Production and Activity Levels

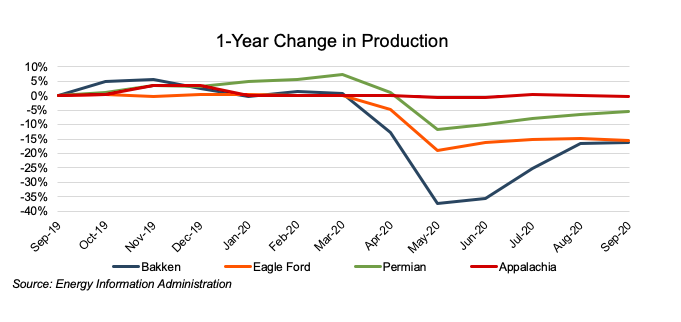

Estimated Bakken production declined approximately 16% year-over-year through September, in line with the Eagle Ford, though worse than production declines seen in the Permian (down approximately 5%) and Appalachia (essentially flat). However, the Bakken has rebounded strongly from production lows observed in May following April’s historic rout in crude oil prices. The Bakken was particularly impacted by production curtailments, driven in part by higher pricing differentials given the basin’s location, higher breakeven prices, and the fact that most operators in the basin have diverse operations, giving them optionality as to where to curtail production while being able to maintain cash flow necessary for near-term obligations (unlike pure-play counterparts).

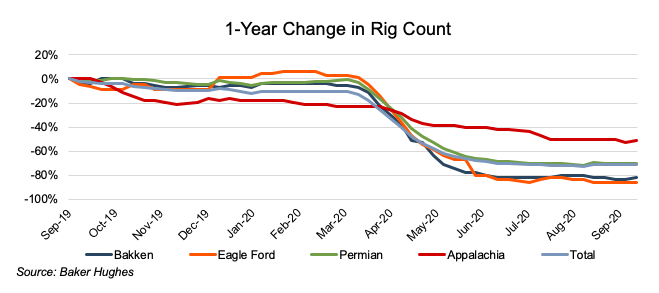

The rig count in the Bakken stood at 10 as of September 18, down over 80% from the prior year. Only the Eagle Ford has seen a more severe drop in rigs, with the rig count declining by more than 86% during the same period. While swift, the decline has stabilized. The Bakken’s rig count has ranged between 9 and 11 rigs during the third quarter. However, a meaningful increase in rigs is unlikely given reduced capex budgets.

The rig count in the Bakken stood at 10 as of September 18, down over 80% from the prior year. Only the Eagle Ford has seen a more severe drop in rigs, with the rig count declining by more than 86% during the same period. While swift, the decline has stabilized. The Bakken’s rig count has ranged between 9 and 11 rigs during the third quarter. However, a meaningful increase in rigs is unlikely given reduced capex budgets.

Commodity Prices Stabilize, Though Uncertain Demand Dynamics Remain

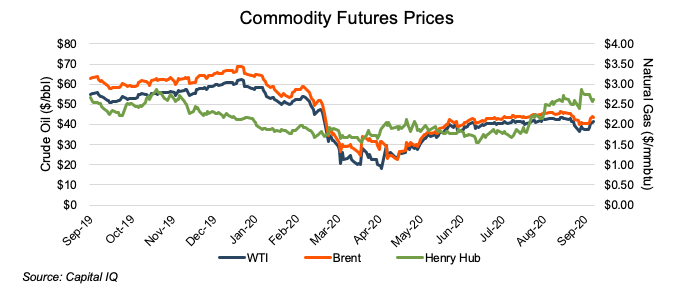

The third quarter of 2020 was relatively quiet for commodity prices, with near-term WTI futures prices oscillating around $40/bbl. Natural gas prices, which avoided crude oil’s steep declines in April, have generally been trending higher. Part of that relates to a reduction of associated gas production driven by lower oil production activity, as well as some regular seasonality as winter approaches.

We note that CapitalIQ has revised the default futures contracts utilized for historical commodity pricing in order to make the output more reasonable. (Hence the lack of negative prices shown in the preceding chart.) As such, the information shown may not tie to previous analyses.

However, there is still considerable uncertainty around future demand, both near-term and long-run. While resuming economic activity has spurred an increase in consumption, changing travel habits and concerns around a potential surge of COVID-19 cases during the upcoming traditional flu season have clouded experts’ ability to make projections. In the longer-run, BP’s 2020 Energy Outlook expects global liquid fuels consumption to peak by 2030 under a “business as usual” scenario. Under scenarios assuming more aggressive policy measures to reduce carbon emission, BP’s analysis suggests that liquid fuels consumption peaked in 2019 and will continue to trend downward.

We note that CapitalIQ has revised the default futures contracts utilized for historical commodity pricing in order to make the output more reasonable. (Hence the lack of negative prices shown in the preceding chart.) As such, the information shown may not tie to previous analyses.

However, there is still considerable uncertainty around future demand, both near-term and long-run. While resuming economic activity has spurred an increase in consumption, changing travel habits and concerns around a potential surge of COVID-19 cases during the upcoming traditional flu season have clouded experts’ ability to make projections. In the longer-run, BP’s 2020 Energy Outlook expects global liquid fuels consumption to peak by 2030 under a “business as usual” scenario. Under scenarios assuming more aggressive policy measures to reduce carbon emission, BP’s analysis suggests that liquid fuels consumption peaked in 2019 and will continue to trend downward.

Financial Performance

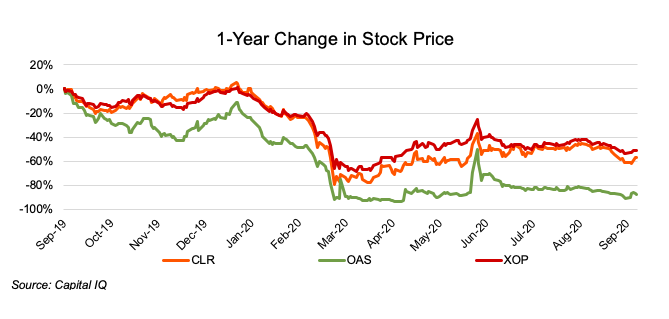

With Whiting’s restructuring (discussed in a subsequent section), the Bakken-focused peer group with meaningful historical trading activity has become quite small. Continental Resources is down approximately 57% year-over-year, though that isn’t much worse than the overall exploration & production sector (as proxied by XOP, which is down 51% over the same period). Oasis Petroleum’s stock price has declined by approximately 88% over the past year and the company has warned of a potential bankruptcy filing.

We note that neither company is pure-play Bakken, as Continental has a sizeable acreage position in Oklahoma’s SCOOP/STACK, and Oasis has operations in the Permian as well. Other publicly traded Bakken operators, including ExxonMobil, Marathon Oil, Hess, EOG, Ovintiv, ConocoPhillips, and QEP, also have diverse operations outside the basin. Northern Oil & Gas, which has traditionally focused on owning non-operating working interests in the Bakken, has expanded outside the basin with acquisitions in the Permian.

Equinor, which entered the Bakken with its $4.7 billion acquisition of Brigham Exploration, announced that it is halting all U.S. shale drilling and well completion activity.

The lack of a pure-play Bakken peer set makes it difficult to draw conclusions specific to the basin, but is also a telling fact about the difficult operating conditions in the area.

We note that neither company is pure-play Bakken, as Continental has a sizeable acreage position in Oklahoma’s SCOOP/STACK, and Oasis has operations in the Permian as well. Other publicly traded Bakken operators, including ExxonMobil, Marathon Oil, Hess, EOG, Ovintiv, ConocoPhillips, and QEP, also have diverse operations outside the basin. Northern Oil & Gas, which has traditionally focused on owning non-operating working interests in the Bakken, has expanded outside the basin with acquisitions in the Permian.

Equinor, which entered the Bakken with its $4.7 billion acquisition of Brigham Exploration, announced that it is halting all U.S. shale drilling and well completion activity.

The lack of a pure-play Bakken peer set makes it difficult to draw conclusions specific to the basin, but is also a telling fact about the difficult operating conditions in the area.

Whiting Emerges, Oasis Potentially to Enter Bankruptcy

Whiting Petroleum, which announced its Chapter 11 reorganization process in April, emerged from bankruptcy in September. The reorganization process allowed Whiting to reduce its debt load by more than $3 billion, from over $3.4 billion to just $425 million. While shareholders were able to avoid being completely wiped out, the restructuring was extremely dilutive. Legacy shareholders now own approximately 3% of the equity of the new entity.

Oasis Petroleum announced it skipped an interest payment due September 15. That puts the company in a 30-day grace period in which it can continue to negotiate with lenders regarding a restructuring. Oasis has been reviewing strategic alternatives with advisors, including “a recapitalization transaction with a third-party capital provider; restructuring of the Company’s existing debt either through an out-of-court process or under Chapter 11 of the Bankruptcy Code; or other strategic transaction.”

Dakota Access Pipeline Under Siege Again

Energy Transfer’s Dakota Access Pipeline (“DAPL”), which was the subject of protests in 2016 and 2017, is under renewed legal action. The pipeline, which was instrumental in helping minimize pricing differentials in the land-locked Bakken relative to other basins, has the capacity to transport 570 mbbl/d of crude oil from the Bakken to a hub in Illinois, with connections to pipelines serving refining markets in the Midwest and Gulf Coast.

In July, a judge ruled that DAPL must be shut down and emptied by August 5, pending an environmental review by the Army Corps of Engineers. A U.S. appeals court reversed the shutdown order in August, though the requirement for the environmental review is still under appeal. Based on the current trial schedule, DAPL’s should be able to continue operating through at least late December before a federal court could mandate another shutdown.

Despite the renewed legal scrutiny, Energy Transfer is pushing forward with an expansion plan which would roughly double DAPL’s capacity. The additional capacity is expected to come online in the third quarter of 2021.

Conclusion

The Bakken was hit the hardest by curtailments driven by low commodity prices, but has also seen the sharpest rebound in production. Whiting’s successful restructuring should add stability to the basin, but Oasis may take its place shortly in the bankruptcy courts. While operating conditions are difficult across the U.S., the stress appears quite acute in the Bakken.

We have assisted many clients with various valuation needs in the upstream oil and gas space in both conventional and unconventional plays in North America, and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.