Independent RIAs Drive M&A During Downturn

RIA M&A Amid COVID-19 (Part II)

The outlook for RIA M&A at the end of the first quarter was murky. While we did not expect deals already in motion to be canceled, we did expect deal activity to temporarily slow. We theorized that this slowdown could actually benefit the industry if RIA principals used the downtime to think about succession planning. DeVoe & Company summarized similar expectations for RIA M&A in a “Four-Phase Outlook for M&A Post COVID-19” published in its Q1 RIA Deal Book:

- Live transactions get completed.

- A lull in activity as owners respond to the COVID-19 pandemic rather than seek out new deals

- A surge in activity caused by delayed deals coming to the market

- Return to normalcy where the trends of increased M&A continue with an aging ownership base and a need for succession planning

So, were these expectations on track?

Review of M&A in Q2 2020

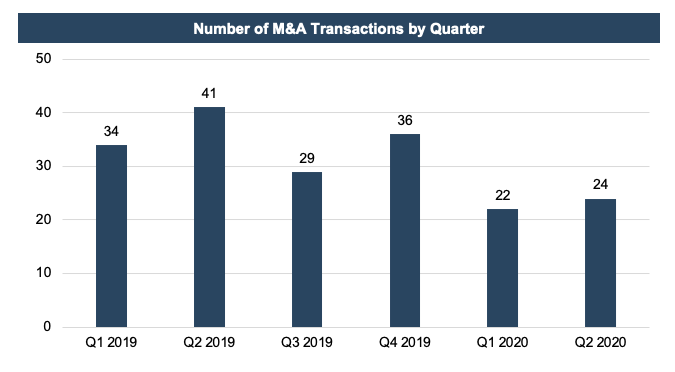

As anticipated, previously announced deals in the final stages of negotiations did close but new deal activity slowed some in the second quarter. According to Fidelity’s Wealth Management M&A Report, M&A activity in January and February kept pace with 2019 levels but fell off in March, April, and May. There were 24 transactions involving RIAs with over $100 million but less than $20 billion in AUM announced in Q2 2020 (and many of these deals were announced in June 2020). Still, this represents a decline in M&A activity compared with last year, as shown in the chart below.

Interestingly, in the second quarter of 2020, independent RIAs, rather than consolidators, drove much of the deal activity. Over the last few years, we have written about RIA consolidators time after time:

- Acquisition activity in the sector has been led primarily by RIA consolidators, with Focus Financial Partners, Mercer Advisors (no relation), and United Capital Financial Advisers each acquiring multiple RIAs during 2017 (January 2018)

- Several trends which have driven the uptick in sector M&A in recent years continued into 2018, including increasing activity by RIA aggregators (January 2019)

- RIA consolidators now account for about half of wealth management acquisition activity—and that percentage has been increasing (January 2020)

In the second quarter, two independent RIAs—The Mather Group (TMG) and Creative Planning—accounted for approximately 21% of the total transactions announced, while consolidators accounted for only 17% of the deals.

The Mather Group (an independent wealth management firm with seven offices around the U.S.) announced its sixth acquisition in the last 18 months on June 16, 2020, only one week after announcing a previous acquisition. The acquisition of Knoxville-based Resource Advisory Services, with $116 million in AUM, will bring TMG’s AUM to over $3.9 billion. TMG’s acquisition of Resource Advisory Services is indicative of a few M&A trends.

First, in a relationship-driven business such as wealth management, the fastest way to expand a firm’s footprint is often through acquisitions. TMG has been working to expand its footprint into the Southeast and this acquisition is a sensible addition to their recent acquisition of Atlanta-based Barnett Financial. Additionally, this acquisition highlights a struggle many RIA owners face: a need for scale but a hesitation to partner with PE-backed firms who have a reputation for pushing growth at all costs. Many RIA principals need a succession plan, and private equity capital isn’t always the right answer. Resource Advisory Services’ founder David Lewis said, “I’m thrilled to partner with a next-generation founder who isn’t private-equity backed, and feel very confident TMG’s long-term vision will support my advisors into the future.”

Creative Planning, based in Overland Park, Kansas, is one of the nation’s largest independent RIAs, announced three deals in the second quarter. Its most recent acquisition of Starfire Investment Advisers ($560 million AUM) was Creative Planning’s eighth deal in 2020 and its twelfth deal since it started on its acquisition spree last year. Creative Planning organically grew its AUM to $48 billion and since February 2019, has added another $5 billion in AUM through acquisitions. We expect to see more acquisitions from Creative Planning as it strives to reach $100 billion in AUM and become more of a household name. While Creative Planning is a driver in the trend of consolidation, it differentiates itself from traditional RIA consolidators by acquiring 100% of target companies and integrating them into the Creative Planning brand and investment philosophy. Additionally, while it is PE-backed, NY based General Atlantic holds a non-controlling minority share.

Creative Planning’s M&A activity and investment from General Atlantic makes us ask: When does an RIA shift from being an independent wealth manager to an acquirer of independent wealth managers? Mercer Advisors (no relation) seemed to make this transition when it first started buying RIAs in 2016. Since then, it has acquired around 30 advisory firms and has financed its acquisition activity by selling a sizeable stake in the company to PE firm Oak Hill Capital Partners while maintaining an investment from Genstar Capital.

The line between independent wealth manager and consolidator can be murky, but the trend this quarter was clear. Established consolidators, who primarily rely on debt financing or capital from PE firms, slowed acquisition activity in the second quarter. Dynasty Financial announced two deals in Q2, Focus Financial and Mercer Advisors each announced one deal, and Wealth Enhancement Group and HighTower Advisors did not report any deal activity in the second quarter – while strategic acquisitions by independent RIAs continued.

RIA consolidators who use leverage to buy RIAs were much more vulnerable to the decline in the market at the end of March. Most RIA consolidators have never been through a market downturn and their balance sheets may have not been as well-capitalized as needed to handle what many expected to be a few bad quarters and potentially years. With leverage on the balance sheet, interest coverage ratios became a concern for consolidators and the downturn in March likely served as a warning for aggregators to reevaluate their balance sheets. Most independent RIAs, on the other hand, have lived through market downturns previously and had capital built up to slug through a few bad quarters. Some even had the capital to acquire firms when competition from other buyers temporarily eased.

Outlook for RIA M&A

While RIA M&A did slow some in Q2, we don’t expect that this slowdown will continue as M&A activity picked up in June. We have been contacted by several RIA principals who are using this time to reconsider their buy-sell agreements and their plans for their firms. These conversations often prompt strategic discussions which can pique some firms’ interest in making acquisitions, can guide others down a path of internal succession planning as they prepare for retirement, and can serve as a wakeup call to others who are tired of dealing with the volatility inherent in many RIA practices. We also hope that the recent downturn and lack of activity from RIA consolidators will lead buyers to proceed with more caution when partnering with leveraged consolidators. Amid a market downturn, when RIA principals should be focused on servicing client assets, the charge to save margin to meet interest coverage ratios will trickle down to the principal of those RIAs.

RIA Valuation Insights

RIA Valuation Insights