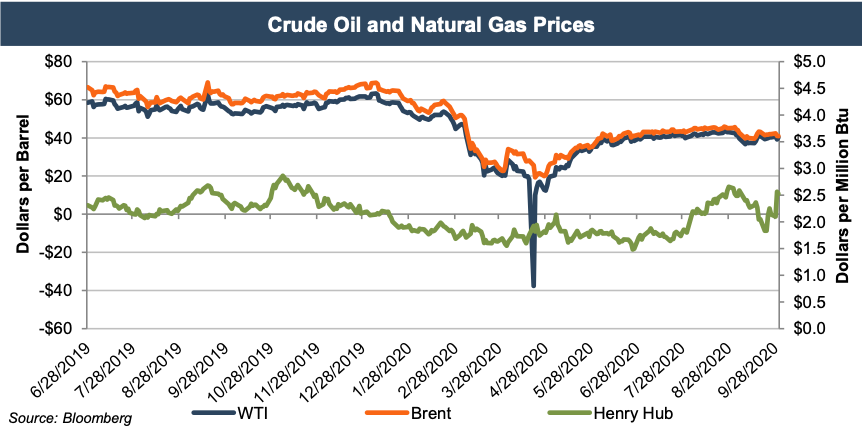

The third quarter of 2020 experienced a relatively stable price environment compared to the volatile prices seen in the first half of the year. The WTI range narrowed, hovering around $40 per barrel, and natural gas increased from $1.70 per MMbtu to $2.50 per MMbtu. According to the Dallas Federal Survey released on September 23, industry participants expect oil price to be nominally higher than last quarter’s expectations, but respondents continue to state that most new drilling remains uneconomic. The concurrent overlapping impact of (i) discord created by the OPEC/Russian rift and resulting supply surge; and (ii) the drop in demand due to COVID-19 related issues was historic and continued to play a role in the third quarter. As optimism surrounding a gradual demand recovery has increased, companies are preparing for an eventful end to 2020. As if COVID-19 and the Russian-Saudi price rift wasn’t eventful enough, an election in November will add to the mix for what seems to be an already pressing and critical time for the industry. The unfortunate, overlapping timing of these events has made the bankruptcy courts busy, with no indication of that trend coming to a halt. In this post, we will examine the macroeconomic factors that have affected the industry in the third quarter and peek behind the curtain on what the remainder of the year might hold.

Global Economics

OPEC+

On June 6, OPEC+ members reached an agreement to continue cutting 9.7 million barrels a day, or about 10% of global output under normal circumstances, through July. The extended supply cuts helped oil prices continue their recovery from their drastic drop in April due to the demand issues caused by COVID-19. The original agreement that OPEC+ reached on April 12 stated that production was set to increase gradually after June, but members refined that plan and continued their supply cuts for another month.

On July 15, OPEC + members agreed to loosen existing production caps by roughly 1.6 million barrels a day. The agreement was slated to begin in August as demand was showing signs of recovery amid the COVID-19 related lockdowns. The decision created a 10% increase in Brent prices to $43.30/bbl. OPEC expects the world’s demand for oil to increase by 7 million barrels a day next year, after a forecast 8.9 million barrel a day decline in 2020. A primary source of overall industry decline is the lack of jet fuel demand as travel has decreased significantly throughout the year. According to the Dallas Federal Energy Survey, 74% of industry executives believe that OPEC will play a bigger role in the determination of the price of oil going forward.

Potential Market Consequences: Trump vs. Biden Administration

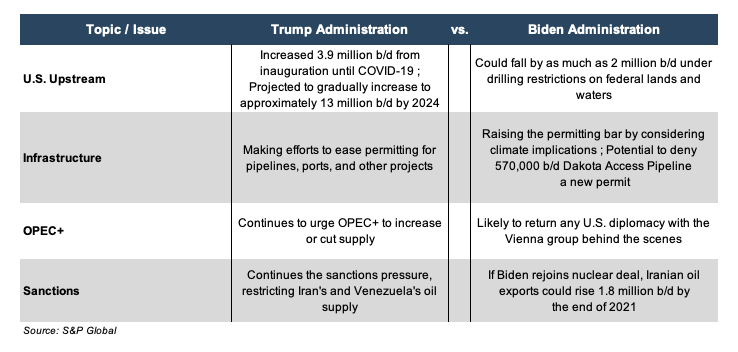

The upcoming election in November 2020 is on the industry’s mind as both administrations have expressed their energy initiatives that will be implemented during the next four years. The election comes at a pressing time in the industry, with the next four years of U.S. oil and gas policy at stake. The major topics at hand include domestic production, infrastructure plans, OPEC+ engagements, and international sanctions. The following chart shows the contrasting platforms of the two potential administrations:

U.S. Production

The decline in production, 9.7 million b/d year-over-year in August, reflects voluntary production cuts by OPEC+ along with reductions in drilling activity and curtailments as of late. The EIA estimates that U.S. crude oil production increased to 10.8 million b/d in August as operators have brought wells back online in response to rising prices after curtailing production in the second quarter. Frac fleets have slowly grown since May, but still are down roughly 68% from the peak in 2020. After September, however, the EIA projects U.S. crude oil production to decline slightly as new drilling activity will not generate enough production to offset declines from existing wells. According to the Dallas Federal Energy Survey, 66% of industry executives believe that U.S. oil production has peaked. The upcoming election poses significant uncertainties as the two administrations’ contrasting agendas will play a major role in U.S. production moving forward.

Bankruptcy

Companies are on their heels heading into the end of 2020. Bankruptcy activity has heightened, and debt levels have increased as companies are hoping the worst is behind them. The question is whether the worst is yet to come. Balance sheets have become increasingly important and cash will remain king until the price environment becomes more economic. Deal activity has been quiet as of late, though ended with a bang given Devon’s announced merger with WPX. More deals could come as buyers and sellers turn to consolidation to reduce costs in these challenging times. That does, however, assume companies will not have to file for bankruptcy.

Interest Rates

The U.S. Federal Reserve cut interest rates twice in the month of March. On March 3, the Fed made an emergency decision to cut interest rates by 0.5% in response to the foreseeable economic slowdown due to the spread of the coronavirus. This cut was anticipated and largely shrugged off by the markets as interest rates continued their precipitous decline. Benchmark rates were again cut on March 15 by a full percent to near zero. The Federal Reserve’s latest forecast suggests that rates will remain close to zero for the foreseeable future until inflation increases.

Conclusion

As the industry attempts to recover from a dramatic timeline of events in the first half of 2020, many uncertainties remain ahead. Companies are trying to survive during the challenging environment while attempting to shore up the balance sheet and hang on tight with the election on the horizon. Potential policy changes might be the least of companies’ worries as other pressing issues are affecting them in the very short-term. All of the pieces are stacking up against the industry, and it will be interesting to analyze the next six months, which could very well look different.

At Mercer Capital, we stay current with our analysis of the energy industry both on a region-by-region basis within the U.S. as well as around the globe. This is crucial in a global commodity environment where supply, demand, and geopolitical factors have varying impacts on prices. We have assisted clients with diverse valuation needs in the upstream oil and gas industry in North America and internationally. Contact a Mercer Capital professional to discuss your needs in confidence.