2015 was a strong year for FinTech. For those still skeptical, consider the following:

- All three publicly traded FinTech niches that we track (Payments, Solutions, and Technology) beat the broader market, rising 11 to 14% compared to a 1% return for the S&P 500;

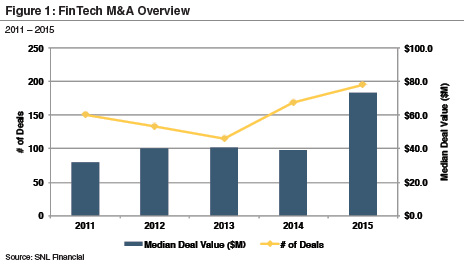

- FinTech M&A volume and pricing rose sharply over recent historical periods with 195 announced deals and a median deal value of $74 million in 2015 (Figure 1);

- A number of notable fundings for private FinTech companies occurred with roughly $9.0 billion raised among approximately 130 U.S. FinTech companies in larger funding rounds (only includes raises over $10 million).

One of the more notable FinTech events in 2015 was Square's IPO, which occurred in the fourth quarter. Square is a financial services and mobile payments company that is one of the more prominent FinTech companies with its high profile founder (Jack Dorsey, the Twitter co-founder and CEO) and early investors (Kleiner Perkins and Sequoia Capital). Its technology is recognizable with most of us having swiped a card through one of their readers attached to a phone after getting a haircut, sandwich, or cup of coffee. Not surprisingly, Square was among the first FinTech Unicorns, reaching that mark in June 2011. Its valuation based on private funding rounds sat at the top of U.S.-based FinTech companies in mid-2015.

So all eyes in the FinTech community were on Square as it went public in late 2015. Market conditions were challenging then (compared to even more challenging in early 2016 for an IPO), but Square had a well-deserved A-list designation among investors. Unfortunately, the results were mixed. Although the IPO was successful in that the shares priced, Square went public at a price of $9 per share, which was below the targeted range of $11 to $13 per share. Also, the IPO valuation of about $3 billion was sharply below the most recent fundraising round that valued the company in excess of $5 billion.

In the category its great pay if you can get it, most Series E investors in the last funding round had a ratchet provision that provided for a 20% return on their investment, even if the offering price fell below the $18.56 per share price required to produce that return. The ratchet locked in through the issuance of additional shares to the Series E investors. The resulting dilution was borne by other investors not protected by the ratchet.

On the flip side the IPO was not so bad for new investors. Square shares rose more than 45% over the course of the opening day of trading and then traded in the vicinity of $12 to $13 per share through year-end. With the decline in equity markets in early 2016, the shares traded near the $9 IPO price in mid-February.

IPO pricing is always tricky—especially in the tech space—given the competing demands between a company floating shares, the underwriter, and prospective shareholders. The challenge for the underwriter is to establish the right price to build a sizable order book that may produce a first day pop, but not one that is so large that existing investors are diluted. According to MarketWatch, less than 2% of 2,236 IPOs that priced below the low end of their filing range since 1980 saw a first day pop of more than 40%. By that measure, Square really is a unique company.

One notable takeaway from Square's experience is that the pricing of the IPO as much as any transaction may have marked the end of the era of astronomical private market valuations for Unicorn technology companies. The degree of astronomical depends on what is being measured, however. We have often noted that the headline valuation number in a private, fundraising round is often not the real value for the company. Rather, the price in the most recent private round reflects all of the rights and economic attributes of the share class, which usually are not the same for all shareholders, particularly investors in earlier fundraising rounds. As Travis Harms, my colleague at Mercer Capital noted: "It's like applying the pound price for filet mignon to the entire cow – you can't do that because the cow includes a lot of other stuff that is not in the filet."

While a full discussion of investor preferences and ratchets is beyond the scope of this article, they are fairly common in venture-backed companies. Recent studies by Fenwick & West of Unicorn fundraisings noted that the vast majority offered investors some kind of liquidation preference. The combination of investor preferences and a decline in pricing relative to prior funding rounds can result in asymmetrical price declines across the capital structure and result in a misalignment of incentives. John McFarlane, Sonos CEO, noted this when he stated: "If you're all aligned then no matter what happens, you're in the same boat… The really high valuation companies right now are giving out preferences – that's not alignment."

A real-world example of this misalignment was reported in a New York Times story in late 2015 regarding Good Technology, a Unicorn that ended up selling to BlackBerry for approximately $425 million in September 2015. While a $425 million exit might be considered a success for a number of founders and investors, the transaction price was less than half of Good's purported $1.1 billion valuation in a private round. The article noted that while a number of investors had preferences associated with their shares that softened the extent of the pricing decline, many employees did not. "For some employees, it meant that their shares were practically worthless. Even worse, they had paid taxes on the stock based on the higher value."

As the Good story illustrates, the valuation process can be challenging for venture-backed technology companies, particularly those with several different share classes and preferences across the capital structure, but these valuations can have very real consequence for stakeholders, particularly employees. Thus, it is important to have a valuation process with formalized procedures to demonstrate compliance with tax and financial reporting regulations when having valuations performed. Certainly, the prospects for scrutiny from auditors, SEC, and/or IRS are possible but very real tax issues can also result around equity compensation for employees.

Given the complexities in valuing venture-backed technology companies and the ability for market/investor sentiment to shift quickly, it is important to have a valuation professional that can assess the value of the company as well as the market trends prevalent in the industry. At Mercer Capital, we attempt to gain a thorough understanding of the economics of the most recent funding round to provide a market-based "anchor" for valuation at a subsequent date. Once the model is calibrated, we can then assess what changes have occurred (both in the market and at the subject company) since the last funding round to determine what impact if any that may have on valuation. Call us if you have any questions.

For those interested in additional FinTech trends, check out our latest FinTech industry newsletter and sign up for future issues here.

One of the more notable FinTech events in 2015 was Square's IPO, which occurred in the fourth quarter. Square is a financial services and mobile payments company that is one of the more prominent FinTech companies with its high profile founder (Jack Dorsey, the Twitter co-founder and CEO) and early investors (Kleiner Perkins and Sequoia Capital). Its technology is recognizable with most of us having swiped a card through one of their readers attached to a phone after getting a haircut, sandwich, or cup of coffee. Not surprisingly, Square was among the first FinTech Unicorns, reaching that mark in June 2011. Its valuation based on private funding rounds sat at the top of U.S.-based FinTech companies in mid-2015.

So all eyes in the FinTech community were on Square as it went public in late 2015. Market conditions were challenging then (compared to even more challenging in early 2016 for an IPO), but Square had a well-deserved A-list designation among investors. Unfortunately, the results were mixed. Although the IPO was successful in that the shares priced, Square went public at a price of $9 per share, which was below the targeted range of $11 to $13 per share. Also, the IPO valuation of about $3 billion was sharply below the most recent fundraising round that valued the company in excess of $5 billion.

In the category its great pay if you can get it, most Series E investors in the last funding round had a ratchet provision that provided for a 20% return on their investment, even if the offering price fell below the $18.56 per share price required to produce that return. The ratchet locked in through the issuance of additional shares to the Series E investors. The resulting dilution was borne by other investors not protected by the ratchet.

On the flip side the IPO was not so bad for new investors. Square shares rose more than 45% over the course of the opening day of trading and then traded in the vicinity of $12 to $13 per share through year-end. With the decline in equity markets in early 2016, the shares traded near the $9 IPO price in mid-February.

IPO pricing is always tricky—especially in the tech space—given the competing demands between a company floating shares, the underwriter, and prospective shareholders. The challenge for the underwriter is to establish the right price to build a sizable order book that may produce a first day pop, but not one that is so large that existing investors are diluted. According to MarketWatch, less than 2% of 2,236 IPOs that priced below the low end of their filing range since 1980 saw a first day pop of more than 40%. By that measure, Square really is a unique company.

One notable takeaway from Square's experience is that the pricing of the IPO as much as any transaction may have marked the end of the era of astronomical private market valuations for Unicorn technology companies. The degree of astronomical depends on what is being measured, however. We have often noted that the headline valuation number in a private, fundraising round is often not the real value for the company. Rather, the price in the most recent private round reflects all of the rights and economic attributes of the share class, which usually are not the same for all shareholders, particularly investors in earlier fundraising rounds. As Travis Harms, my colleague at Mercer Capital noted: "It's like applying the pound price for filet mignon to the entire cow – you can't do that because the cow includes a lot of other stuff that is not in the filet."

While a full discussion of investor preferences and ratchets is beyond the scope of this article, they are fairly common in venture-backed companies. Recent studies by Fenwick & West of Unicorn fundraisings noted that the vast majority offered investors some kind of liquidation preference. The combination of investor preferences and a decline in pricing relative to prior funding rounds can result in asymmetrical price declines across the capital structure and result in a misalignment of incentives. John McFarlane, Sonos CEO, noted this when he stated: "If you're all aligned then no matter what happens, you're in the same boat… The really high valuation companies right now are giving out preferences – that's not alignment."

A real-world example of this misalignment was reported in a New York Times story in late 2015 regarding Good Technology, a Unicorn that ended up selling to BlackBerry for approximately $425 million in September 2015. While a $425 million exit might be considered a success for a number of founders and investors, the transaction price was less than half of Good's purported $1.1 billion valuation in a private round. The article noted that while a number of investors had preferences associated with their shares that softened the extent of the pricing decline, many employees did not. "For some employees, it meant that their shares were practically worthless. Even worse, they had paid taxes on the stock based on the higher value."

As the Good story illustrates, the valuation process can be challenging for venture-backed technology companies, particularly those with several different share classes and preferences across the capital structure, but these valuations can have very real consequence for stakeholders, particularly employees. Thus, it is important to have a valuation process with formalized procedures to demonstrate compliance with tax and financial reporting regulations when having valuations performed. Certainly, the prospects for scrutiny from auditors, SEC, and/or IRS are possible but very real tax issues can also result around equity compensation for employees.

Given the complexities in valuing venture-backed technology companies and the ability for market/investor sentiment to shift quickly, it is important to have a valuation professional that can assess the value of the company as well as the market trends prevalent in the industry. At Mercer Capital, we attempt to gain a thorough understanding of the economics of the most recent funding round to provide a market-based "anchor" for valuation at a subsequent date. Once the model is calibrated, we can then assess what changes have occurred (both in the market and at the subject company) since the last funding round to determine what impact if any that may have on valuation. Call us if you have any questions.

For those interested in additional FinTech trends, check out our latest FinTech industry newsletter and sign up for future issues here.

Related Links

Mercer Capital's Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.