Production and Activity Levels

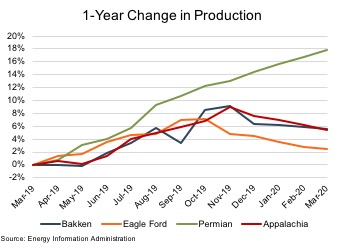

Eagle Ford production grew approximately 2% year-over-year through March, lagging behind the Permian (18%), Bakken (6%) and Appalachia (5%). This is driven, in part, by the maturity of the Eagle Ford play relative to other areas, as well as the Eagle Ford’s relatively high proportion of gas production.

The rig count in the Eagle Ford at March 20th stood at 67, down 18% from the prior year. This decline is more severe than reductions seen in the Bakken and Permian, though better than Appalachia and the overall US rig count. The Eagle Ford’s rig count has also seen a strong bounce back from November’s lows. However, rig counts are a lagging indicator, so may fall further in light of recent commodity price declines.

The rig count in the Eagle Ford at March 20th stood at 67, down 18% from the prior year. This decline is more severe than reductions seen in the Bakken and Permian, though better than Appalachia and the overall US rig count. The Eagle Ford’s rig count has also seen a strong bounce back from November’s lows. However, rig counts are a lagging indicator, so may fall further in light of recent commodity price declines.

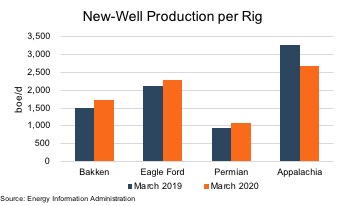

The Eagle Ford is also seeing gains in new-well production per rig. While this metric doesn’t cover the full life cycle of a well, it is a signal of the increasing efficiency of operators in the area. New-well production per rig in the Eagle Ford increased 8% on a year-over-year basis through March, compared to increases of 15%, 13%, and -18% in the Bakken, Permian, and Appalachia, respectively.

The Eagle Ford is also seeing gains in new-well production per rig. While this metric doesn’t cover the full life cycle of a well, it is a signal of the increasing efficiency of operators in the area. New-well production per rig in the Eagle Ford increased 8% on a year-over-year basis through March, compared to increases of 15%, 13%, and -18% in the Bakken, Permian, and Appalachia, respectively.

Commodity Prices Fall Amid Coronavirus Outbreak and Russian / Saudi Price War

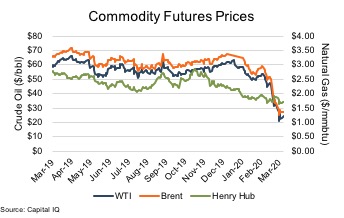

After hitting recent highs in early January, oil prices generally declined in January and February as the spread of the coronavirus raised investor concerns regarding oil demand due to potential travel restrictions and declining economic activity. The decline accelerated on March 6, as Saudi and Russia could not come to an agreement regarding production cuts in light of declining demand, sending WTI futures down 10% to $41.28. The feud escalated over the weekend as Saudi Arabia slashed its official crude oil selling prices and indicated its intent to ramp up production. WTI futures fell an additional 25% the following Monday, March 9.

Since then, prices continued to decline, with WTI front month futures settlement prices hitting $20.83 on March 18. Prices have rebounded somewhat from this level but remain extremely volatile.

Since then, prices continued to decline, with WTI front month futures settlement prices hitting $20.83 on March 18. Prices have rebounded somewhat from this level but remain extremely volatile.

Financial Performance

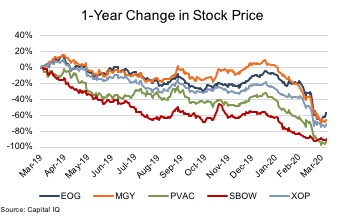

All Eagle Ford E&P operators analyzed have had year-over-year stock price declines. EOG and Magnolia outperformed the broader E&P universe (XOP), though Penn Virginia and Silverbow are both down more than 90%.

Despite this financial performance, no Eagle Ford operators have filed for bankruptcy in the immediate wake of the price downturn. However, the commodity price environment has impacted the restructuring processes for Eagle Ford operators that entered bankruptcy in 2019. According to bankruptcy proceedings, Sanchez Energy may not be able to repay its debtor-in-possession (DIP) loan, which would result in no recovery for any legacy creditors. EP Energy announced in early March that its restructuring plan had been approved by the bankruptcy court. However, the deal was called off later in the month as lenders for the company’s exit financing pulled their support.

Despite this financial performance, no Eagle Ford operators have filed for bankruptcy in the immediate wake of the price downturn. However, the commodity price environment has impacted the restructuring processes for Eagle Ford operators that entered bankruptcy in 2019. According to bankruptcy proceedings, Sanchez Energy may not be able to repay its debtor-in-possession (DIP) loan, which would result in no recovery for any legacy creditors. EP Energy announced in early March that its restructuring plan had been approved by the bankruptcy court. However, the deal was called off later in the month as lenders for the company’s exit financing pulled their support.

Infrastructure

One of the Eagle Ford’s key advantages is its proximity to Gulf Coast refineries and export infrastructure. However, that benefit is eroding as demand for refined products is tanking (though storage costs are surging) and some importers are seeking to invoke force majeure clauses to reject LNG shipments.

This also comes at a time when new pipelines are coming into service to carry Permian production to the Gulf Coast. The EPIC crude pipeline entered service in February, carrying oil volumes from Orla, Texas, to Corpus Christi. In September 2019, Kinder Morgan’s Gulf Coast Express was placed in service, transporting natural gas from the Permian to Agua Dulce (just southwest of Corpus Christi). Early next year, Kinder Morgan’s Permian Highway natural gas pipeline is expected to come online, carrying volumes from the Permian’s Waha hub to the Gulf Coast. While this infrastructure build-out is helping make energy markets more efficient, it is diminishing the Eagle Ford’s previous marketing advantages.

Conclusion

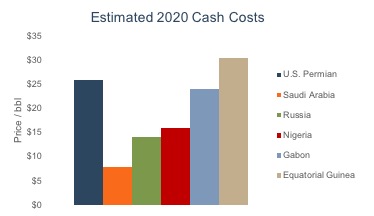

Commodity prices are putting immense strain on E&P companies, and there is little relief in sight. The Eagle Ford’s maturity means that many of the lowest-cost, highest-return locations have already been drilled. The basin’s marketing advantages are eroding as new pipeline infrastructure transports surging Permian volumes to the Gulf Coast. With two Eagle Ford operators already in bankruptcy (Sanchez and EP Energy) and unable to exit, we’ll see if anyone joins them over the next twelve months.

We have assisted many clients with various valuation needs in the upstream oil and gas space in both conventional and unconventional plays in North America, and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.