Upstream and oilfield service companies have bucked trends most of this year.

While other industries have had stagnant to negative returns, the oil patch has outperformed them all, as I highlighted earlier this summer. Since then, market capitalizations have stagnated. Yet, the reality is that equity returns are soaring on a wave of cash flow right now.

Operational cash flow for the sector was at its highest in the five year period since 2017 at $203 billion, according to the EIAs’ Financial Review of the Global Oil and Natural Gas Industry: Second Quarter 2022 report.

This led to a 22% return on equity which was notable not only because it was the highest recorded return in the survey period, but also because it usurped U.S. manufacturing companies' returns on equity for the first time in the survey period.

It has been a long time coming, but several realities have been coming to the forefront to build this wave: world realities, production realities, and capital realities.

World Realities

The energy industry’s reality is one tethered to the zeitgeist. Few if any other industries are as sensitive to the volatility of politics, regulation, and events. A year ago, longer-term supply and demand trends were pushing tailwinds for upstream producers, but those winds blew up into a storm when Russia invaded Ukraine. Several of my contributing colleagues here at Forbes.com have done good work covering these developments. That has Russian oil production likely dropping around 20%, with an accompanying impact to prices. In addition, OPEC+ has reduced oil production quotas for October.

The energy industry’s reality is that some unintended consequences regarding the scramble for energy transition away from fossil fuels have collided with “contingencies.” Aramco’s CEO Amin Nasser was very blunt about this in Switzerland last Tuesday (before the Nord Stream incident).

Perhaps most damaging of all was the idea that contingency planning could be safely ignored

“Perhaps most damaging of all was the idea that contingency planning could be safely ignored,” said Nasser, “Because when you shame oil and gas investors, dismantle oil- and coal-fired power plants, fail to diversify energy supplies (especially gas), oppose LNG receiving terminals, and reject nuclear power, your transition plan had better be right.”

“Instead, as this crisis has shown, the plan was just a chain of sandcastles that waves of reality have washed away.And billions around the world now face the energy access and cost of living consequences that are likely to be severe and prolonged,” said Nasser.

There has been a flurry of speculation as to who is responsible for the explosions emanating from the Nord Stream pipeline, but what is now concerning is Europe’s ability to keep warm this winter. The U.K. reversed its fracking ban to help secure its energy supply. It may be too little too late this winter for the Brits.

In the meantime, Europe’s eyes look to the U.S. to stand in the growing energy gap, particularly gas. The U.S. has skyrocketed to become the top exporter of LNG in the world this year. This won’t change any time soon and is expected to continue to expand and grow.

At the same time, U.S. domestic demand has been growing too, thus multiplying natural gas prices compared to two years ago.

Production Realities

While demand has resurged domestically and abroad, upstream production has not been keeping up the same way it has in the past. The good news is that production is growing and will continue to. However, there are several things limiting growth. As I have written before, producers have been cautious for a myriad of reasons and as such, new major investments in development and drilling have been stalled. According to the EIA Financial Review, Capex of the companies surveyed was $59 billion in the 2Q of 2022, only 8% higher than the 2Q of 2021.

Rig counts are growing, but not at the same pace as they did the last time commodity prices were this high.

DUC wells are at the lowest level in almost a decade, so drilling inventories continue to shrink.

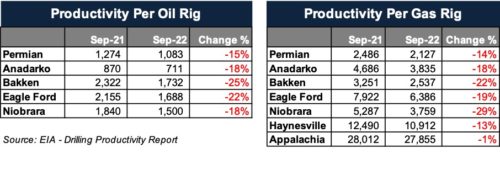

Another reality is that productivity at the individual rig level is waning. This comes in two ways: 1) the form of productivity for new wells drilled, and 2) existing legacy production is declining faster than before.

Explanations for this are not entirely clear.

Perhaps it is the exhaustion of top-tier PUD well locations, continued permitting problems that Joe Manchin could not fix, or the flight of talent from the oilfield in the last few cycles. Costs increased for the seventh straight quarter in the Fed Survey – near historical index highs. Nonetheless – it is happening and fueling a bevy of comments like this from the Dallas Fed Survey: “Uncertainty on the political front continues to be a major concern. The withdrawal of leases that have already been issued is an example. Inflationary pressure is eating significantly into discretionary cash flow, limiting the amount of money allocated to new projects.” 85% of survey participants expected to see a significant tightening in the oil market by the end of 2024 given the underinvestment in exploration.

Capital Realities

In the past several years there simply has not been enough capital deployed in the sector to defray some of the shorter-term event volatility such as Ukraine’s war with Russia.

79% in the Fed Survey expect to see some investors return to the space

With the spike in prices, 79% in the Fed Survey expect to see some investors return to the space, attracted by superior returns. However, it may be some time for that to matter. In this business, measured in years and decades, investments that can move the world needle take time to come to fruition. In the meantime, 69% of respondents in the Fed Survey expect to see the age of inexpensive gas ending by 2025. Existing capital remains focused on paying off debt and dividends, not drilling. Cash flows from Operations of $203 billion and Capex of $59 billion clearly communicates this reality.

In the long run, prices ultimately communicate reality in a commodity business, so the expectations of higher prices should be the instigator to change behavior to a more balanced energy policy for much of the developed world.

In the short run, oil and gas investors are getting exceptional returns. That should not change any time soon.

Originally appeared on Forbes.com.