Q3 2019 RIA Market Update

Asset and Wealth Management Stocks Languish in the Third Quarter

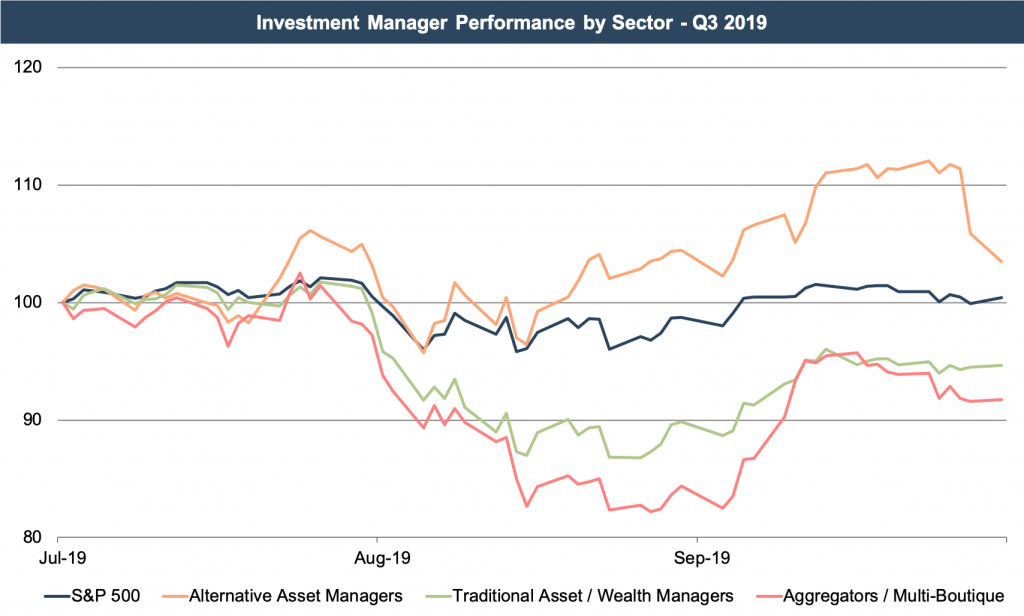

Broad market indices were generally flat over the last quarter, while most categories of publicly-traded asset and wealth manager stocks were off 5% to 10%.

Our index of traditional asset and wealth managers ended the quarter down 5.4%, underperforming the S&P 500 which was up 0.4% over the same time. Aggregators and multi-boutique model firms declined 8.3%. Alt managers were the bright spot in the sector, up 3.5%.

The asset and wealth management industry is facing numerous headwinds, chief among them being ongoing pressure for lower fees. Traditional asset and wealth managers feel this pressure acutely, which has likely contributed to their relative underperformance over the last quarter. Alt managers, which have been the sector’s sole bright spot during this time, are more insulated from fee pressure due to the lack of passive alternatives to drive fees down.

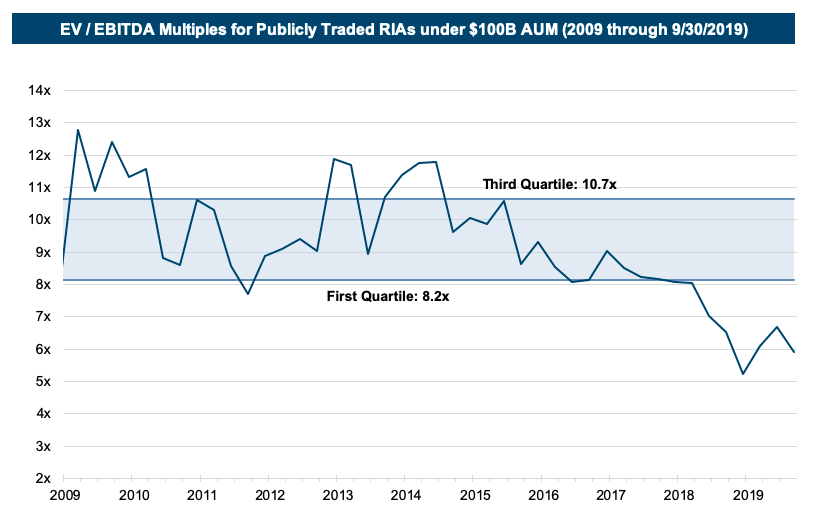

These headwinds have contributed to a decline in EBITDA multiples for traditional asset/wealth managers, which in turn has resulted in lackluster stock price performance. As shown below, EBITDA multiples remain well below historical norms, although they have recovered somewhat from the low point seen last December.

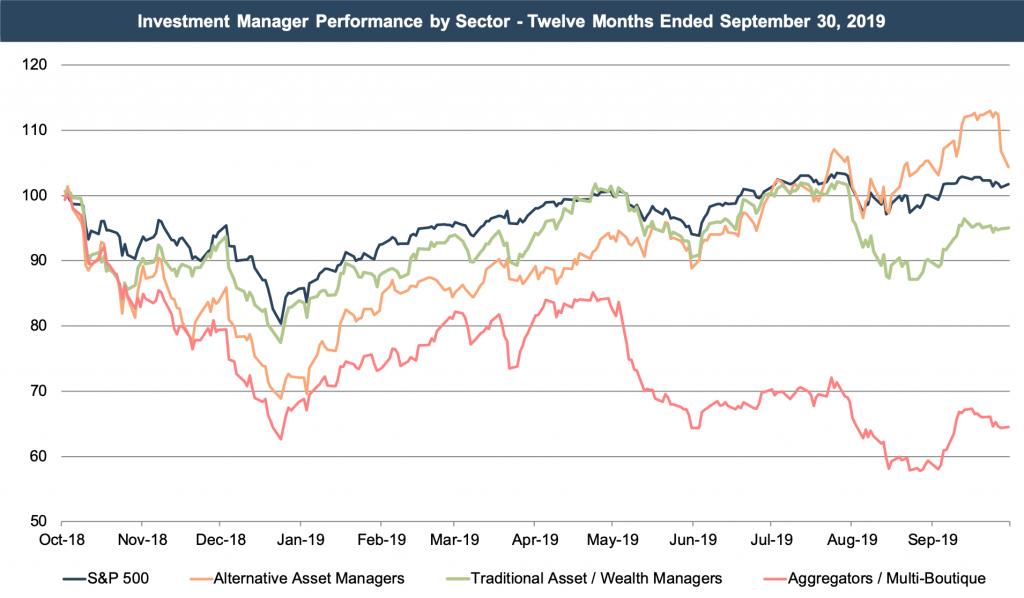

Expanding the performance chart over the last year reveals similar trends in asset/wealth manager performance relative to the broader market. Over this longer timeframe, alt managers are still the only category with positive returns, although performance has been volatile. Traditional asset/wealth managers generally moved in lockstep with the broader market until the third quarter of this year when relative performance declined significantly. Aggregators and multi-boutique have declined over 30%.

The 30%+ decline in the aggregator and multi-boutique index may come as a surprise given all the press about consolidation in the industry and headline deals for privately held aggregators. Over the last year, there have been two significant deals for privately-held wealth management aggregators: United Capital was bought by Goldman Sachs for $750 million, and Mercer Advisors’ PE backers sold a significant interest to a new PE firm, Oak Hill Capital Management. Both deals reportedly occurred at high-teens multiples of adjusted EBITDA.

It appears the market may have grown skeptical of the purely financial consolidator strategy.

Meanwhile, stock of Focus Financial, a publicly traded wealth management aggregator, has declined significantly. On September 30th, Focus stock closed at $23.80, about half its price a year prior and about 35% below the price at its July 2017 IPO.

So why has Focus stock languished while Mercer Advisors and United Capital have both sold significant interests at attractive valuations? One explanation is different business models. The latter two firms are more “true” consolidators, where acquired firms are rebranded and integrated, then presented to the market as a coherent whole. Focus, on the other hand, is a pure financial consolidator. Acquired firms continue to operate as they did before the acquisition, and the only real difference (other than some back-office integration) is how the economics of the firm are distributed. There are pros and cons to each model, but given the poor performance of Focus Financial’s stock since IPO, it appears the market may have grown skeptical of the purely financial consolidator strategy.

Implications for Your RIA

With EBITDA multiples for publicly traded asset and wealth managers still well below historical norms, it appears the public markets are pricing in many of the headwinds the industry faces. It is reasonable to assume that the same trend will have some impact on the pricing of privately held RIAs as well.

But the public markets are just one reference point that informs the valuation of privately held RIAs, and developments in the public markets may not directly translate to privately held RIAs. Depending on the growth and risk prospects of a particular closely-held RIA relative to publicly traded asset and wealth managers, the privately held RIA can warrant a much higher, or much lower, multiple.

In our experience, the issues of comparability between small, privately held businesses and publicly traded companies are frequently driven by key person risk/lack of management depth, smaller scale, and less product and client diversification. These factors all contribute to the less-than-perfect comparability between publicly traded companies and most privately held RIAs. Still, publicly traded companies provide a useful indication of investor sentiment for the asset class, and thus, should be given at least some consideration.

Improving Outlook

The outlook for RIAs depends on a number of factors. Investor demand for a particular manager’s asset class, fee pressure, rising costs, and regulatory overhang can all impact RIA valuations to varying extents. The one commonality, though, is that RIAs are all impacted by the market. Their product is, after all, the market.

The outlook for RIAs appears to have improved since the significant market drop in December 2018.

The impact of market movements varies by sector, however. Alternative asset managers tend to be more idiosyncratic but are still influenced by investor sentiment regarding their hard-to-value assets. Wealth managers and traditional asset managers are vulnerable to trends in asset flows and fee pressure. Aggregators and multi-boutiques are in the business of buying RIAs, and their success depends on their ability to string together deals at attractive valuations and create synergies.

On balance, the outlook for RIAs appears to have improved since the significant market drop in December 2018. Since then, industry multiples have rebounded somewhat, and the broader market has recovered its losses and then some—which should have a positive impact on future RIA revenues and earnings.

More attractive valuations could entice more M&A, coming off the heels of a record year in asset manager deal-making. We’ll keep an eye on all of it during what will likely be a very interesting year for RIA valuations.

RIA Valuation Insights

RIA Valuation Insights