In August, Chesapeake Energy Corporation announced that it would acquire Vine Energy Inc. in a stock-and-cash transaction valued at approximately $2.2 billion. We previously discussed Vine’s IPO, which was the first upstream (non-minerals, non-SPAC) initial public offering since Berry Petroleum’s debut in mid-2017. Vine’s decision to be acquired in a ~0% premium transaction less than five months after its IPO speaks to the difficulty for E&P companies to manage public market dynamics even in a much-improved commodity price environment. In this post, we dig into the transaction rationale, look at relative value measures, and analyze how this transaction seems to indicate a shift in Chesapeake’s strategy.

Transaction Rationale

Chesapeake’s acquisition generally follows the recent upstream M&A playbook: mostly stock, low-to no-premium, and a focus on cost synergies.

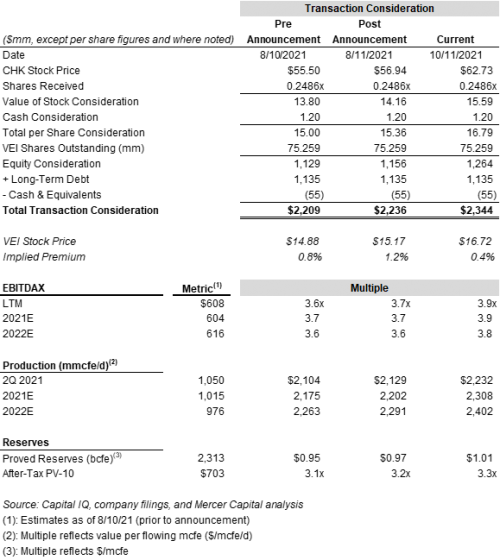

Cash consideration of $1.20 per share represents 8% of the $15.00 total consideration per share. It is somewhat curious that there’s a cash component to the purchase, especially for a company that recentlyemerged from bankruptcy in a transaction that doubles the company’s leverage. However, even with the cash outlay and assumption of Vine’s debt, Chesapeake management indicates that the pro forma entity will have a relatively modest net debt to 2022E EBITDAX ratio of 0.6x.

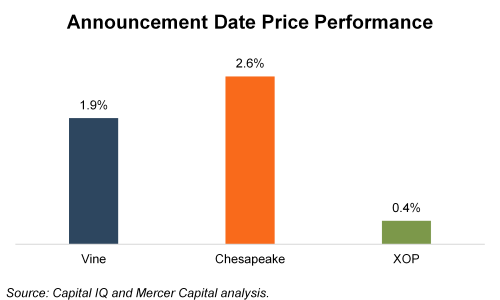

Based on market data, immediately prior to announcement, the transaction consideration represents a <1% premium to Vine’s stock price. While that may not seem like a great deal for shareholders, the 92% stock consideration means that legacy Vine shareholders should benefit from any synergies achieved by the transaction. On the announcement date, market reaction was generally positive, with both Vine and Chesapeake outperforming the broader upstream universe (as proxied by the SPDR S&P Oil & Gas Exploration & Production ETF, ticker XOP).

As for those synergies, management expects to save $20 million per year on general & administrative and lease operating expenses, with another $30 million per year in capital efficiencies, resulting in an annual savings of $50 million per year.

As for those synergies, management expects to save $20 million per year on general & administrative and lease operating expenses, with another $30 million per year in capital efficiencies, resulting in an annual savings of $50 million per year.

Valuation Considerations

Relative value measures for the transaction are shown in the following table:

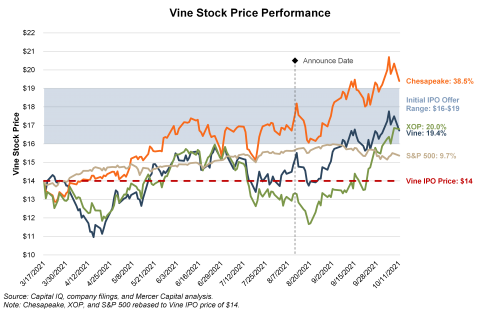

As with any transaction with a stock component, the transaction consideration is dynamic and fluctuates with the acquirer’s stock price. The initial transaction consideration of $15 per share was only $1 higher than Vine’s IPO price. But with the run-up in natural gas prices and continued exposure via stock consideration, Vine has recently traded at all-time highs and is now within its initial IPO offer range.

As with any transaction with a stock component, the transaction consideration is dynamic and fluctuates with the acquirer’s stock price. The initial transaction consideration of $15 per share was only $1 higher than Vine’s IPO price. But with the run-up in natural gas prices and continued exposure via stock consideration, Vine has recently traded at all-time highs and is now within its initial IPO offer range.

Chesapeake Shifts Back to Natural Gas Roots

Chesapeake has historically focused on natural gas production. However, in the wake of persistently low natural gas prices from roughly 2010-2020, the company sought to diversify its production mix and become more oil focused. In pursuit of this goal, the company was particularly active on the M&A and A&D front, with actions including the sale of itsUtica assets in Ohio and acquisition of Eagle Ford producer WildHorse Development Corporation. Ultimately, the company overextended itself and entered bankruptcy in mid-2020.

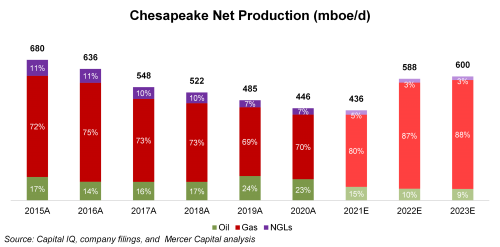

After emerging from bankruptcy earlier this year, management indicated that investment activity would be focused on natural gas assets. The timing seems apt with the recent increase in natural gas prices. The acquisition of Vine will stem Chesapeake’s recent trend of production declines and materially increase its natural gas mix.

After emerging from bankruptcy earlier this year, management indicated that investment activity would be focused on natural gas assets. The timing seems apt with the recent increase in natural gas prices. The acquisition of Vine will stem Chesapeake’s recent trend of production declines and materially increase its natural gas mix.

Conclusion

Vine’s brief stint as a public company looks to be coming to an end. With natural gas stealing the spotlight from crude oil, Chesapeake is seeking to return to its former glory as America’s natural gas champion. The combination with Vine will make Chesapeake a dominate force in the Haynesville and support the company’s pivot away from oil.

We have assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America, and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.