RIAs Still Reeling from Last Year’s Sell-Off

Despite Recent Uptick, Investment Managers are Underperforming

Ordinarily, we’d expect investment manager stocks to outperform the S&P in a stock market rally. As the broader indices creep up, so does AUM and revenue. Higher top-line growth typically leads to even greater gains in profitability with the help of operating leverage. Assuming no change in the P/E multiple, RIAs stock prices should outpace the market in a bull run.

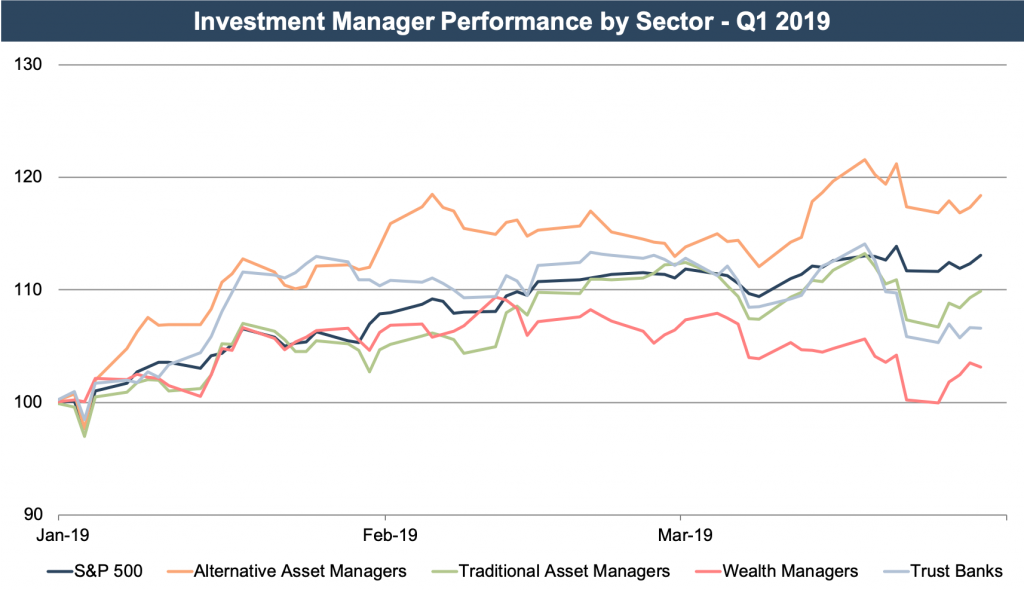

This isn’t always the case though. So far this year, most classes of RIA stocks have underperformed the market despite its relatively sharp increase through the first three months.

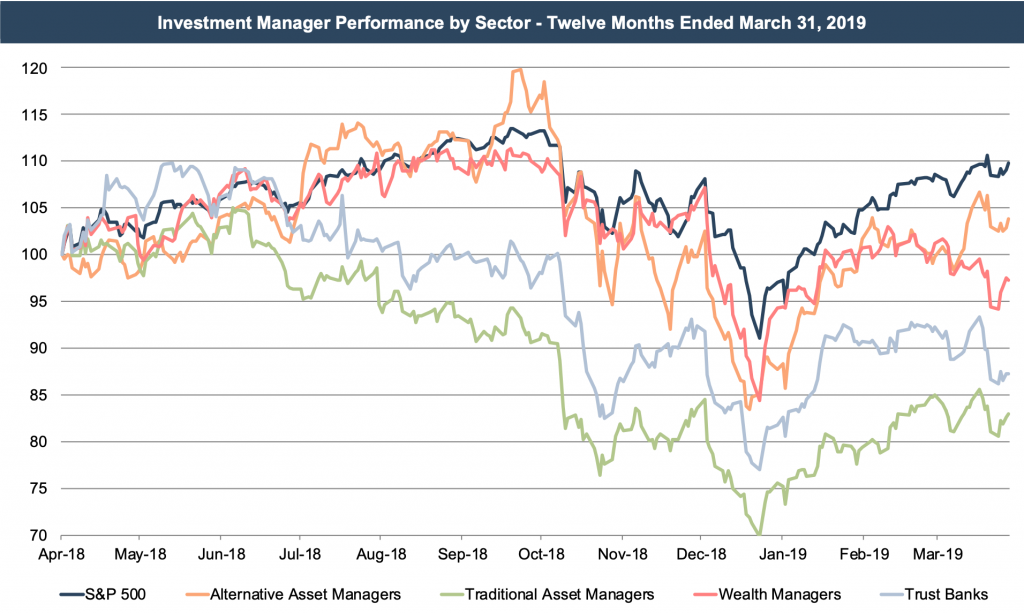

The explanation isn’t necessarily obvious. Investors are likely concerned about the industry’s prospects in the face of fee compression and continued asset outflows. Alternative asset managers were the sector’s sole bright spot as hedge funds tend to do well in volatile market conditions. However, expanding this graph over the last year shows that they too have underperformed the market over this time.

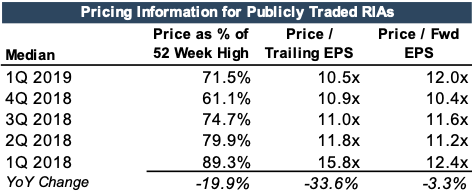

The fallout over this time is primarily attributable to the decline in the (historical) earnings multiple.

Since this multiple is a function of risk and growth, at least one of those factors is weighing on investors. We believe it is a combination of the two. Rising fee pressure and continuing demand for passive products have heightened the industry’s risk profile while dampening growth prospects. The forward multiple has recovered some this year, but that’s likely attributable to analysts’ downward revisions of forward earnings estimates in Q1 after the market decline from the prior quarter.

As noted a couple of weeks ago, traditional asset managers have felt these pressures most acutely. Poorly differentiated products have struggled to withstand downward fee velocity and increased competition from ETF strategies. To combat fee pressure, traditional asset managers have had to either pursue scale (e.g. BlackRock) or offer products that are truly differentiated (something that is difficult to do with scale). Investors have been more receptive to the value proposition of wealth management firms as these businesses are (so far) better positioned to maintain pricing schedules.

Implications for Your RIA

Your company is probably facing the same industry headwinds and competitive pressures that publicly traded RIAs are dealing with.

In all likelihood, your investment management firm is much smaller than the public RIAs, many of which have several hundred billion in AUM and thousands of employees across the country. It’s also probably unlikely that your business lost 20% of its value last year like most of the public “comps.” The market for these businesses was particularly volatile in 2018, and year-end happened to fall at the low end of the range. So far this year, most publicly traded RIAs have recovered some of these losses during more favorable market conditions.

Still, we can’t totally ignore what the market is telling us about RIA valuations. We often get pushback from clients for even considering how the market is pricing these businesses (typically as a multiple of earnings) given how large these companies are relative to theirs. The reality though is that your subject company is probably facing the same industry headwinds and competitive pressures that publicly traded RIAs are dealing with. If investors have turned particularly bullish or bearish on the industry’s prospects, we have to consider that in our analysis.

A (Less) Bearish Outlook

The outlook for these businesses is market driven—though it does vary by sector. Trust banks are more susceptible to changes in interest rates and yield curve positioning. Alternative asset managers tend to be more idiosyncratic, but are still influenced by investor sentiment regarding their hard-to-value assets. Wealth managers and traditional asset managers are more vulnerable to trends in active and passive investing.

On balance, the outlook for the rest of 2019 doesn’t look great given what happened to RIA stocks at the end of 2018, but the recent uptick suggests that it’s not as bad as it was a few months ago. The market is clearly anticipating lower revenue and earnings following the Q4 correction, which could be exacerbated if clients start withdrawing their investments. On the other hand, more attractive valuations could also entice more M&A, coming off the heels of a record year in asset manager dealmaking. We’ll keep an eye on all of it during what will likely be a very interesting year for RIA valuations.

RIA Valuation Insights

RIA Valuation Insights