Second quarter earnings for publicly traded upstream producers are trickling in, and profitability has returned to the energy sector. In the meantime, government officials have been sending mixed messages to the upstream sector, desiring temporary supply relief in the aim of lowering prices whilst remaining bearish on fossil fuels overall. The industry response: thanks, but no thanks (a polite way of putting it). Producers have largely been holding the course set years ago towards returns and deleveraging, snubbing pressure from the Biden administration. It has been tempting for producers to ramp up production amid $100+ oil prices and gas prices the highest they have been since 2008. However, with supply chain issues and labor shortages, the appeal has been dampened.

Cash Flow Remains King

According to the latest Dallas Fed Energy Survey, business conditions remain the highest in the history of the survey. Concurrently, profits continue to rise. Analysts are pleased and management teams are eagerly talking about free cash flow, debt management, and stock buybacks. By the way, an interesting factoid from Antero’s investor presentation: most oil and gas companies are now much less levered than their S&P 500 counterparts. When it comes to Net Debt to EBITDAX multiples, the majors average about 0.9x while the S&P 500 averages 2.8x. Most independents that I reviewed were aiming towards around 1x leverage.

The industry should be able to keep it up. Last year around this time, I was questioning how long this might be able to continue. I noted drilled but uncompleted well (“DUC”) counts as an inexpensive proxy for profitable well locations. However, at today’s prices, DUCs matter less than they did from an investment decision standpoint.

I sampled current investment presentations of six upstream companies (randomly chosen) and read them to discern key themes that they are communicating to investors. Adding new rigs to the mix was not on any of their agendas. Not one has announced a revision to their capex plans from early in the year even amid the changes in the past five months.

There have been some companies accelerating plans, but not many. This quote from the Fed Energy Survey was representative of sentiment in this area: “Government animosity toward our industry makes us reluctant to pursue new projects.” There are 752 rigs in the U.S. currently, according to Shaleexperts.com. In early March, the week before the pandemic wreaked its industry havoc — there were 792. Yes - we still have not reached pre-pandemic rig counts. To boot, rigs are relatively less productive on a per rig basis, primarily because most new drilling locations are less attractive and productive than the ones already drilled. The capex calvary is not coming to the rescue either. Capex at the world’s top 50 producers is set to be just over $300 billion this year, as compared to $600 billion in 2013 according to Raymond James. 2013 was the last year oil prices were over $100 a barrel for the year. As has been said before, production should grow, but not at a particularly rapid pace.

Energy Valuations: A Bright Spot

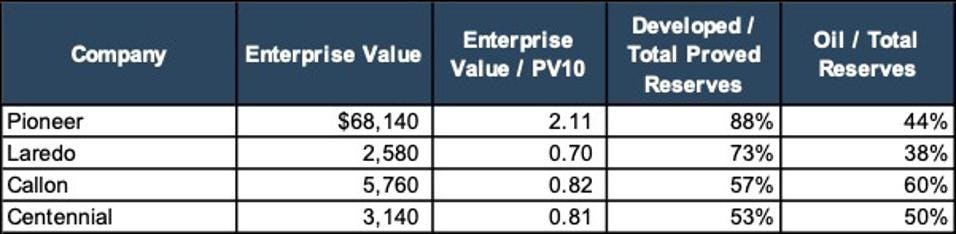

These industry and commodity forces have contributed to the energy sector having an outstanding year from a stock price and valuation perspective as well. Returns have outpaced all other sectors, and Permian operators have performed at the top of the sector. While the U.S. suffered its second quarter of GDP decline in a row, and the stock market has officially become a bear but energy returns stand out.

Some investors appear to be changing their tune towards the energy sector amid these kinds of results, and the valuations are reflecting this. There are some indicators that suggest we could be entering into a long “super cycle” for the energy sector whereby the industry could outperform for years to come. It bears out that to fruition the sentiment I quoted last year as well from the Dallas Fed’s Survey: “We have relationships with approximately 400 institutional investors and close relationships with 100. Approximately one is willing to give new capital to oil and gas investment…This underinvestment coupled with steep shale declines will cause prices to rocket in the next two to three years. I don’t think anyone is prepared for it, but U.S. producers cannot increase capital expenditures: the OPEC+ sword of Damocles still threatens another oil price collapse the instant that large publics announce capital expenditure increases.” That prophecy has come true.

Supply Chain Woes

The challenge for producers may be less about growth and more about maintenance. 94% of Dallas Fed Survey Respondents had either a slightly or significantly negative impact from supply-chain issues at their firm. Major concerns about labor, truck drivers, drill pipe and casing supplies, equipment, and sand are hampering the execution of existing drilling plans, to say nothing about expansion.

“Supply chain and labor-shortage issues persist. Certain materials are difficult to access, which is hampering our ability to plan, absent a willingness to depart from certain historical practices relating to quality standards.” – Dallas Fed Respondent.

Nonetheless, global inventories continue to decline. The U.S. Energy Information Administration’s short-term energy outlook expects production to catch up, but it appears harder to envision that now and nobody exactly knows what that will look like in the U.S. The EIA acknowledged that pricing thresholds at which significantly more rigs are deployed are a key uncertainty in their forecasts.

Who knows how much longer upstream companies will continue to tune out the administration or finally try to rev up their growth plans in response to commodity prices? The December 2026 NYMEX futures strip is over $70 right now. There are a lot of potentially profitable wells to be drilled out there at $70 oil. However, management teams know all too well that prices can change quickly. We shall see.

Originally appeared on Forbes.com.