Sometimes deals can go horribly wrong between the signing of a merger agreement and closing. Buyers can fail to obtain financing that seemed assured; sellers can see their financial position materially deteriorate; and a host of other “bad” things can occur. Most of these lapses will be covered in the merger agreement through reps and warranties, conditions to close, and if necessary, the nuclear trigger that can be pushed if negotiations do not produce a resolution: the material adverse event clause (MAEC). And MAEC = litigation.

Bank of America’s (BAC) 2008 acquisition of Countrywide Financial Corporation will probably be remembered as one of the worst transactions in U.S. history, given the losses and massive fines that were attributed to Countrywide. BAC management regretted the follow-on acquisition of Merrill Lynch so much that the government held CEO Ken Lewis’ feet to the fire when he threatened to trigger MAEC in late 2008 when large swaths of Merrill’s assets were subjected to draconian losses. BAC shareholders bore the losses and were diluted via vast amounts of common equity that were subsequently raised at very low prices.

Another less well-known situation from the early crisis years is the acquisition of Charlotte-based Frist Charter Corporation (FCTR) by Fifth Third Bancorp (FITB). The transaction was announced on August 16, 2007 and consummated on June 6, 2008. The deal called for FITB to pay $1.1 billion for FCTR, consisting 30% of cash and 70% FITB shares with the exchange ratio to be set based upon the five day closing price for FITB the day before the effective date. At the time of the announcement FITB expected to issue ~20 million common shares; however, 45 million shares were issued because FITB shares fell from the high $30s immediately before the merger agreement was signed to the high teens when it was consummated. (The shares would fall to a closing low of $1.03 per share on February 20, 2009; the shares closed at $25.93 per share on July 14, 2017.) The additional shares were material because FITB then had about 535 million shares outstanding. Eagerness to get a deal in the Carolinas may have caused FITB and its advisors to agree to a fixed price / floating exchange ratio structure without any downside protection.

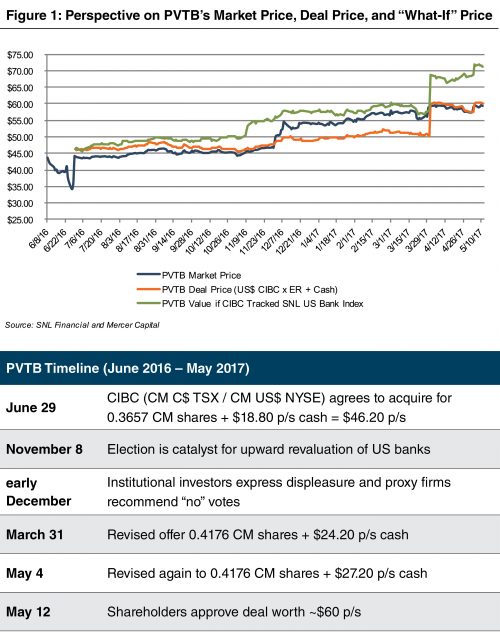

A more recent example of a deal that may entail both buyer and seller regrets is Canadian Imperial Bank of Commerce’s (CIBC) now closed acquisition of Chicago-based Private Bancorp Inc. (PVTB). A more detailed account of the history of the transaction can be found here. The gist of the transaction is that PVTB entered into an agreement to be acquired by CIBC on June 29, 2016 for 0.3657 CIBC shares that trade in Toronto (C$) and New York (US$), and $18.80 per share of cash. At announcement the transaction was valued at $3.7 billion, or $46.20 per share. As U.S. bank stocks rapidly appreciated after the November 8 national elections, institutional investors began to express dismay because Canadian stocks did not advance. In early December, proxy firms recommended shareholders vote against the deal. A mid-December shareholder vote was then postponed.

CIBC subsequently upped the consideration two times. On March 31, 2017, it proposed to acquire PVTB for 0.4176 CIBC shares and $24.20 per share of cash. On May 4, CIBC further increased the cash consideration by $3.00 to $27.20 per share because its shares had trended lower since March as concerns intensified about the health of Canada’s housing market. On May 12, shareholders representing 66% of PVTB’s shares approved the acquisition.

Figure 1 highlights the trouble with the deal from PVTB shareholders’ perspective. While the original deal entailed a modest premium, the performance of CIBC’s shares and the sizable cash consideration resulted in little change in the deal value based upon the original terms. On March 30 the deal equivalent price for PVTB was $50.10 per share, while the market price was $59.00 per share. The following day when PVTB upped the consideration the offer was valued at $60.11 per share; however, the revised offer would have been worth nearly $69 per share had CIBC’s shares tracked the SNL U.S. Bank Index since the agreement was announced on June 29. On May 11 immediately before the shareholder vote the additional $3.00 per share of cash offset the reduction in CIBC’s share price such that transaction was worth ~$60 per share, while the “yes-but” value was over $71 per share had CIBC’s shares tracked the U.S. index since late June. Fairness opinions do not cover regret, but there are some interesting issues raised when evaluating fairness from a financial point of view of both PVTB and CIBC shareholders. (Note: Goldman Sachs & Co. and Sandler O’Neill & Partners provided fairness opinions to PVTB as of June 29 and March 30. The registration statement does not disclose if J.P. Morgan Securities provided a fairness opinion as the lead financial advisor to CIBC. The value of the transaction on March 30 when the offer was upped the second time was $4.9 billion compared to CIBC’s then market cap of US$34 billion.)

Fairness is a Relative Concept

Some transactions are not fair, some are reasonable, and others are very fair. The qualitative aspect of fairness is not expressed in the opinion itself, but the financial advisor conveys his or her view to management and a board that is considering a significant transaction. When the PVTB deal was announced on June 29, it equated to $46.35 per share, which represented premiums of 29% and 14% to the prior day close and 20-day average closing price. The price/tangible book value multiple was 220%, while the P/E based upon the then 2016 consensus estimate was 18.4x. As the world existed prior to November 8, the multiples appeared reasonable but not spectacular.

Fairness Does not Consider 20-20 Hindsight Vision

Fairness opinions are qualified based upon prevailing economic conditions; forecasts provided by management and the like and are issued as of a specific date. The opinion is not explicitly forward looking, while merger agreements today rarely require an affirmation of the initial opinion immediately prior to closing as a condition to close. That is understandable in the context that the parties cut a deal that was deemed fair to shareholders from a financial point of view when signed. In the case of PVTB, the future operating environment (allegedly) changed with the outcome of the national election. Banks were seen as the industry that would benefit from a combination of lower corporate tax rates, less regulation, faster economic growth, and higher rates as part of the “reflation trade.” A reasonable deal became not so reasonable if not regrettable when the post November 8 narrative excluded Canadian banks. Time will tell if PVTB’s earning power really will improve, or whether the move in bank stocks was purely speculative.

Subtle Issues Sometimes Matter

Although not a major factor in the underperformance of CIBC’s shares vis-à-vis U.S. banks, the Canadian dollar weakened from about C$1.30 when the merger was announced on June 29 to C$1.33 in early December when the shareholder meeting was postponed. When shareholders voted to approve the deal on May 12 the Canadian dollar had eased further to C$1.37. The weakness occurred after the merger agreement was signed and the initial fairness opinions were delivered on June 29. Sometimes seemingly small financial issues can matter in the broad fairness mosaic, but only with the clarity of hindsight.

Waiting for a Better Deal is not a Fairness Consideration

Although a board will consider the business case for a transaction and strategic alternatives, a fairness opinion does not address these issues. The original registration statement noted that Private was not formally shopped. The deal was negotiated with CIBC exclusively, which twice upped its initial offer before the merger agreement was signed in June. It was noted that the likely potential acquirers of PVTB were unable to transact for various reasons. The turn of events raises an interesting look-back question: should the board have waited for a better competitive situation to develop? We will never know; however, the board is given the benefit of the doubt because it made an informed decision given what was then known.

The Market Established a Fair Price

Institutional shareholders had implicitly rejected what became an unfair deal by early December when PVTB’s shares traded well above the deal price. The market combined with the “no” recommendation of three proxy firms forced PVTB to delay the special meeting. The increase in the consideration in late March pushed the deal price to a slight premium to PVTB’s market price. CIBC increased the cash consideration an additional $3.00 per share in early May to offset a decline in CIBC’s shares that had occurred since the consideration was increased in March. The market had in effect established its view of a fair price. While CIBC could have declined to up its offer yet again, it chose to offset the decline.

Relative Fairness from CIBC’s Perspective Fluctuated

What appeared to be a reasonable deal from CIBC’s perspective in June became exceptionally fair by early December, if the market is correct that the earning power of U.S. commercial banks will materially improve as a result of the November 8 election. CIBC’s financial advisors can easily change assumptions in Excel spreadsheets to justify a higher price based upon better future earnings than originally projected, but would doing so be “fair” to CIBC shareholders whether expressed euphemistically or formally in a written opinion? So far the evidence of higher earning power is indirect via the market placing a higher multiple on current bank earnings in expectation of much better earnings that will not be observable until 2018 or 2019. That as a stand-alone proposition is an interesting valuation attribute to consider as part of a fairness analysis both from PVTB’s and CIBC’s perspective.

Conclusion

Hindsight is easy; predicting the future is a fool’s errand. Fairness opinions do not opine where securities will trade in the future. Some PVTB shareholders may have regrets that CIBC was not a U.S. commercial bank whose shares would have out-performed CIBC’s after November 8. CIBC shareholders may regret the PVTB acquisition even though U.S. expansion has been a top priority. The key, as always in any M&A transaction, will be execution over the next several years rather than the PowerPoint presentation. Higher rates, a faster growing U.S. economy and the like will help, too, if they occur.

We at Mercer Capital cannot predict the future, but we have over three decades of experience in helping boards assess transactions as financial advisors. Sometimes paths and fairness from a financial point of view seem clear; other times they do not. Please call if we can assist your company in evaluating a transaction.

This article originally appeared in Mercer Capital's Bank Watch, July 2017.