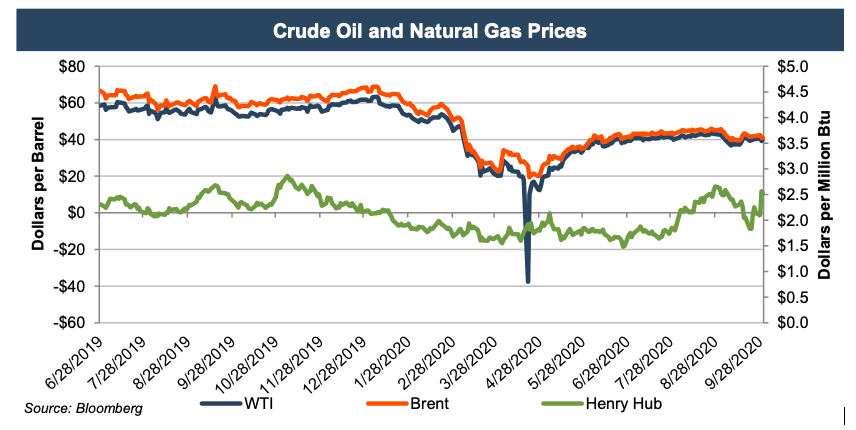

To say that 2020 has been “rough” for U.S. oil and gas (O&G) industry participants would be the height of an understatement. The one-two punch of the Saudi-Russia dust-up over oil market share, and the COVID-19 pandemic, which together spiked oil supplies and made demand plunge, combined to set-up for a record bad year for the O&G industry. Oil prices, that ended 2019 near $60/barrel (WTI), tumbled below $22/barrel in late March, and hit a 2020 low of $17/barrel in April. A much welcome partial recovery during the month of May led to a somewhat stabilized price range of $36-$43/barrel through the third quarter. While $40/barrel oil prices provided at least some relief to O&G industry participants, prices at that level aren’t expected to lead to anything close to a recovery to pre-2020 activity levels. The industry continues to “flow red” with continued bankruptcies piling-up.

Bankruptcy courts have been busy as a result of the O&G industry downturn. Already this year 36 bankruptcies were filed among the production segment operators alone. Industry insider conversations have included concerns that there could be 60-70 additional producer filings by the end of the year.

If those predictions come true, 2020 would represent a record year for O&G-related filings in the annals of the bankruptcy courts. While that may seem like an unusually bad turn for a six-month period of depressed prices, it’s worth noting that the industry was significantly stressed beforehand. Natural Gas Intelligence’s Andrew Baker noted that the anticipated cutbacks in future capital expenditures among the producers for drilling, completions, and other activities in the field will most certainly spread the bankruptcy trend to the oilfield services (OFS) segment that never completely recovered from the 2014 industry downturn. Baker indicated that “many smaller or highly leveraged OFS companies may not be able to hold on” and will be forced to seek the protection of bankruptcy courts.

As Baker referenced, size and financial leverage can generally contribute to an OFS participant business being forced into a bankruptcy filing. In this edition of Mercer Capital’s Energy Valuation Insights blog, we explore some of the many factors that play into making it more (or less) likely that an OFS participant will survive an industry downturn intact, or succumb to market pressures and enter into bankruptcy.

Bankruptcy courts have been busy as a result of the O&G industry downturn. Already this year 36 bankruptcies were filed among the production segment operators alone. Industry insider conversations have included concerns that there could be 60-70 additional producer filings by the end of the year.

If those predictions come true, 2020 would represent a record year for O&G-related filings in the annals of the bankruptcy courts. While that may seem like an unusually bad turn for a six-month period of depressed prices, it’s worth noting that the industry was significantly stressed beforehand. Natural Gas Intelligence’s Andrew Baker noted that the anticipated cutbacks in future capital expenditures among the producers for drilling, completions, and other activities in the field will most certainly spread the bankruptcy trend to the oilfield services (OFS) segment that never completely recovered from the 2014 industry downturn. Baker indicated that “many smaller or highly leveraged OFS companies may not be able to hold on” and will be forced to seek the protection of bankruptcy courts.

As Baker referenced, size and financial leverage can generally contribute to an OFS participant business being forced into a bankruptcy filing. In this edition of Mercer Capital’s Energy Valuation Insights blog, we explore some of the many factors that play into making it more (or less) likely that an OFS participant will survive an industry downturn intact, or succumb to market pressures and enter into bankruptcy.

OFS Bankruptcy Differentiators

There are most certainly many factors that may contribute to, or deter, an OFS company’s need to file for bankruptcy protection during an industry downturn. Some are more general and more obvious, while others are more specific and not as readily discerned. Here we address some of the more general factors (margins, financial leverage, and breadth of product/service offerings), some industry specific factors (customer sectors and basins served), and the benefit of industry experience.

General Factors

As in any industry, the ability to survive a downturn in the OFS industry is all about maintaining cash flow, and therefore liquidity. No surprise here, a company generating higher margins in “normal” industry conditions is more readily able to navigate a downturn when the company’s margins are likely to get pinched. As such, bankruptcies during a downturn in the industry are materially more likely among highly competitive sectors of the OFS industry where margins tend to be lower, as opposed to less competitive sectors, where margins tend to be more robust. Beyond general competition levels, a particular OFS company’s margins may be influenced by a number of factors. These include proprietary products or processes, its having embraced efficiency inducing technology and automation, and other factors that contribute to lower cost of sales, or operating expenses. With higher margins, an OFS company is able to endure the margin reductions that come with industry downturns with a significantly lower probability of reaching a financial breaking point.

...the ability to survive a downturn in the OFS industry is all about maintaining cash flow, and therefore liquidity.

Similarly, the degree to which an OFS company makes use of financial leverage to enhance returns can play into its ability to weather an industry storm. Take Company A and Company B that both generate the same operating cash flow margins – margins before consideration of financing costs in the form of interest expenses on outstanding debt. If Company A carries a lower level of debt financing (relative to Company B), its operating cash flow will be greater than Company B’s. The cash flow differential may not be a make-or-break matter during normal industry conditions when both companies are generating significant cash flows relative to their interest expense. However, during periods of reduced cash flow, the more leveraged company may reach a point where operating cash flows are inadequate to meet its interest payments. So, the financial leverage that enhances return during the times of industry strength can be the same financial leverage that leads to distressed liquidity during industry downcycles.

An OFS company’s breadth of product or service offerings can also impact the ability to maintain operations during a downturn. Larger OFS participants, with multiple product or services offerings, have the benefit of being able to consider shifting its efforts among various offerings. In that way, the company can emphasize operations where it can continue providing more productive (profitable) lines and deemphasize less productive lines. It may even be in a position to sell-off assets related to less productive lines in order to maintain liquidity to continue operations of productive lines. WorldOil Magazine’s David Wethe cites examples of this type of shifting of products/services in Schlumberger’s sale of its land-rig unit in the Middle East and Precision Drilling’s sale of its Mexican operations as the companies struggled in recent years. Unlike these larger industry participants, smaller companies with very limited product or service offerings, don’t have nearly the same level of flexibility. Among these smaller OFS companies, diversity of offerings may simply not exist. That leaves the businesses without the ability to shift away from less profitable products or services, and therefore make them more prone to the necessity of a bankruptcy filing.

Industry-Specific Factors

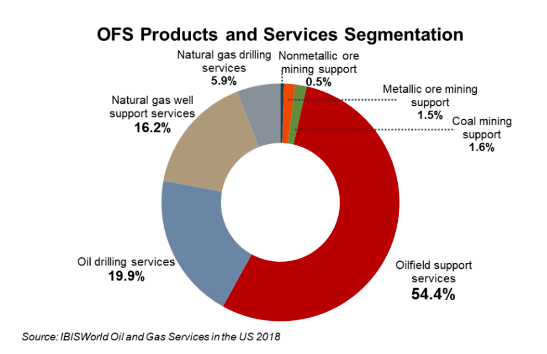

The diversity and breadth of the OFS industry brings additional factors that may influence an industry participant being forced into a bankruptcy filing. Despite the misnomer, the OFS industry includes providers of products and services to both oil-focused and gas-focused E&P companies. The graphic below provides some insight as to just how wide an array of products and services are represented within the OFS industry.

Sub-Sectors Focus

Due to the significant differences between the operations of the OFS industry participants, an industry downturn doesn’t impact all OFS participants to the same degree. For instance, OFS businesses that disproportionately serve the natural gas side of the industry were not as significantly impacted by the precipitous drop in oil prices during the 2020 second quarter. In the same way, OFS participants may be impacted quite differently based on the E&P subsector that they serve. For example, during the 2020 oil price disruption, new drilling operations were much more adversely affected than were continuing production operations. Following a sharp decline in oil prices, exploration operations may be curtailed much more so than production operations. For example, when oil prices are in the $35 to $40 per barrel range, it can be economically beneficial to continue production from existing wells, but quite uneconomically viable to incur the cost of drilling new wells. Even much less economical to incur exploration related expenses. As such, OFS companies whose products or services support production activities – fracking, well maintenance services, and production chemical providers – face less dire circumstance at $35 to $40/barrel prices than OFS companies that support exploration activities – geological, seismic, drilling, and site preparation services.

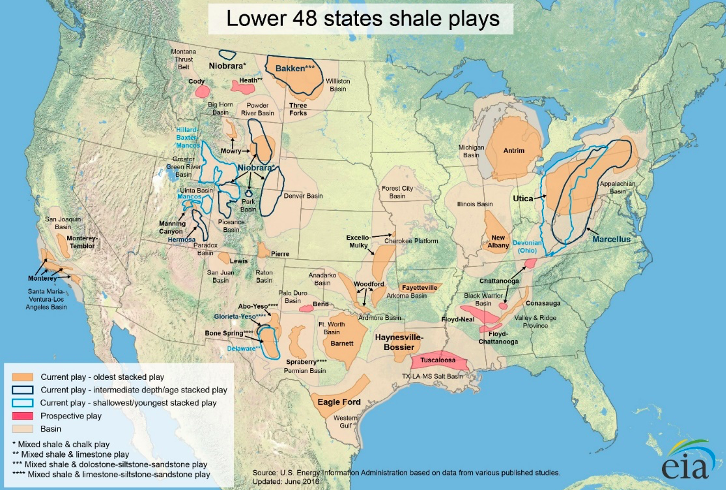

Basin Focus

Beyond the differences between serving the oil versus gas subsectors, and the differences between serving exploration versus production subsectors, there are differences in the basins that a particular OFS business focuses on. These differences can generally be categorized into three areas – type of oil, midstream transportation availability, and production cost. Different basins may produce different types (grades) of crude oil (light versus heavy, sweet versus sour, etc.), which require varying levels of refining in order to generate end products. As such, the “price” of oil isn’t uniform across basins, and as a result, a drop in oil demand can impact different basins to varying degrees.

[caption id="attachment_34074" align="alignnone" width="726"]

http://www.eia.gov/maps/maps.htm[/caption]

Similarly, the midstream transportation assets of a particular basin can influence the price of oil based on the location of the production facilities. Basins, where pipeline capacity is lacking, may have a higher cost of getting the oil to refining facilities and, therefore, require higher prices to justify continued production. In much the same way, different basins can have materially different production costs per barrel depending on the age of the fields and the specific geology of the field.

As with basins that suffer from higher costs in getting produced oil to refineries, basins that have higher production costs (the total cost of bringing oil/gas to the surface) may not have the needed economics to justify continued production at oil prices that allow for continued production from basins with lower production costs. For example, Reuter’s Energy Correspondent, Liz Hampton, notes that oil firms operating outside the Permian basin (in Oklahoma, Colorado, Wyoming, Kansas, and parts of New Mexico) where production costs are higher may be particularly hit hard by oil prices in the $25 to $30/barrel range. On average, producers in those states need oil prices at $47 a barrel to make money.

http://www.eia.gov/maps/maps.htm[/caption]

Similarly, the midstream transportation assets of a particular basin can influence the price of oil based on the location of the production facilities. Basins, where pipeline capacity is lacking, may have a higher cost of getting the oil to refining facilities and, therefore, require higher prices to justify continued production. In much the same way, different basins can have materially different production costs per barrel depending on the age of the fields and the specific geology of the field.

As with basins that suffer from higher costs in getting produced oil to refineries, basins that have higher production costs (the total cost of bringing oil/gas to the surface) may not have the needed economics to justify continued production at oil prices that allow for continued production from basins with lower production costs. For example, Reuter’s Energy Correspondent, Liz Hampton, notes that oil firms operating outside the Permian basin (in Oklahoma, Colorado, Wyoming, Kansas, and parts of New Mexico) where production costs are higher may be particularly hit hard by oil prices in the $25 to $30/barrel range. On average, producers in those states need oil prices at $47 a barrel to make money.

Liquidity Management and Cost Structure

To this point, we’ve addressed factors that primarily impact the demand for an OFS participant’s products and services. Now we move to factors beyond demand – liquidity and cost structure/control. In a pronounced industry downturn, where cash flows are known to be turning negative for an indeterminate amount of time, liquidity becomes a major focus point. If cash runs out, a previously slow decline in business can rapidly turn into a downward spiral. Managing the company’s liquidity can involve several related actions including reducing costs, drawing down existing lines of credit (before they become difficult to access), and engaging as soon as possible with debt providers. While it may seem that these actions would have the same benefit to all OFS participants, the results of such efforts can vary markedly.

In a pronounced industry downturn, liquidity becomes a major focus point.

OFS businesses that have closely managed their line of credit, such that they have abundant LOC capacity remaining when a downturn occurs, have flexibility that other OFS businesses lack. Likewise, OFS participants that maintain close debtor relationships are likely to get a better reception when negotiating with their debtors for adjustments to their debt structure, or for forbearance terms.

In terms of cost reduction, a company’s particular cost structure plays a significant role in its ability to cut expenses. Businesses with higher fixed costs lack the level of flexibility in cost containment that lower fixed cost businesses have. For example, businesses in which human resources are a larger percentage of total expenses have greater flexibility when considering staff reductions, pay-cuts, furloughs, and reducing hours. Furthermore, the ability to take those type cost containment actions can be easier for OFS businesses where the time to identify and hire qualified employees is shorter, and the cost of training such employees is lower. These factors make it easier to take critical human resource related / cost containment actions, in that any resulting staff losses can easily be replaced, and at a lower replacement cost.

Management Experience

Our discussion of differences among OFS industry participants during a downturn, would be incomplete without addressing the benefit of a management team with deep industry experience. Industry downcycles in highly cyclical industries, can be even more challenging with a management team that has limited experience. Most industries experience some degree of cyclicality, but the O&G industry tends to bring a heightened level of ups and downs, and unexpected supply and demand shifts. Afterall, how many industries can even fathom the idea of the futures market, for their only product, pushing into the realm of negative pricing? How many industries can be so significantly impacted, in such a short period of time, by a market share spat between market participants on the other side of the globe – not to mention those market participants being countries (Saudi Arabia and Russia) rather than individual businesses. Not exactly an industry conducive to downturn survival if the management team has limited industry experience.

In a recent management interview with one of our recurring OFS clients, the head of the company expressed how industry experience allows a seasoned management team to act quickly and decisively, and that such actions can make or break an OFS business in an industry wide downturn. He commented that less experienced management teams sometimes suffer from a “drug” known as “hopium” – a tendency to hope that the downturn will be short lived and therefore hesitate to take the necessary decisive action needed to stave off a cash crunch that can rapidly turn into a bankruptcy filing. He further noted that due to his teams’ deep industry experience across multiple O&G cycles, when the combined COVID-19 and Saudi-Russian dust-up hit, his team immediately, as he put it, flipped open to page 5 of their “Oh <bleep>” playbook and began a pre-planned series of actions to enhance liquidity and reduce costs, without allowing unwarranted “hope” to get in the way. As such, their business, while certainly feeling the impact of the downturn, is feeling it much less negatively than other OFS businesses.

Conclusion

While the O&G industry has many systematic forces that impact industry participants across the board, there are many unsystematic forces that lead to marked differences in the magnitude of the downturn’s impact on individual businesses. The OFS portion of the O&G industry is particularly diverse with subsector and basic focus potentially imposing greater, or lesser, downturn risk on a particular OFS market participant. Beyond those demand impacting factors, cost structure and level of industry cycle, experience among management teams have a significant impact on an OFS business’s ability to hold-on during an industry wide downturn and avoid the need for a bankruptcy filing.