Production and Activity Levels

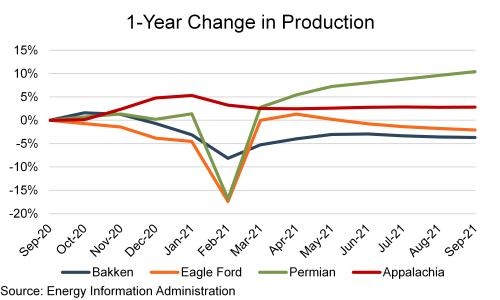

Estimated Bakken production (on a barrels of oil equivalent, or “boe” basis) decreased approximately 4% year-over-year through September. Production in the Permian and Appalachia increased 10% and 3% year-over-year, respectively, while the Eagle Ford’s production declined 2%. While production in the Bakken rebounded sharply once wells were brought back online aftercurtailments in mid-2020, it has generally trended lower during 2021. Production in the Eagle Ford and Permian was meaningfully impacted in February 2021, driven by Winter Storm Uri that disrupted power supplies throughout Texas.

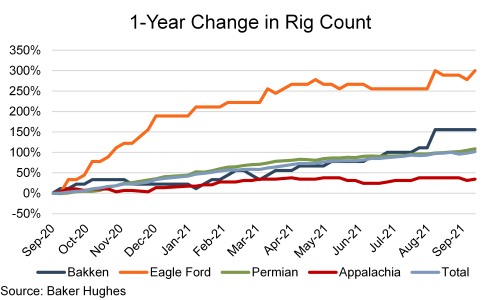

As of September 17th, there were 23 rigs in the Bakken up 156% from September 11, 2020. Eagle Ford, Permian, and Appalachia rig counts were up 300%, 109%, and 34%, respectively, over the same period.

As of September 17th, there were 23 rigs in the Bakken up 156% from September 11, 2020. Eagle Ford, Permian, and Appalachia rig counts were up 300%, 109%, and 34%, respectively, over the same period.

One may wonder why Bakken production has been on the decline given substantial rig count growth, while Permian production has continued to increase despite a more moderate increase in rigs. The answer has to do with legacy production declines and new well production per rig. Based on data from the U.S. Energy Information Administration, the Bakken needs roughly 19 rigs running to offset existing production declines. That number for the Permian is approximately 200 rigs. The Bakken’s rig count only recently broke above that maintenance level of drilling, whereas the Permian has had over 200 active drilling rigs since February 2021. Current activity in the Bakken should stem the recent production declines, but growth will likely be modest without additional rigs.

One may wonder why Bakken production has been on the decline given substantial rig count growth, while Permian production has continued to increase despite a more moderate increase in rigs. The answer has to do with legacy production declines and new well production per rig. Based on data from the U.S. Energy Information Administration, the Bakken needs roughly 19 rigs running to offset existing production declines. That number for the Permian is approximately 200 rigs. The Bakken’s rig count only recently broke above that maintenance level of drilling, whereas the Permian has had over 200 active drilling rigs since February 2021. Current activity in the Bakken should stem the recent production declines, but growth will likely be modest without additional rigs.

Oil Stabilizes while Natural Gas Soars

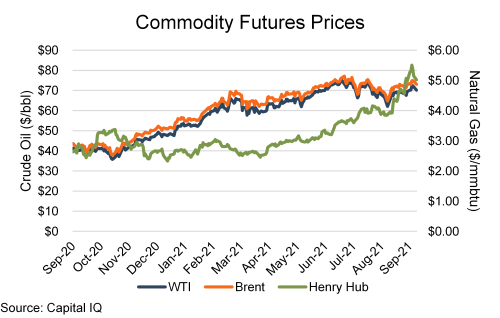

After a significant run-up in the first two quarters of the year, oil prices were largely range-bound during the third quarter of 2021, with front-month futures prices for West Texas Intermediate (WTI) generally oscillating between $65/bbl and $75/bbl. Rising COVID-19 cases in the U.S. caused the Delta variant to put a damper on travel activity and associated fuel consumption. However, producers seem to be maintaining their capital discipline even in light of higher prices, which is limiting production growth. Henry Hub natural gas front-month futures prices began the quarter at approximately $3.63/mmbtu but broke above $5.00/mmbtu in September. The current run-up in natural gas prices has some concerned about what the winter may hold, when prices generally increase due to heating demand. In Europe, declining coal capacity and less-than-expected wind generation from North Sea wind turbines have contributed to surging natural gas prices, and the situation is beginning to impact industrial production.

However, the current commodity price environment may be short-lived. Commodity futures prices are in backwardation (meaning that current prices are higher than future prices), implying some near-term tightness that is expected to subside. This sentiment is echoed by the U.S. Energy Information Administration, which stated in their September 2021 Short-term Energy Outlookthat “growth in production from OPEC+, U.S. tight oil, and other non-OPEC countries will outpace slowing growth in global oil consumption” and would likely lead to lower oil prices.

However, the current commodity price environment may be short-lived. Commodity futures prices are in backwardation (meaning that current prices are higher than future prices), implying some near-term tightness that is expected to subside. This sentiment is echoed by the U.S. Energy Information Administration, which stated in their September 2021 Short-term Energy Outlookthat “growth in production from OPEC+, U.S. tight oil, and other non-OPEC countries will outpace slowing growth in global oil consumption” and would likely lead to lower oil prices.

Financial Performance

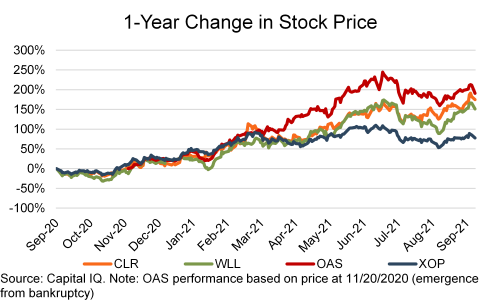

The Bakken public comp group saw strong stock price performance over the past year (through September 20th), with all constituents outperforming the broader E&P sector (as proxied by XOP). Continental and Whiting prices increased 175% and 151% year-over-year, compared to the XOP’s increase of 78%. Oasis, which emerged from bankruptcy in November 2020, is up 191% from its initial closing price post-bankruptcy. However, this impressive stock price performance is probably more reflective of the dire straits of these companies last year. Both Whiting and Oasis declared bankruptcy in 2020 and appear to have benefited from a cleaned-up capital structure.

Keystone XL Finally Cancelled

The Keystone XL pipeline, originally proposed in 2008, was finally cancelled by its developer, Canadian midstream company TC Energy. President Biden revoked a key permit needed for the project on his first day in office.

The proposed pipeline caused significant controversy during its planning stages as it provided takeaway capacity for production from Alberta oil sands (which is more energy intensive, and thus less sustainable, than other forms of hydrocarbon extraction) and its path through Nebraska’s environmentally sensitive Sandhills region and Ogallala Aquifer. Keystone XL also would have provided additional pipeline capacity out of the Bakken, which could become very needed if the also-controversial Dakota Access Pipeline gets shutdown.

Conclusion

While the Bakken saw strong production increases in the wake of mid-2020’s commodity price rout, that recovery appears to have faltered in 2021. Production has generally been on the decline this year, though the recent increase in rigs operating in the basin should stem this decrease and provide for modest production growth going forward. However, companies’ current emphasis on returning cash to shareholders may lead to less investment than has been seen in previous periods with similar commodity price environments.

We have assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America, and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.