The Key Question

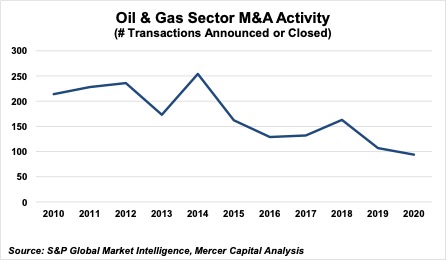

As 2020 progressed, a record number of oil & gas operators and related oil field service companies filed for Chapter 11 bankruptcy, which provides for the reorganization of the firm as opposed to full liquidation (Chapter 7). In addition, consolidation by way of merger and acquisition (“M&A”) activity occurred, albeit such activity was at a 10-year low in 2020.

Regardless of whether a company files for Chapter 11, is party to an M&A transaction, or executes some other form of capital restructuring – such as new equity funding rounds or dividend recaps – one fundamental question takes center stage: Will the company remain solvent?

Regardless of whether a company files for Chapter 11, is party to an M&A transaction, or executes some other form of capital restructuring – such as new equity funding rounds or dividend recaps – one fundamental question takes center stage: Will the company remain solvent?The Four Tests

As noted in our overview of solvency opinions last November, leveraged transactions that occurred pre-COVID-19 will continue to be scrutinized, with many bankruptcy courts considering the issue of solvency retroactively. Due to increased energy price volatility in the first and second quarter of 2020, many operational and dividend programs were suspended.

As oil & gas prices have stabilized and appreciated over the past one to two quarters (in its April Short-Term-Energy Outlook report, EIA projects WTI and Brent to average $58.89 and $62.28 per barrel, respectively), a large number of oil & gas operators have significantly reduced their debt, and are considering or have resumed their operational plans and dividend programs, albeit perhaps not exactly as before their suspension.

Emerging from the chaos of 2020 with lower leverage, leaner and more efficient operations, higher commodity prices, and the continued low interest rate environment, it is not unreasonable to think that oil & gas companies may consider increasing leverage again as operations continue to recover or expand and boards approve the return of capital to shareholders by way of resuming regular or even special dividends.

Often, a board contemplating such actions will be required to obtain a solvency opinion at the direction of its lenders or corporate counsel to provide evidence that the board exercised its duty of care to make an informed decision should the decision later be challenged.

A solvency opinion, typically performed by an independent financial advisor, addresses four questions:

- Does the fair value of the company’s assets exceed its liabilities after giving effect to the proposed action?

- Will the company be able to pay its debts (or refinance them) as they mature?

- Will the company be left with inadequate capital?

- Does the fair value of the company’s assets exceed its liabilities and capital surplus to fund the transaction?

Solvency Considerations within Oil & Gas

Performing a solvency opinion requires careful consideration of numerous factors even when everything clearly appears to be more or less favorable in a proposed transaction that involves increasing leverage. It may be opportune to pursue a dividend recap as debt is cheap and the company is already exhibiting strong growth in an industry potentially starting to recover. A company may increase leverage despite already having sufficient cash on hand for a special distribution, but it wants to maintain flexibility to act on unexpected growth opportunities that may arise. Perhaps the company’s trajectory is so great that even its downside case(s) would be a lofty goal of the next closest competitor. Still, the independent financial advisor must maintain a critical eye, taking a medium- to long-term perspective with a skeptic lens, to determine that the company may reasonably remain solvent.

Now, consider the oil & gas sector in 2020. Under the assumption that additional debt is needed just to survive, never mind paying special dividends, many additional questions to approaching the company’s baseline forecast and downside scenarios arise:

- If the fair value of the company’s assets is already greatly diminished in the current down cycle, how much should you temper – if at all – the downside future scenario(s) when conducting the capital adequacy test? An appropriate stress test scenario for a company at the top or mid-point of the business cycle may look far different from an appropriate stress at the bottom of the cycle.

- How will the balance sheet test fare given the concurrent decrease in asset fair value and increase in liabilities? Even if the capital adequacy and balance sheet tests do not raise any red flags on their own, the cash flow test may reveal significant concerns. Is there enough flexibility with the existing revolver to address cash flow needs over the forecast, or will it need to be increased? Could the revolver even be increased, if needed?

- Can the company financially perform well enough over the next three to five years that future (likely) higher interest rates won’t be overly burdensome if the company must refinance maturing debts?

- And while due diligence and financial feasibility studies are expected to be performed beforehand, what covenant violations are likely to occur and when (in the context of the forecast scenario)? Will the new debt be “covenant-light” and relatively toothless, or will the company find itself that much more constrained when the fangs sink in and the situation is already likely to be dire?