysis is required to ensure these provide meaningful valuation indications. It is important to assess the implied shelf life of the interest and stage of production. Yield also must be considered both in the context of historical and expected future dividends; they must also consider the equity market ecosystem in which the trusts trade. Lastly, yield and implied risk must consider the prevailing commodity price environment and its impact on royalty trust’s operating expenses.

We have assisted many clients with various valuation and cash flow questions regarding royalty interests. Contact Mercer Capital to discuss your needs in confidence and learn more about how we can help you succeed.