FASB Provides Clarity on Accounting for Profits Interest Awards Under ASC 718

In March 2024, the Financial Accounting Standards Board (FASB) issued ASU 2024-01, which clarifies the accounting treatment of profits interest awards. This move aims to enhance the consistency and understanding of Generally Accepted Accounting Principles (GAAP) related to such awards. The ASU update helps entities ascertain whether certain awards need to be measured at fair value under ASC 718 or if they should be accounted for under other guidance. In this article, we summarize the new FASB guidance and discuss common methods for valuing profits interests under ASC 718.

Background

Profits interest awards are commonly utilized by businesses, especially in the private sector, to incentivize employees or non-employees. These awards align compensation with the entity’s performance and provide the holders with a stake in future profits and equity appreciation. Determining the appropriate accounting treatment for profits interest awards can be challenging because profits interest holders solely partake in future profits and/or equity appreciation without possessing rights to the partnership’s net assets existing at the grant date. Nuances in the nature of the eventual payoffs can complicate the decision to either classify such awards as share-based payment arrangements (under Topic 718) or liken them to cash bonuses or profit-sharing arrangements (under Topic 710). FASB issued ASU 2024-01 to clarify how an entity should determine whether a profits interest or similar award is within the scope of ASC 718.

Scope Guidance Clarification

ASU 2024-01 includes certain amendments and the addition of an illustrative example aimed at demonstrating how entities should apply the scope guidance in paragraph 718-10-15-3 of Topic 718.

Key Provisions and Effective Date

The main provisions of the clarification include:

- Illustrative Example: The addition of Example 10 provides four distinct fact patterns to illustrate the application of the scope guidance in paragraph 718-10-15-3. These examples help reduce complexity and address existing diversity in practice.

- Focus on Scope Conditions: The illustrative example emphasizes the scope conditions outlined in paragraph 718-10-15-3, aiding entities in determining whether profits interest awards fall within the scope of Topic 718.

- Improved Clarity: Certain language in the Scope and Scope Exceptions Section of Topic 718 has been amended to enhance clarity and operability without altering the underlying guidance.

For public companies, the ASU is effective for annual periods beginning after December 15, 2024. For all other entities, the amendments are effective for annual periods beginning after December 15, 2025. Early adoption is permitted.

Amended ASC 718 Excerpt

718-10-15-3 The guidance in [this] Topic applies to all share-based payment transactions in which a grantor acquires goods or services to be used or consumed in the grantor’s own operations or provides consideration payable to a customer by either of the following:

a. Issuing (or offering to issue) its shares, share options, or other equity instruments to an employee or a non-employee.

b. Incurring liabilities to an employee or a non-employee that meet either of the following conditions:

-

-

- The amounts are based, at least in part, on the price of the entity’s shares or other equity instruments. (The phrase at least in part is used because an award of share-based compensation may be indexed to both the price of an entity’s shares and something else that is neither the price of the entity’s shares nor a market, performance, or service condition.)

- The awards require or may require settlement by issuing the entity’s equity shares or other equity instruments.

- The amounts are based, at least in part, on the price of the entity’s shares or other equity instruments. (The phrase at least in part is used because an award of share-based compensation may be indexed to both the price of an entity’s shares and something else that is neither the price of the entity’s shares nor a market, performance, or service condition.)

-

Discussion around Illustrative Example

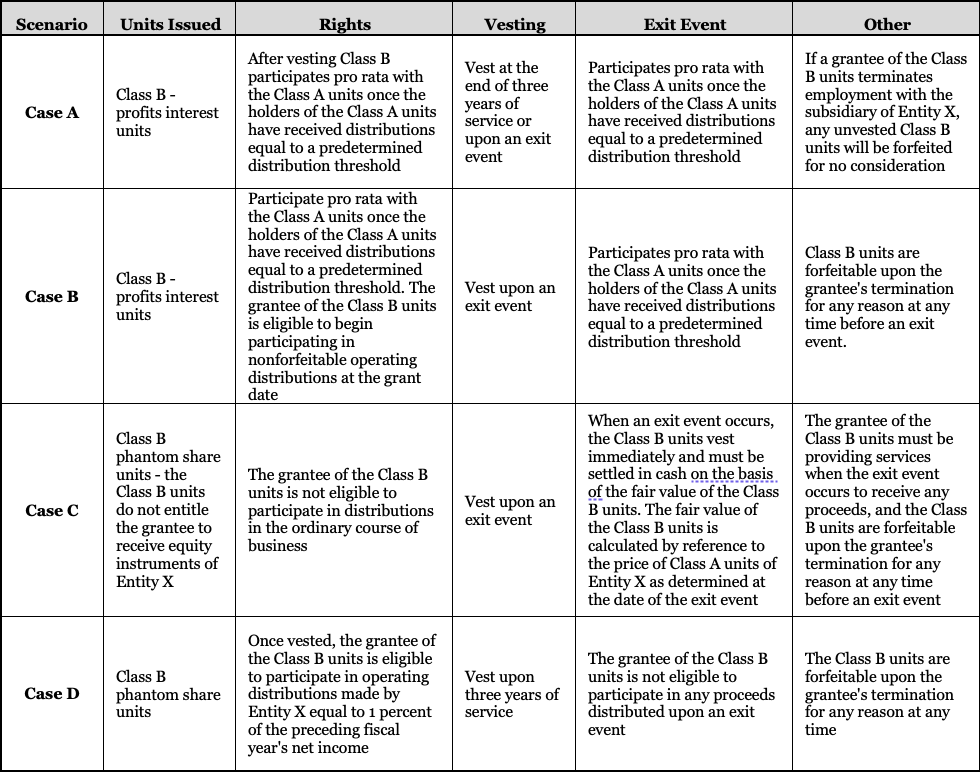

The illustrative example provided in ASU 2024-01 (Cases A, B, C, and D) offer valuable insights into scenarios that entities may encounter when assessing the accounting treatment for profits interest awards. The first two cases describe profits interests that fall within the scope of ASC 718. The second two cases describe phantom share unit awards, one of which would be accounted for under ASC 718 and one that would not.

Cases A, B, C, and D share the following assumptions:

a. Entity X is a partnership. Before June 1, 20X1, Entity X had Class A units outstanding. On June 1, 20X1, Entity X grants Class B incentive units to employees of a subsidiary of Entity X in exchange for services.

b. An exit event may include an initial public offering, a change in control, or a liquidation of Entity X’s

Click here to expand the image above

Interpretation Under ASC 718

Case A: The Class B units meet the conditions outlined in paragraph 718-10-15-3(a) as the Class B units represent equity instruments in Entity X. This is because the Class B unit holders have the right to participate in the residual interest of Entity X through periodic distributions, upon an exit event, or upon settlement proportionate to ownership of Class B units of Entity X. Therefore, the Class B units are within the scope of ASC 718.

Case B: Despite the vesting criteria, the Class B units still meet the conditions of paragraph 718-10-15-3(a), as they entitle the holder to participate in the residual interest of Entity X upon an exit event. The analysis takes into account the conditions for vesting, forfeiture, and participation in distributions to conclude that these units should be accounted for under ASC 718.

Case C: While the Class B units do not meet the condition of paragraph 718-10-15-3(a) because they do not entitle the grantee to shares or other equity instruments of Entity X, they still fall within the scope of ASC 718 due to the cash settlement being based on the entity’s share price, meeting the condition in paragraph 718-10-15-3(b)(1). Therefore, the Class B phantom share units are within the scope of ASC 718.

Case D: Under this scenario the Class B units do not meet the condition in paragraph 718-10-15-3(a) because they do not entitle the grantee to shares or other equity instruments of Entity X. Additionally, the condition in paragraph 718-10-15-3(b) is not met because distributions that are paid to the grantee are based on operating metrics rather than the price of Entity X’s shares. Therefore, under this scenario, the Class B phantom share units are not within the scope of ASC 718 and would be accounted for in accordance with other Topics.

Valuation Considerations

While ASU 2024-01 does not directly discuss fair value measurement, entities should be aware of the techniques and methods used to value profits interests.

The first step in the valuation of profits interest awards is the valuation of the company as a whole using accepted methods under the income approach, market approach, and asset-based approach. Following the valuation of the company comes the more challenging step of valuing the individual classes of equity and profits interests. The situations where the payoff structures are straightforward enough, the most tractable method to value these various classes of equity involves the use of the Option Pricing Model (OPM).

The OPM treats each class of equity as call options on the company’s total equity value, with exercise prices based on the liquidation preferences of each class of equity/profits interest. For profits interests, their value is linked to the residual equity that remains after other equity holders, such as preferred shareholders or common unit holders, have received their predetermined distributions. This residual value represents the potential upside that profits interest holders stand to gain, contingent upon the company’s performance and the occurrence of a liquidity event. The OPM typically uses the Black-Scholes Option Pricing Model to price the various call options. Inputs into the Black-Sholes Option Pricing Model include:

- Stock price: Total equity value of the company as determined using traditional valuation approaches.

- Term: The anticipated timing of future liquidation events.

- Volatility: Total equity volatility of the company, which may be determined by looking at the equity volatility of similar publicly traded companies (adjusting for leverage).

- Risk-Free Rate: Typically, a risk-free rate with a term matching the anticipated time until a liquidity event

- Strike Price: The predetermined distribution threshold after which the profits interest participates pro rata with common units.

More complex payoff structures around profits interests may require the use of more involved techniques, such as Monte Carlo simulations, that build on similar fundamental insights as the OPM but are flexible enough to accommodate nuances in awards design.

Conclusion

FASB’s issuance of ASU 2024-01 represents a significant step towards enhancing consistency and understanding in accounting for profits interest awards. Clearer guidance and the illustrative example will help entities can make more informed decisions regarding the treatment of these awards, ultimately benefiting stakeholders and investors alike.

If you have questions regarding the accounting or valuation of profits interests, please contact a Mercer Capital professional.