What’s Driving RIA M&A?

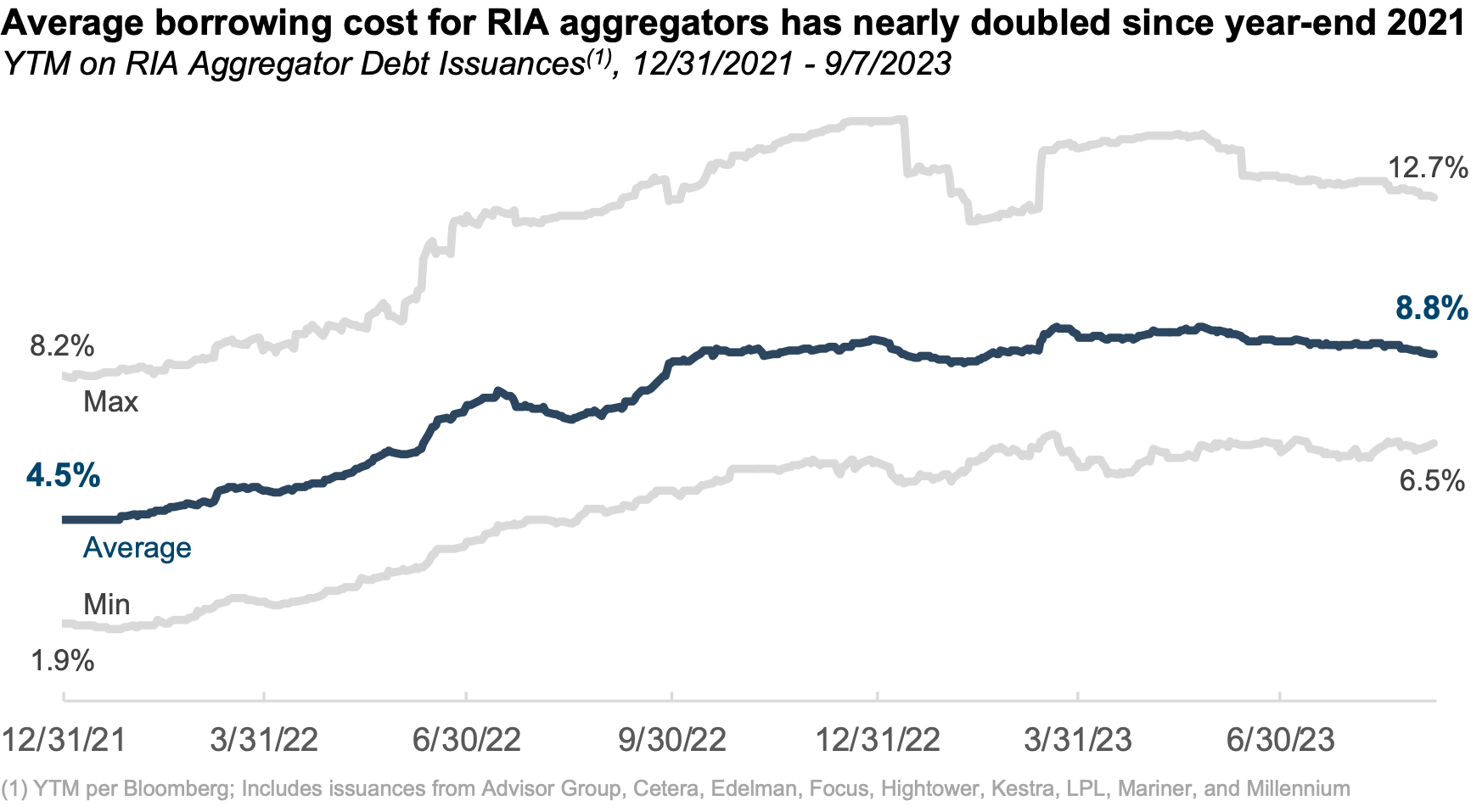

We first wrote about borrowing costs for RIA consolidators late last year, shortly after the Fed’s aggressive hiking cycle led to an abrupt spike in interest rates for virtually all borrowers. Since then, borrowing costs for RIA acquirers have remained roughly flat but at a level significantly elevated from 18 months ago:

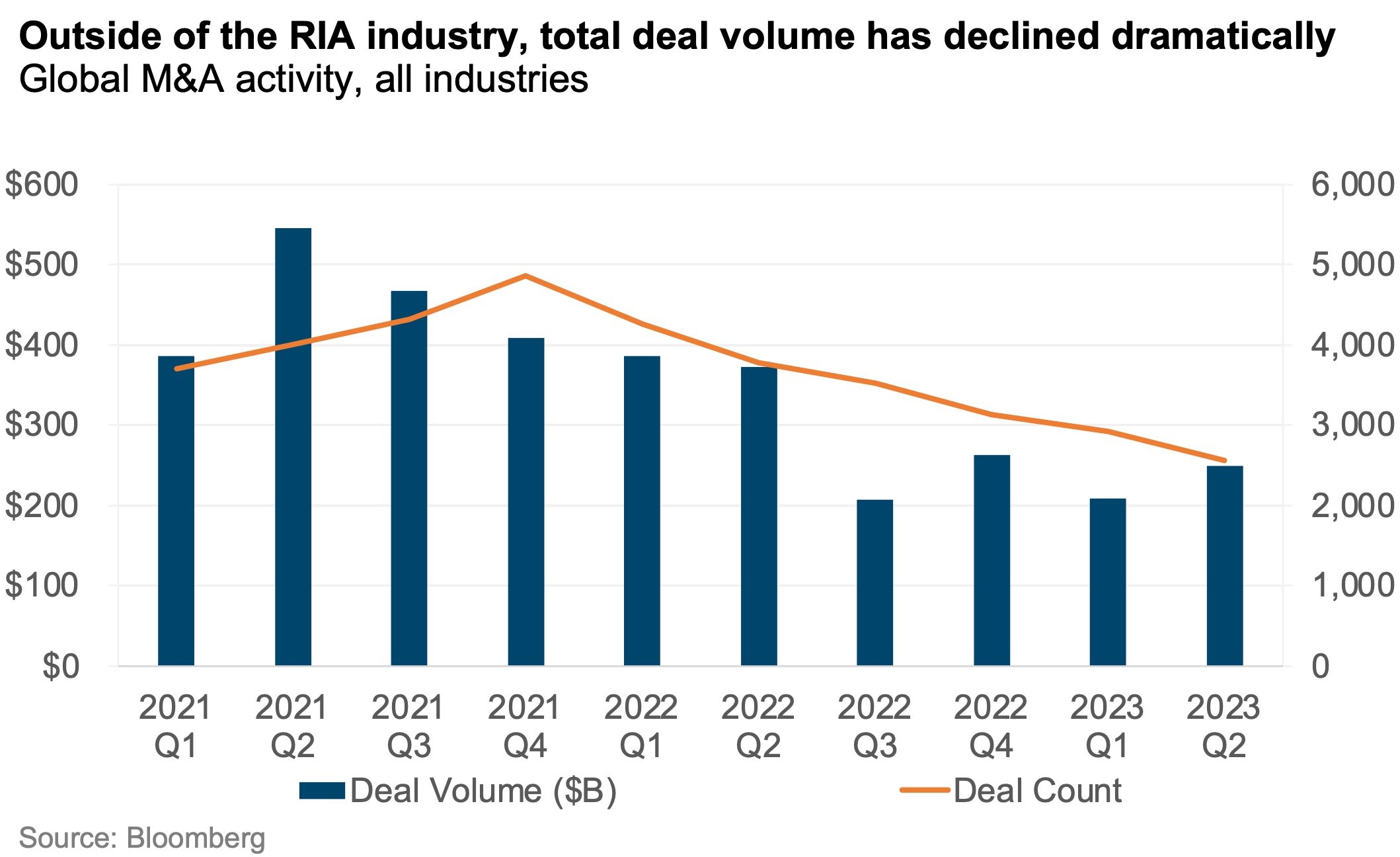

A year ago, our (quite natural) prediction was that a higher cost of capital for RIA aggregators would lead to a slowdown in deal activity. Such a prediction would have been resoundingly validated in virtually any other industry. Outside of the RIA industry, buyers have pumped the brakes, and deal activity has plummeted:

But the story for RIAs has been more nuanced. Deal activity has declined modestly, but the decline has been much less than for global M&A. During the first half of 2023, the number of RIA deals declined about 1% year-over-year versus an over 30% decline in total M&A. What can we attribute the relative strength of M&A in the RIA industry to? We think there are probably a few factors at play.

For one, secular forces like a lack of succession planning have continued to support the supply side of the M&A equation. A lack of viable internal ownership transition options has compelled many firms to market, and it will likely continue to do so for the foreseeable future. Additionally, for all the talk of consolidation in the industry, the number of RIAs continues to increase — meaning that the pool of acquisition targets is growing, not dwindling.

We suspect another factor is that the momentum from the rapid acceleration in M&A that reached a crescendo in 2021 has sustained deal activity in the RIA space for longer than other industries. During the run-up in M&A activity, active acquirers of RIAs invested significantly in various deal-making apparatuses, including dedicated deal teams and integration teams. All of that infrastructure needs to be put to use so deals keep happening — at least in the short run.

Perhaps another factor is private equity’s role in getting deals done by providing capital for many larger aggregators. Unlike capital from an RIA’s own balance sheet, PE capital has a mandate attached. PE firms are beholden to their investors, and RIAs backed by PE are beholden to their PE backers. Private equity funds don’t have the luxury of sitting on the sidelines forever. Thus, there’s an impetus to put capital to work, even if that means looking for the least bad deal. If funds become more difficult to raise (as is happening), there won’t be as much hot money chasing the RIA space.

Despite all the market turmoil, there hasn’t been significant turnover in the types of firms completing deals on the buy side, at least not yet. Deals completed by RIA consolidators have declined only modestly as a percentage of overall deal volume so far in 2023. Still, the financial pressure on consolidator models is real. A market downturn combined with higher borrowing costs have certainly eroded the capital positions of many of the major players out there. New capital—to the extent it’s being raised—often has onerous terms attached (see The Devil in the Details: Diving into the CI US / Bain Transaction).

Amidst all of this, multiples have reportedly held up — or have they? While buyer demand for RIAs has supported multiples more than in other industries, they haven’t defied financial gravity. Headline multiples haven’t changed much since the market peak around year-end 2021, but — as we’ve written about many times on this blog — a lot of window dressing can go on with headline multiples. Under the hood, though, deal terms have adjusted to new market realities, with more deal consideration pushed into earnouts to bridge widening expectation gaps between buyers and sellers.

Where is this all heading? Relative to five years ago, RIA M&A activity has increased dramatically. We think an elevated level of activity is here to stay, but we’ll likely see some evolution in the players involved. The consolidator models prevalent today were largely built during an environment of cheap debt and favorable market conditions—which made it hard to fail. Time will reveal which consolidator models are really adding capabilities or leverage unavailable to smaller firms and which are just an exercise in financial engineering.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, wealth managers, independent trust companies, broker-dealers, PE firms and alternative managers, and related investment consultancies.

RIA Valuation Insights

RIA Valuation Insights