Common Valuation Misconceptions about Your RIA

Old Rules of Thumb, Recent Headlines, and the Endowment Effect

The Endowment Effect on Your RIA

The “endowment effect” refers to an emotional bias that causes individuals to value an object they own higher than its market value. We’ve probably all been guilty of this at various times in our life when it comes to property values or assets that have some sort of emotional or symbolic significance to us.

This seems to be particularly true for business owners, and RIA principals are no exception. It’s understandable since these firms tend to be owner-operated, so RIA principals have often invested a significant portion of their professional lives in building a business that is very valuable to them.

As an independent valuation firm, we can help mitigate the endowment effect by establishing fair market value pricing from a (reasonably informed) outsider’s perspective. Unfortunately, rules of thumb and recent headlines are exacerbating the endowment effect.

Old Rules of Thumb: Your RIA Is Worth 2% of AUM

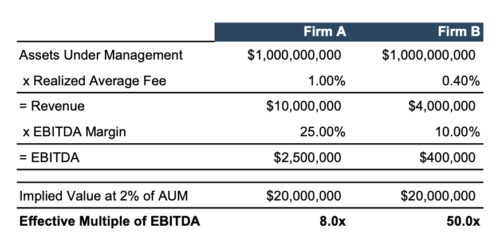

We have cautioned against using AUM and revenue-based multiples before, and an example has proven to be the best way to communicate the unreliability of such metrics. Consider Firm A and Firm B, which both have $1 billion in AUM. Firm A has a higher realized fee than Firm B (100 bps vs. 40 bps) and operates more efficiently (25% EBITDA margin versus 10% EBITDA margin). The result is that Firm A generates $2.5 million in EBITDA versus Firm B’s $400 thousand despite both firms having the same AUM.

The “2% of AUM” rule of thumb implies an EBITDA multiple of 8x for Firm A—a multiple that may or may not be reasonable for Firm A given current market conditions and Firm A’s risk and growth profile, but which is nevertheless within the historical range of what might be considered reasonable. The same “2% of AUM” rule of thumb applied to Firm B implies an EBITDA multiple of 50x, which is unlikely to be considered reasonable in any market conditions.

Recent Headlines: Your RIA Is Worth 15x EBITDA

Deal activity in the investment management space has increased over the last decade as consolidation has increased and outside investors realized the attractiveness of a recurring revenue stream paired with minimal capital investment. But the headlines touting impressive deal multiples really seemed to pick up in 2019 with Goldman’s acquisition of United Capital. However, most of the acquisitions that warrant headlines are of larger investment managers, which due to their sheer scale, are less risky and therefore warrant a higher multiple. These transaction multiples are, therefore, not likely to be indicative of fair market value for most RIAs but get cited quite often because of the headline effect.

Mixing old rules of thumb with recent headlines and the endowment effect typically results in overvaluation, stemming from underestimating non-systematic risk.

Underestimating Non-Systematic Risk

Most investment managers understand that their firm, like any publicly traded company in their clients’ portfolios, is exposed to systematic and non-systematic risks. And most seem to understand that investment management firms are subject to certain industry-wide risks, such as declining AUM bases and fee compression. But many investment management firms also have significant “firm-specific risks” that make their firm riskier than a much larger investment management firm. Many small to mid-sized investment management firms suffer from client concentrations, aging customer bases, unclear succession plans, dependence on key managers, lack of scale, and minimal asset growth (absent market appreciation).

Unfortunately, understanding the value of your RIA is not as easy as applying a multiple to your AUM or run-rate EBITDA. Value is a factor of cash flow, growth, and risk. We’ve written a lot about investment management firm valuations that cover the relevant considerations:

- RIA Margins – How Does Your Firm’s Margin Affect Its Value?

- Where Are RIA Valuations Today?

- Valuing RIAs

Our valuations may consider recent headlines and rules of thumb but are more heavily weighted toward cash flow expectations and transaction pricing of similar businesses. We’re happy to walk you through this if you have any questions.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, wealth managers, independent trust companies, broker-dealers, PE firms and alternative managers, and related investment consultancies.

RIA Valuation Insights

RIA Valuation Insights