What is Step Zero?

A qualitative approach to test goodwill for impairment was introduced by the Financial Accounting Standards Board (“FASB”) when it released Accounting Standards Update 2011-08 (“ASU 2011-08”) in September 2011 as an update to goodwill impairment testing standards under Topic 350, Intangibles—Goodwill and Other.ASU 2011-08 set forth guidance for an optional qualitative assessment to be performed before the traditional quantitative two step goodwill impairment testing process.This preliminary qualitative assessment is known as “Step Zero.”The goal of Step Zero is to simplify and reduce costs of performing the traditional quantitative goodwill impairment test process.

According to ASU 2011-08, Step Zero allows entities “the option to first assess qualitative factors to determine whether the existence of events or circumstances leads to a determination that it is more likely than not that the fair value of a reporting unit is less than its carrying amount.”

Step One is required only if the qualitative assessment supports the conclusion that it is more likely than not (i.e., likelihood greater than 50%) that the fair value is less than the carrying value.Otherwise, Step One of the goodwill impairment testing process is not required.Alternatively, Step Zero can be skipped altogether, and the traditional quantitative goodwill impairment test can be performed beginning with Step One.

Industry Considerations

The standards update release by FASB outlines the individual qualitative categories of the assessment.Specific qualitative events and circumstances to be evaluated include the economy, industry, cost factors, financial performance, firm-specific events, reporting unit events, and changes in share price.

ASU 2011-08 defines industry events and circumstances as follows:

“Industry and market conditions such as a deterioration in the environment in which an entity operates, an increased competitive environment, a decline in market-dependent multiples or metrics (consider in both absolute terms and relative to peers), a change in the market for an entity’s products or services, or a regulatory or political development.”

The process of evaluating an industry involves assessing each of these stated events and circumstances since the previous reporting period and determining how they affect the comparison of fair value to carrying value.By comparing current conditions to the prior period, an analysis of relative improvement or deterioration can be made concerning each industry factor and the industry as a whole.

Increasing multiples, share prices, financial metrics, and M&A activity indicate that an industry is improving and suggests that it is more likely than not that the reporting unit’s fair value is greater than its carrying value. Decreasing multiples, share prices, financial metrics, and M&A activity indicate the industry is weakening and suggests that fair value may be less than the reporting unit’s carrying value.

Industry Analysis

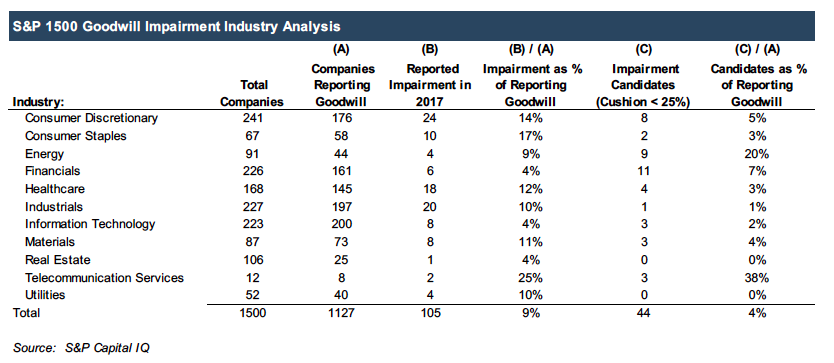

An analysis of the S&P 1500, an index that includes approximately 90% of the market capitalization of U.S. stocks, reveals the prevalence of impairment in different industries. For example, of the companies reporting goodwill on their balance sheets, 25% of telecommunication, 17% of consumer staples, and 14% of consumer discretionary companies recorded goodwill impairment charges in 2017.

On the other hand, the more robust performance of financial, information technology, and real estate companies is manifest in that only 4% of companies reporting goodwill in each industry recorded a goodwill impairment charge in 2017.

Further analysis indicates that companies in the energy and telecommunication industries are currently more likely to be potential impairment candidates as 20% and 38%, respectively, of companies reporting goodwill have cushions (the amount by which market value of equity exceeds book value of equity) of less than 25%. Deterioration in the operating environment of these industries may result in an increase in goodwill impairment charges.Industries with fewer impairment candidates at the moment include real estate, utilities, and industrials.

Industry considerations are particularly important to the qualitative assessment and provide valuable insight on the potential for impairment. The qualitative assessment is especially valuable in industries that are performing well as it is less likely that goodwill is impaired.

Step Zero provides the opportunity to perform a preliminary qualitative analysis to determine the necessity of performing the traditional two step goodwill impairment test and can lead to a simpler, more efficient impairment testing process.

The analysts at Mercer Capital have experience in, and follow, a diverse set of industries.We help clients assemble, evaluate, and document relevant evidence for the Step Zero impairment test. Call us today so we can help you.

Originally appeared in Mercer Capital's Financial Reporting Update: Goodwill Impairment