Transaction activity in the Permian Basin, and frankly elsewhere as well, is in a unique, and potentially critical situation as companies are facing unpredictable consequences and uncertain futures.

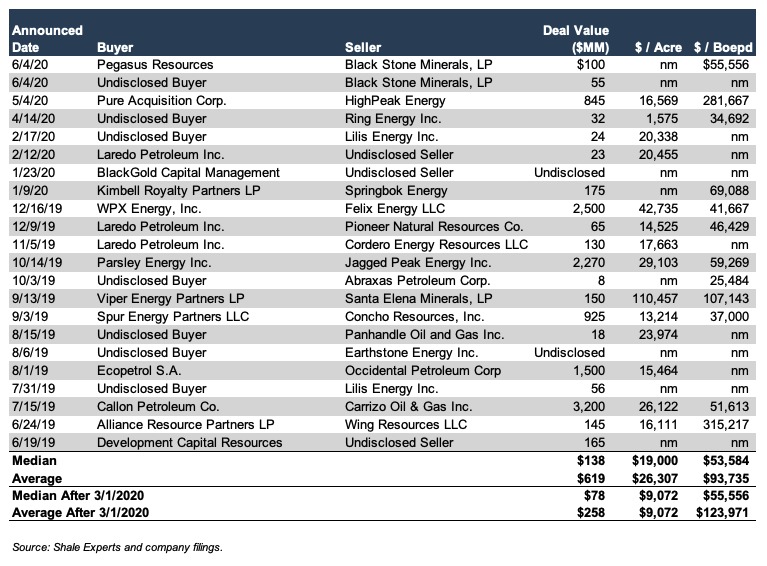

A table detailing E&P transaction activity in the Permian over the last twelve months is shown below. Relative to 2018-2019, deal count decreased by ten and median deal size declined by roughly $60 million year-over-year. Although this table looks busy with a number of deals, the transactions that occurred before March are most likely not indicative of the road ahead. Industry participants are much more concerned with deals that have been announced following the dramatic fall in oil price due to COVID-19 and the Russian-Saudi price war, which in this case was determined to be after March 1, 2020. Looking at the table, only four deals have been announced post-March. Although the sample is small, they could be the best indication of what is to come, assuming prices remain depressed.

Black Stone Minerals Letting Go of Core Permian Acreage

In early June, Black Stone Minerals announced that they were selling a total of $155 million of royalty interest assets in two separate transactions to strengthen their balance sheet and liquidity position. This appeared to be core acreage in the Permian as the price per flowing barrel was a premium compared to average private transactions of $40,000 per flowing barrel in March and April. The deal with Pegasus Resources included a 57% undivided interest across parts of the company’s Delaware Basin position and a 32% undivided interest across parts of the company’s Midland Basin position. Black Stone noted that proceeds from the sale will be used to reduce the balance outstanding on the company’s revolving credit facility. Black Stone expects its total debt levels to be under $200 million after closing the two transactions.

HighPeak Energy & Pure Acquisition Combine Forces After Early Complications

Pure Acquisition, a blank-check company, announced in early May that it was acquiring Howard county focused HighPeak Energy in a deal worth $845 million. The original deal, which was terminated due to the crash in oil prices and market uncertainty, included a three-way merger agreement with private-equity-backed Grenadier Energy Partners. The new business combination between HighPeak Energy and Pure Acquisition will hold a pure-play 51,000-net-acre position in the northern Midland Basin. Jack Hightower, HighPeak Energy’s Chairman and CEO, commented, “With the decline of energy prices over the last few months, several energy companies are struggling. However, due to our low drilling and completion costs and our low operating costs, our breakeven prices are much lower than our competitors which enables us to operate profitably at lower price levels.” Time will tell whether the merger will be able to capitalize. The transaction is expected to close in the third quarter of 2020, with the combined company trading on the NASDAQ.

Ring Energy Taking a Conservative Approach Moving Forward

In mid-April, Ring Energy agreed to sell its Delaware Basin asset located in Culberson and Reeves Counties, Texas for $31.5 million to an undisclosed buyer. The asset included a 20,000 net-acre position with current production of 908 boepd (63% oil) at the time of the deal. Kelly Hoffman, CEO of Ring Energy stated, “The proceeds from this transaction will be used to reduce the current balance on the company’s senior credit facility. The current environment mandates a cautious, conservative approach going forward, and strengthening our balance sheet is a step in the right direction.” Ring Energy continues to hold positions in the Permian and Ventral Basin Platform and the Northwest Shelf. The company recently completed a redetermination of its senior credit facility and expects the transaction to close before the end of July.

Conclusion

M&A transaction activity in the Permian was skewed, in terms of deal count, as most activity during the last twelve months occurred in the second half of 2019. Deal motives moving forward will be interesting to monitor as companies may be forced to let go of premium acreage, notably in the Permian Basin, to improve their liquidity positions. It does not appear to be a seller’s market, as sellers realize the intrinsic value associated with acreage. If companies have the luxury and are not forced to sell, they seem to be holding on tight searching for the light at the end of the tunnel.