The burgeoning mineral market is leading the way for an energy sector that has lagged in returns for several years now. This was one of the themes from the DUG Permian Basin Conference in Fort Worth last month. Among the discussion, presenters including Scott Noble, CEO of Noble Royalties and Rusty Shepherd of RBC Capital Markets highlighted the ascension of the estimated $400 to $600 billion onshore mineral market in the U.S., depending on who’s doing the estimating.

The interest in the segment has been undergirded by the attractive cash returns coupled with fewer risks and burdens.

The interest in the segment has been undergirded by the attractive cash returns coupled with fewer liability risks, operating risks, and expense burdens. In addition, royalty owners retain ownership rights to perpetuity. These characteristics of royalty and mineral plays have drawn investors in as compared to the market’s negative response to upstream management teams merely seeking to beef up the size of their reserve reports.

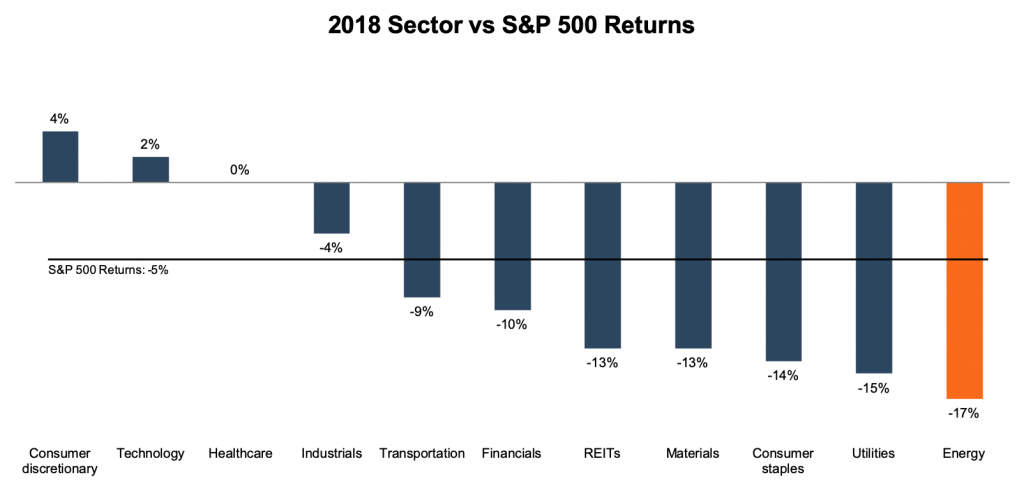

Overall, the energy market’s returns have been subpar. As a sector, energy has lagged all other major sectors over the past several years. In 2018, the returns were again at the bottom of the heap.

Source: Company filings and FactSet[/caption]

Source: Company filings and FactSet[/caption]

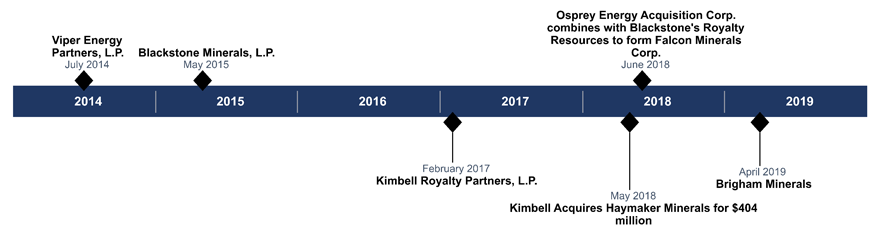

However, there is an energy sub-sector that has been an emerging bright spot: public mineral aggregators. Brigham Minerals (MNRL) is the latest mineral acquisition company to go public following a trend of other large mineral rights and royalty companies to IPO in recent years. Brigham began trading on April 18 at $18.00 per share on the New York Stock Exchange. Brigham became the fifth mineral company to go public since 2014, far outpacing the energy sector in general.

Source: Company filings and Brigham S-1[/caption]

Source: Company filings and Brigham S-1[/caption]

The attraction and growing appetite for mineral aggregators lies in its asset level economics. Several presenters at the conference touched on various factors that are driving returns and valuations. While current producing wells bring in monthly cash flow, they also demand the lowest returns. According to B.J. Brandenberger of Ten Oaks Energy Advisors, producing minerals are commonly purchased on expected returns of 8% to 10%, whereby DUC wells and permitted wells currently have expected returns around 12% and 15%. Undeveloped properties are often valued at over 20% expected return profiles depending on various factors such as the hydrocarbon producing layers in the ground (or “benches” as the industry sometimes calls them). Most of the uncertainty and intrigue has to do with undeveloped properties. The reasons that expected returns are so much higher than producing properties lies in unknowns such as drilling timing, operator quality and expertise, production assumptions, and pricing differentials to name a few.

The mineral segment is representing an economic bright spot in a sector that, while improving, has resided in the dark from a stock return perspective.

This kind of uncertainty comes with the opportunity for outsized returns resulting in market attraction. According to Oil and Gas Investor’s reckoning, there were 12 companies listed in their mineral company directory in 2015. In 2019, this has ballooned to 140.

Public momentum has grown as demand for these investment vehicles is high. Given most new entrants in the market are private equity funded with exit expectations in upcoming years, the chances are high that we see an increase in the number of IPOs from mineral aggregators in the future compared to upstream and E&P companies. Time will tell. In the meantime, the mineral segment is representing an economic bright spot in a sector that, while improving, has resided in the dark from a stock return perspective.