The economics of Oil & Gas production vary by region. Mercer Capital focuses on trends in the Eagle Ford, Permian, Bakken, and Marcellus and Utica plays. In this post, we take a closer look at the Eagle Ford.

Production and Activity Levels

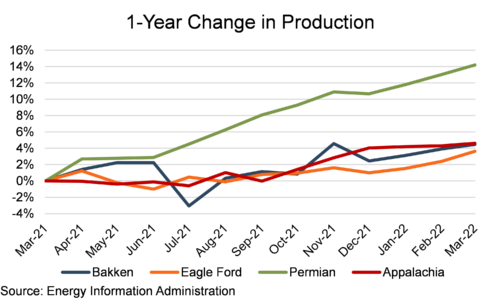

Estimated Eagle Ford production (on a barrels of oil equivalent, or “boe,” basis) increased approximately 4% year-over-year through March. This is in line with the production increases seen in the Bakken and Appalachia (4% and 5%, respectively) but lags behind the Permian, where production increased 14% year-over-year.

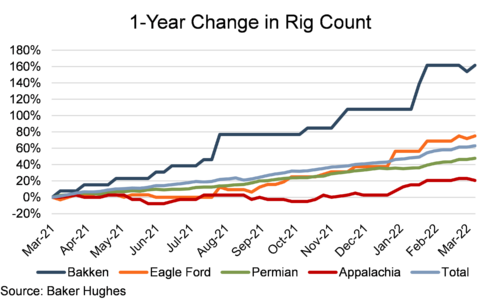

There were 56 rigs in the Eagle Ford as of March 25, up 75% from March 19, 2021. Bakken, Permian, and Appalachia rig counts were up 162%, 48%, and 21%, respectively, over the same period.

One may wonder why the Eagle Ford has lagged the Permian in production growth despite a larger increase in rigs. The answer has to do with legacy production declines and new well production per rig. Based on data from the U.S. Energy Information Administration (“EIA”), the Eagle Ford needs ~40-45 rigs running to offset existing production declines, and only recently (starting in January) had more rigs running than this maintenance level. The Permian has generally been operating with more than the maintenance level of rigs, so it has seen a higher level of production growth despite a smaller increase in rigs. However, with 56 rigs now running in the Eagle Ford, more production growth should be on the way.

Commodity Prices Rise Amid Geopolitical Tension

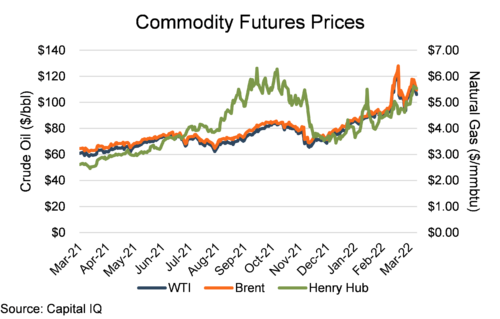

Oil prices generally rose through the first two months of the quarter as increased demand was met with continued producer restraint. While the shale revolution had largely put geopolitics in the back seat as a key driver of commodity prices, geopolitics once again became front and center as Russia launched its invasion of Ukraine. In response, Western nations launched a series of economic sanctions against Russia. While the sanctions generally included carve-outs for energy exports, issues with financing and insurance, as well as the exit of Western oil companies and oilfield service providers from Russia, have resulted in a substantial decline in oil exports from the country. Russia was the third-largest producer of petroleum and other liquids in 2020, according to data from the U.S. Energy Information Administration, behind the U.S. and just shy of Saudi Arabia. The potential for that much oil to no longer be available for global markets has led to a high degree of volatility in oil prices. West Texas Intermediate (WTI) front-month futures prices began the quarter at ~$75/bbl and reached $120/bbl in March. Prices have swung dramatically based on actions in Ukraine and the progress of peace talks.

Natural gas prices did not exhibit the same level of volatility as oil prices, given the more localized nature of the commodity. However, natural gas is becoming more globalized as Europe grapples with how to replace Russian imports. One obvious source is the United States, as President Biden pledged to boost LNG exports to Europe, despite these same exports being demonized by Democratic Senator Elizabeth Warren just a few short months ago. Administration officials aim to increase European LNG exports to 50 billion cubic meters annually, up from 22 billion cubic meters exported to the E.U. last year.

Financial Performance

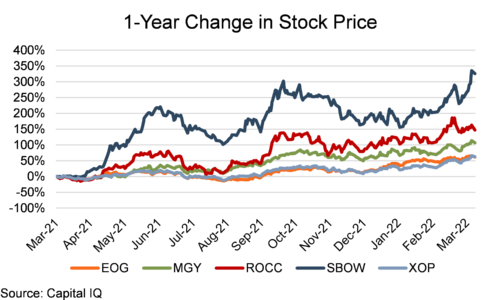

The Eagle Ford public comp group saw relatively strong stock price performance over the past year (through March 28). The beneficial commodity price environment was a significant tailwind to smaller, more leveraged producers like SilverBow and Ranger, whose stock prices increased 326% and 147%, respectively, during the past year, outperforming the broader E&P sector (as proxied by XOP, which rose 62% during the same period). Larger, less leveraged EOG was a laggard, with its stock price rising 61%, slightly behind the broader E&P sector.

Survey Says Eagle Ford Wells Among Most Economic

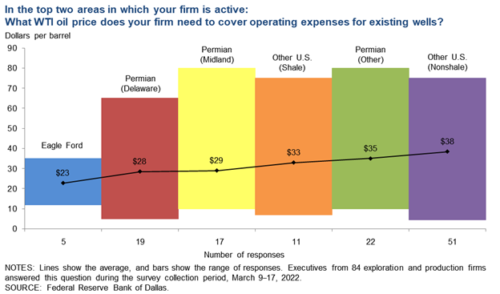

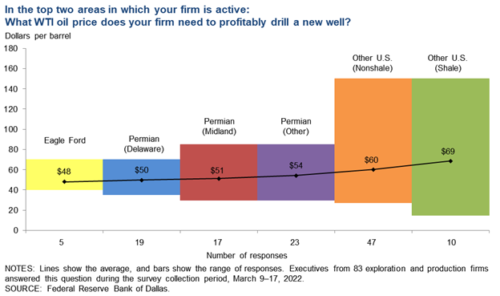

According to participants of the First Quarter 2022 Dallas Fed Energy Survey, Eagle Ford wells are among the most economic in the nation.

Survey respondents indicated that the average WTI price needed to break even on existing Eagle Ford wells was $23/bbl. This is below the average breakeven in the Permian ($28-$29) and other parts of the U.S. ($30+). While the economic advantage diminishes somewhat for drilling new wells, the Eagle Ford also had the lowest average breakeven for new development, with producers needing WTI at $48/bbl to profitably drill new wells, besting the Permian ($50-51) and other parts of the country ($54-$69).

The Eagle Ford’s economic advantage comes from both its geology and geography. The basin’s proximity to Gulf Coast refining and export markets gives it a leg up relative to more inland basins.

Conclusion

Eagle Ford production growth was relatively muted over the past year as capital discipline led to producers running rigs largely at maintenance level. However, with the recent surge in commodity prices, producers are finally starting to bring more rigs online, which should lead to more production growth. However, this growth can’t fill the void left by Russian exports, so commodity prices will likely remain volatile until there is some sort of resolution in Ukraine.

We have assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.