I recently attended FinXTech, an industry event where the hosts at Bank Director bring together FinTech founders and bank directors and executives for productive conversations about the road ahead as partners (and competitors).

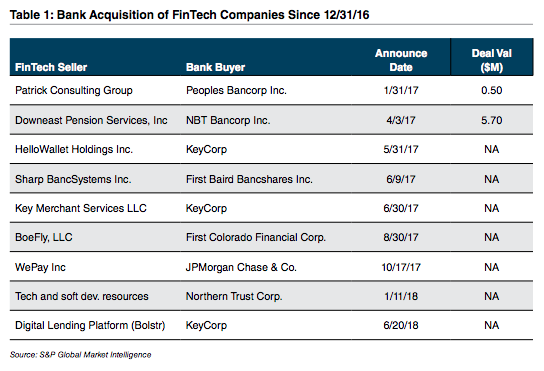

Those discussions occurred against a backdrop in which FinTech, as a concept to enhance the customer experience and to drive operating efficiencies, is widely accepted by bank management, shareholders, and regulators. How “FinTech” is implemented varies depending upon resources. As shown in the Table 1, there has been no surge of M&A in which banks buy FinTech companies. Only nine of 276 transactions announced since year-end 2016 entailed a bank or bank holding company acquirer. KeyCorp, which has been one of the nine active FinTech acquirers, announced in June 2018 that it would acquire digital lending technology for small businesses built by Chicago based FinTech company Bolstr. At best, activity can be described as episodic as it relates to bank acquisitions, which appears to be designed to supplement internal development.

The very largest banks such as JPMorgan Chase & Co. are spending billions of dollars annually to upgrade technology—a level of spending that even super regional banks cannot match. In contrast, community and regional banks have been left scratching their heads about how to address FinTech-related issues when money is a constraining factor.

During the FinXTech 2018, the focus shifted from the potential disruption of a bank’s franchise by FinTech to the potential to partner with FinTech companies, which stood out to me as a marked change from prior years.

Both banks and FinTech companies realize that they need each other to some degree. For banks, FinTech offers the potential to leverage innovation and new technologies to meet customer expectations, enhance efficiency, and compete more effectively against the biggest banks. For FinTech companies, the benefits from bank partnerships can include the potential to leverage the bank’s customer relationships to scale more quickly, access to funding, and regulatory/compliance expertise. Several examples of successful partnerships between banks and FinTech companies were highlighted at the FinXTech event. (You can read more about some of them here.)

The FinTech/Bank partnership theme also was evident in GreenSky’s recent IPO, a FinTech company based in Atlanta. GreenSky arranges loans primarily for home improvement projects. Bank partners pay GreenSky to generate and service the loans while the bank funds and holds the loans on their balance sheet. As more partnerships emerge, it will be interesting to see if FinTech impacts the valuation of banks that effectively leverage technology to achieve strategic objectives such as growing low-cost core deposits, opening new lending venues, and improving efficiency. One would think the answer will be “yes” if the impact can be measured and is meaningful.

Another trend to look for will be whether smaller banks become more active as investors in FinTech companies. For the most part, investments by community and regional banks in FinTech companies remains sporadic at best even though FinTech companies raised nearly $16 billion of equity capital between year-end 2016 and June 2018 in both private and public offerings. An interesting transaction we observed was a $16 million Series A financing by Greenlight Financial Technology, Inc., a creator of smart debit cards, in which the investors included SunTrust Bank, Amazon Alexa Fund, and $619 million asset NBKC Bank, among others.

FinXTech 2018 included several sessions related to due diligence for FinTech partnerships; however, with limited M&A and investing activity by banks there was little discussion about valuation issues, which can be challenging for FinTech companies and differs markedly from methods employed to value a bank.

Not surprisingly, we have lots of thoughts on the subject.

With the emerging partnership theme from FinXTech 2018 in mind, view our complimentary webinar “How to Value an Early-Stage FinTech Company.” Additionally, if you have questions, reach out to one of our professionals to discuss your needs in confidence.

Originally published in Bank Watch, June 2018.