The economics of Oil & Gas production vary by region. Mercer Capital focuses on trends in the Eagle Ford, Permian, Bakken, and Marcellus and Utica plays. The cost of producing oil and gas depends on the geological makeup of the reserve, depth of reserve, and cost to transport the raw crude to market. We can observe different costs in different regions depending on these factors. This quarter we take a closer look at the Marcellus and Utica shales.

Production and Activity Levels

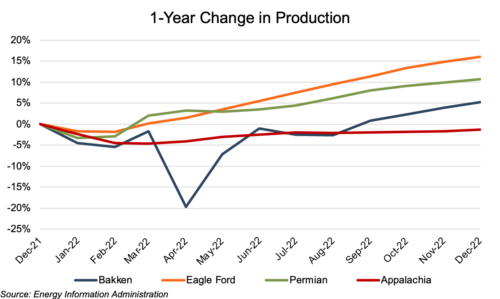

Estimated Appalachian production (on a barrels of oil equivalent, or “boe” basis) decreased approximately 1% year-over-year through late December. Production in the Eagle Ford, Permian, and Bakken increased 16%, 11%, and 5% year-over-year. Despite a much-improved year-over-year commodity price environment, Appalachian production was fairly stable, largely due to high price volatility over the year, which left the markets uncertain as to where prices would be going forward.

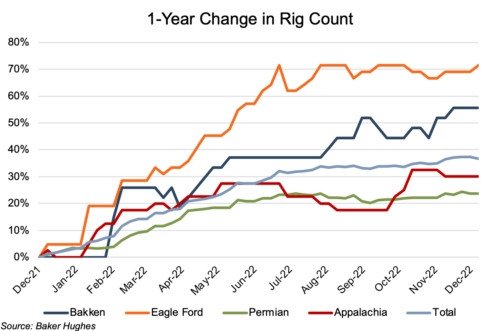

Rig counts continued to climb in all four basins over the last year. Growth rates in the Appalachian and Permian basins were more modest, while rates for the Bakken and Eagle Ford basins were notably higher. The Appalachian rig count rose 30% from 40 to 52 rigs. Among the oil-focused basins, the Eagle Ford led with a 71% increase from 42 to 72 rigs. The Bakken followed with a 56% increase (27 to 42 rigs), while the Permian had the lowest increase with a 24% increase (283 to 350 rigs).

As is typical, Appalachian production has been relatively flat despite its rig count growth. That’s due to the basin’s higher production declines which necessitate a higher rig count to maintain production levels.

Commodity Price Volatility

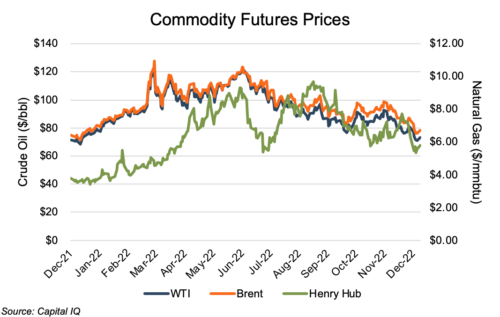

Henry Hub natural gas front-month futures prices have experienced significant volatility over the latest year. Prices began 2022 on a general upswing before rising sharply as the market reacted to Russia’s invasion of Ukraine in late February. As Russia subsequently began leveraging its natural gas supplies against Europe in retaliation of Europe’s response to the war in Ukraine, natural gas prices became notably more volatile. They rose from an early March low of $4.56 to an early June high of $9.29 — only to drop back to $5.39 in late June and then hit a 2022 high of $9.42 in late August. By mid-December, Henry Hub had declined, albeit with only lightly reduced volatility, to $5.79.

Oil prices, as benchmarked by West Texas Intermediate (WTI) and Brent Crude (Brent), also began 2022 on a steady upward trend that took the WTI from $76/bbl to $88/bbl and the Brent from $79/bbl to $91/bbl, prior to the Russian invasion. As the reality of the Russian-Ukraine war took hold, the oil benchmarks showed a marked uptick in volatility that lasted into mid-May, with prices hitting highs of $120/bbl and $128/bbl, and lows of $93/bbl and $96/bbl. Since then, WTI and Brent prices have trended downward, exhibiting more typical volatility other than modest rallies in August and October. As of mid-December, WTI sat at $73/bbl and Brent at $78/bbl.

Financial Performance

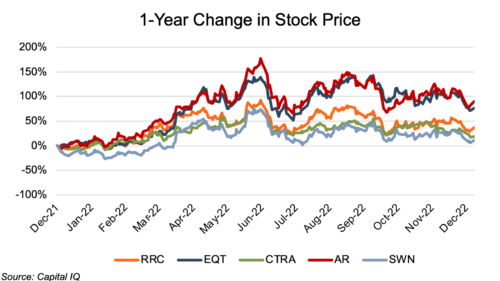

The Appalachian public comp group saw markedly strong stock price performance over the past year (through December 12th), led by Antero and EQT with price increases of 90% and 77% as of December 12th. The remaining members of the comp group showed more modest 1-year price increases of 12% to 38%. Prices peaked in early June for all members, except EQT, with year-to-date increases of 71% to 171%. EQT’s stock price peaked in mid-September at a year-to-date increase of 143%. Stock prices fell sharply beginning in mid-September but reversed direction immediately following the sabotage of the Nord Stream pipelines in the Baltic Sea that transport Russian natural gas to northern Europe.

Antero and EQT led the way among this group for several reasons. For Antero, one reason appears to have been its lack of hedging for 2023, which has allowed it greater exposure to the uptick in gas prices and has allowed Antero to be aggressive in paying down debt. EQT, on the other hand, does have more near-term hedging ceilings to deal with. However, its strength is in its operational efficiencies, whereby their recent literature demonstrates breakeven operating expenses at $1.37 per mcf. This is among the lowest in the industry and allows them to accumulate cash flow.

Conclusion

Appalachian production held steady in 2022 despite historically high commodity price volatility driven by the Russian-Ukraine war, the sabotage of the Nord Stream pipelines, and rising LNG exports to Europe to stave-off potential winter heating shortages. The Q4 Appalachian rig count is at a level beyond that needed for production volume maintenance, so there would seem to be at least some potential for Henry Hub price reductions going into 2023. However, the demand for new natural gas supplies to Europe provides a countervailing wind to any potential downward movement in natural gas prices. In the end, the natural gas markets seem to be in the midst of a series of events that promise continued supply and demand shifts with no certainty as to where the market will go in 2023.

We have assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.