The recent rise of oil prices returning to over $50 per barrel is a welcome sign to mineral and royalty holders across the board. There are inklings of bullish expectations for oil and gas prices in the coming year. However, climbing back up the valuation cliff that these assets fell from in March 2020 is still daunting. There are a lot of factors keeping this asset class from rebounding such as rig counts, capex budgets and supply chain issues. It has slowed royalty acquisitions and divestitures to a crawl and pushed undeveloped acreage values in many areas to multi-year lows.

On the other hand, these same factors have led to a rush of estate planning transaction activity. The combination of depressed E&P valuations, the potential for future tax changes and the ability for mineral and royalty holding entities to utilize minority interest and marketability discounts have kept many tax advisors busy in recent months. These low valuations may not last for much longer if some recent bullish sentiment comes to fruition though. In the meantime, let us expound a bit on these forces keeping mineral and royalty valuations in their existing state.

Low Upstream Valuations

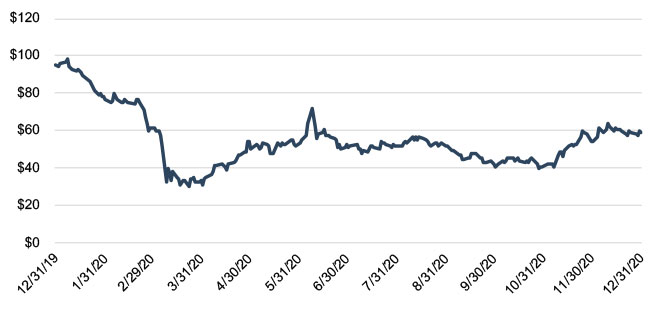

There is no need to explain how 2020 was a tough year, though the pain was dire for many upstream companies. Recovery appears to be gaining ground, but the momentum is tentative and some changes in travel habits might become permanent. While E&P company values (as proxied by the SPDR S&P Oil & Gas Exploration & Production ETF $XOP) have recovered from their lows in March, the index remains down year-over-year, having declined 38% during 2020.

[caption id="attachment_35814" align="alignnone" width="668"]

SPDR S&P Oil & Gas Exploration & Production ETF (XOP) | Source: CAPITAL IQ[/caption]

The recent flurry of E&P bankruptcies also is indicative of a challenging operating environment and reduced equity valuations. There are exceptions with assets and situations of highly economic Tier 1 production, and/or acreage that can maintain or have proportionally small value decreases during this downturn, but most E&P companies have suffered alongside commodity prices. One of the significant outcomes from this is that rig counts remain less than half what they were pre-pandemic. This lack of activity is contributing to current oil inventory issues and price gains but is also keeping raw and undeveloped acreage valuations particularly depressed due to the slowdown in prospective development timelines.

SPDR S&P Oil & Gas Exploration & Production ETF (XOP) | Source: CAPITAL IQ[/caption]

The recent flurry of E&P bankruptcies also is indicative of a challenging operating environment and reduced equity valuations. There are exceptions with assets and situations of highly economic Tier 1 production, and/or acreage that can maintain or have proportionally small value decreases during this downturn, but most E&P companies have suffered alongside commodity prices. One of the significant outcomes from this is that rig counts remain less than half what they were pre-pandemic. This lack of activity is contributing to current oil inventory issues and price gains but is also keeping raw and undeveloped acreage valuations particularly depressed due to the slowdown in prospective development timelines.

Potential For Future Tax Changes

President Biden’s tax plan calls for some major changes to the current gift & estate tax regime. Most notably, the estate tax exemption could be reduced from today’s $11.7 million (unified) to $3.5 million (estate) and $1.0 million (gift), and the tax rate could increase from 40% to 45%. The prospects for tax reform likely increased after Georgia’s Senate run-off elections on January 5th which put the Democrats in control of both houses of Congress.

While new tax legislation could potentially be made retroactive to January 1, many tax policy experts see that as unlikely.

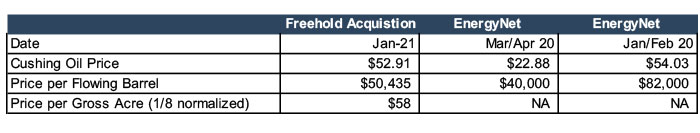

Acreage Values Remain Depressed

These dynamics are keeping values low. Cash flow values are coming back, but not much else. Few are paying for undrilled acreage unless it is extremely high quality. Freehold’s recent $58 million royalty package acquisition demonstrates this. The deal announced in early January included 400,000 gross acres of mineral title and overriding royalty interests across 12 basins and eight states. It traded for about 58x months of prospective cash flow, but the incremental acreage value was minimal (if anything).

[caption id="attachment_35815" align="alignnone" width="700"]

Royalty/Mineral Transaction Activity | Sources: Energy Net, EIA, and Hart Energy[/caption]

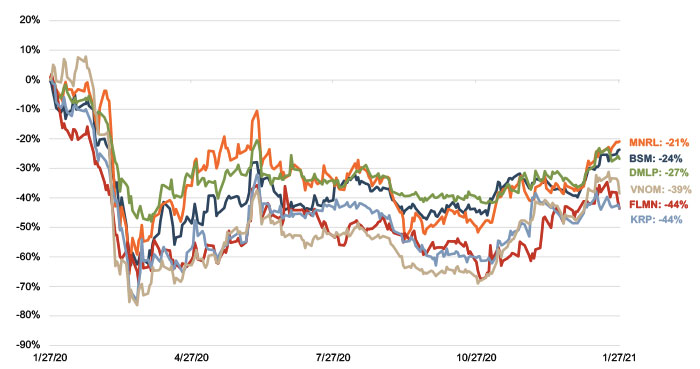

This characteristic is also apparent in mineral aggregators’ stock prices, which remain significantly lower even though oil and gas prices are in a similar spot as a year ago.

[caption id="attachment_35816" align="alignnone" width="700"]

Royalty/Mineral Transaction Activity | Sources: Energy Net, EIA, and Hart Energy[/caption]

This characteristic is also apparent in mineral aggregators’ stock prices, which remain significantly lower even though oil and gas prices are in a similar spot as a year ago.

[caption id="attachment_35816" align="alignnone" width="700"] Mineral Aggregator Stock Performance: 2020-2021 | Source: Capital IQ[/caption]

Mineral Aggregator Stock Performance: 2020-2021 | Source: Capital IQ[/caption]

Until The Drill Bit Turns…

Many things remain uncertain, but for investors in mineral and royalty assets, prices above $50 per barrel again is a start. The more restrictive regulatory environment will likely also buoy prices. However, until production ramps up and future drilling inventory comes into focus, expect that mineral and royalty values will still have a steep cliff to climb.

Originally appeared on Forbes.com on January 29, 2021.