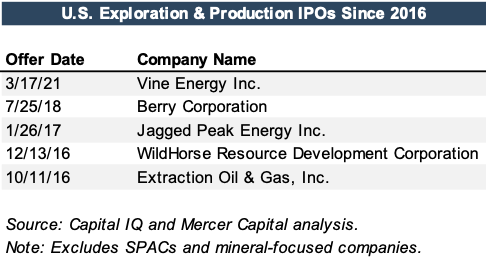

It’s been tough out there for equity capital markets bankers covering the upstream sector. Since 2016, there have only been five U.S. exploration & production company IPOs. [1] The dearth of activity is driven by a number of factors, including poor historical returns from the space, special purpose acquisition companies (SPACs) supplanting the traditional IPO process, and environmental, social, and governance (ESG) pressures resulting in less capital availability.

Three U.S. E&P IPOs took place in late 2016 and early 2017. Berry Petroleum, a California producer focused on conventional production methods, went public in mid-2018. Nearly three years would pass until the next IPO: Vine Energy.

Three U.S. E&P IPOs took place in late 2016 and early 2017. Berry Petroleum, a California producer focused on conventional production methods, went public in mid-2018. Nearly three years would pass until the next IPO: Vine Energy.

Vine IPO

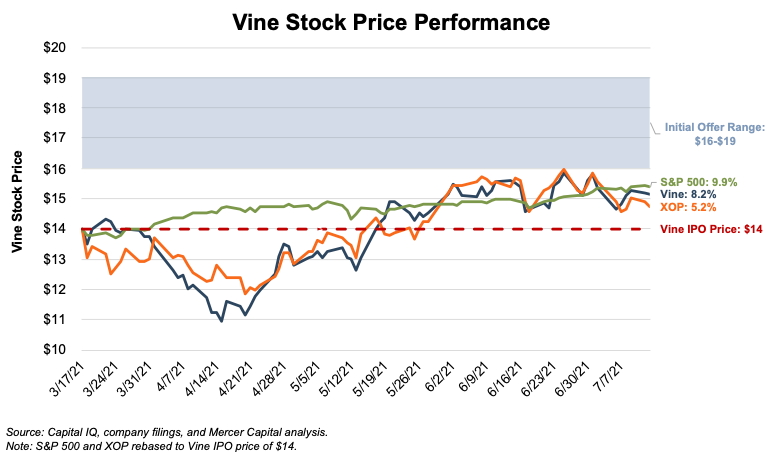

Vine Energy, a pure-play Haynesville gas producer, broke this nearly three-year dry spell with their IPO in March of this year. However, Vine had a rough start as a public company. The IPO priced at $14 per share, below the anticipated offering price of $16 to $19 per share indicated in Vine’s S-1. Once trading began, there was no typical IPO pop, as the stock opened at $13.75. The stock continued to trade down over the next several weeks, closing below $11 in mid-April.

However, Vine’s stock price performance since the nadir has been relatively strong. The stock price rose to almost $16 in late June, up more than 44% from its low. Overall, the stock is up 8% from its IPO price, outperforming the broader E&P sector (as proxied by XOP, the SPDR S&P Oil & Gas Exploration & Production ETF), though still lagging the S&P 500.

However, Vine’s stock price performance since the nadir has been relatively strong. The stock price rose to almost $16 in late June, up more than 44% from its low. Overall, the stock is up 8% from its IPO price, outperforming the broader E&P sector (as proxied by XOP, the SPDR S&P Oil & Gas Exploration & Production ETF), though still lagging the S&P 500.

Are More E&P IPOs Coming?

While we don’t have a crystal ball, there several are factors that could lead to additional E&P IPOs over the next several years.

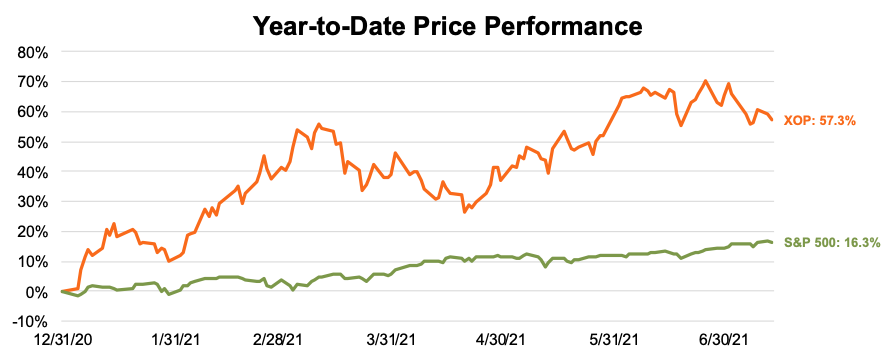

Restraint Leading to Returns: E&P companies were maligned for a “drill, baby, drill” mentality which led to huge amounts of capital being deployed to generate suboptimal returns. However, they seemed to have learned their lesson and are now showing capital discipline, even in light of a much-improved commodity price environment. The result is that shale drillers are actually delivering free cash flow. That appears to be impacting stock prices, as the year-to-date performance (through 7/13/2021) of XOP has trounced the S&P 500 (shown in the following chart). If this performance holds, investors who previously shunned the industry may begin dipping their toes back in with increased allocations to the sector.

Need for Private Equity to Exit: Between 2015 and 2019, private equity funds raised approximately $86 billion of capital to deploy on U.S. oil & gas assets. However, that capital raising has slowed, and traditional oil & gas PE sponsors (including Riverstone, EnCap, and NGP) have begun focusing on energy transition investments. With less private equity capital in the ecosystem, and public E&Ps showing restraint with respect to capital spending, public markets may be the best exit opportunity for certain larger PE-backed companies.

Need for Private Equity to Exit: Between 2015 and 2019, private equity funds raised approximately $86 billion of capital to deploy on U.S. oil & gas assets. However, that capital raising has slowed, and traditional oil & gas PE sponsors (including Riverstone, EnCap, and NGP) have begun focusing on energy transition investments. With less private equity capital in the ecosystem, and public E&Ps showing restraint with respect to capital spending, public markets may be the best exit opportunity for certain larger PE-backed companies.

It Might Be Another Long Dry Spell Before We See Another E&P IPO

Lack of Public S-1 Filings: The IPO process is an involved and lengthy affair. One of the first steps required to go public is filing an S-1, which is the initial registration form for new securities required by the SEC. The S-1, which is usually filed well in advance of an actual public offering, describes the company’s operations and includes financial information. According to data from Capital IQ, there do not appear to be any U.S. E&P companies with active registration statements for material sized (>$50 million) offerings. The most recent S-1 filings for uncompleted offerings are from Tapstone Energy and EnVen Energy Corporation. However, both of those registration statements have been withdrawn. With no E&P companies currently teed up to go public, it will likely be a while before one makes it through the process.Less Need for Growth Capital: As previously discussed, with many shale drillers generating free cash flow, there is less need for growth capital to support operating activities. As such, private operators may eschew the scrutiny and pressure of public markets and remain private.

Continued ESG Pressures: With increasing emphasis on ESG issues, it could be challenging to generate the typical level of investor appetite necessary to successfully execute an IPO, especially among large institutional investors who typically anchor many IPO processes.

SPAC Alternative: SPACs have emerged as a viable alternative to the traditional IPO process. Several E&P companies were early adopters of SPACs as a means to go public, including Centennial, Alta Mesa, and Magnolia. While many energy-focused SPACs indicate that they are seeking opportunities in the energy transition space, there are a handful that may be seeking to acquire E&P companies.Conclusion

Vine’s public market debut brought an end to a long-running drought of E&P IPOs, though it may be more of an anomaly than a harbinger of things to come. With no public S-1 filings among upstream energy companies and continued investor focus on ESG issues, we don’t expect to see any new public E&P companies any time soon.

We have assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America, and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.