Goodwill Impairments Are on the Rise. Surprised?

Executive Summary

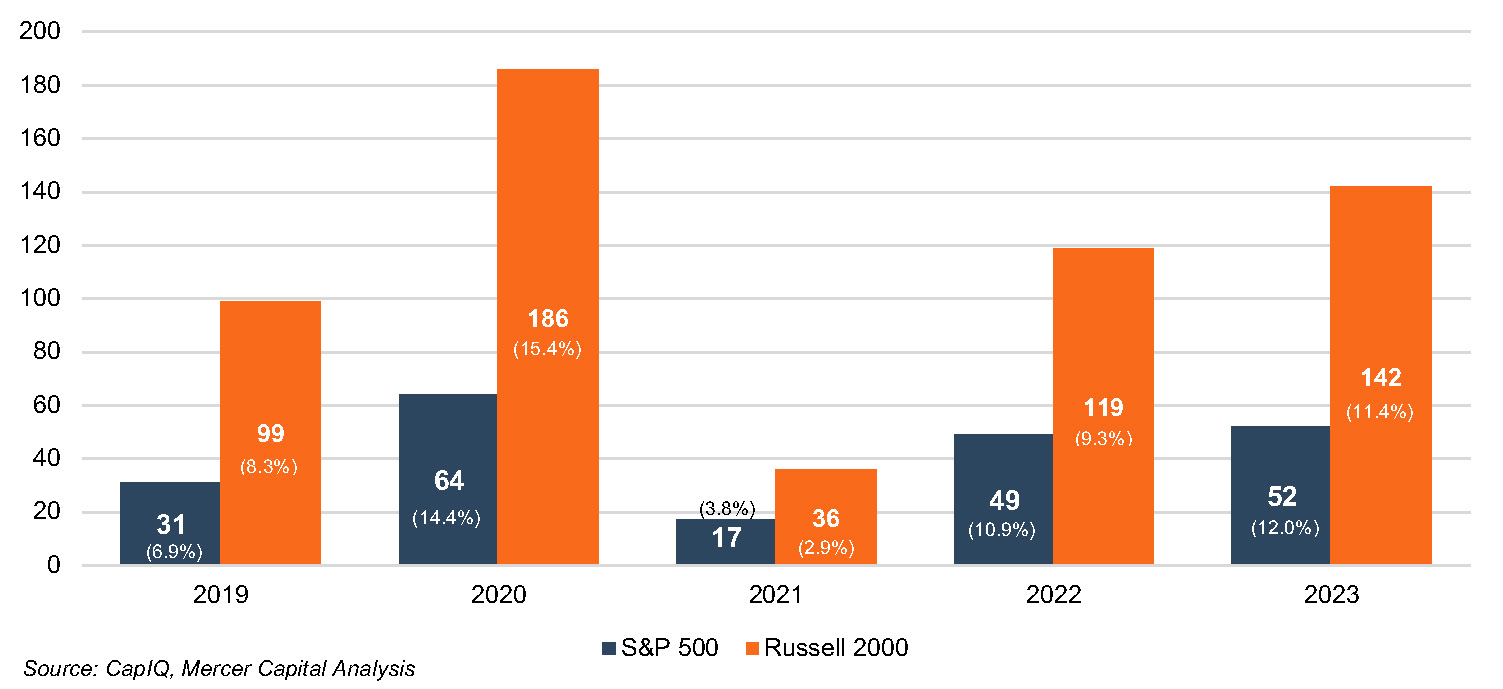

Preliminary results for 2023 show that the number of goodwill impairments is increasing for both large and middle-market public companies. Based on data through November, the number of impairments recorded by firms on the S&P 500 and Russell 2000 indices had already eclipsed 2021 and 2022 full-year figures. Interestingly, these trends materialized even as the indices themselves posted favorable total returns for the year of 25% and 14%, respectively. Public and private companies currently in the process of performing their annual/interim impairment tests should be on the alert if their peer group turns out to be the one recording impairment charges.

Back in 2020, the stock market downturn stemming from pandemic shutdowns resulted in triggering events and impairment charges for many companies. This was especially evident among smaller publicly-traded companies (as tracked by the Russell 2000 versus the S&P 500). The number of charges dropped drastically in 2021 (even compared to 2019 results), suggesting that some of the 2020 impairment charges may have reflected a pull-forward of later charges. Since that time, the number and percentage of companies recording charges has steadily increased, with preliminary figures for 2023 already exceeding the numbers recorded in 2022.

Total Goodwill Impairment Charges and % of companies with GW that recorded charges

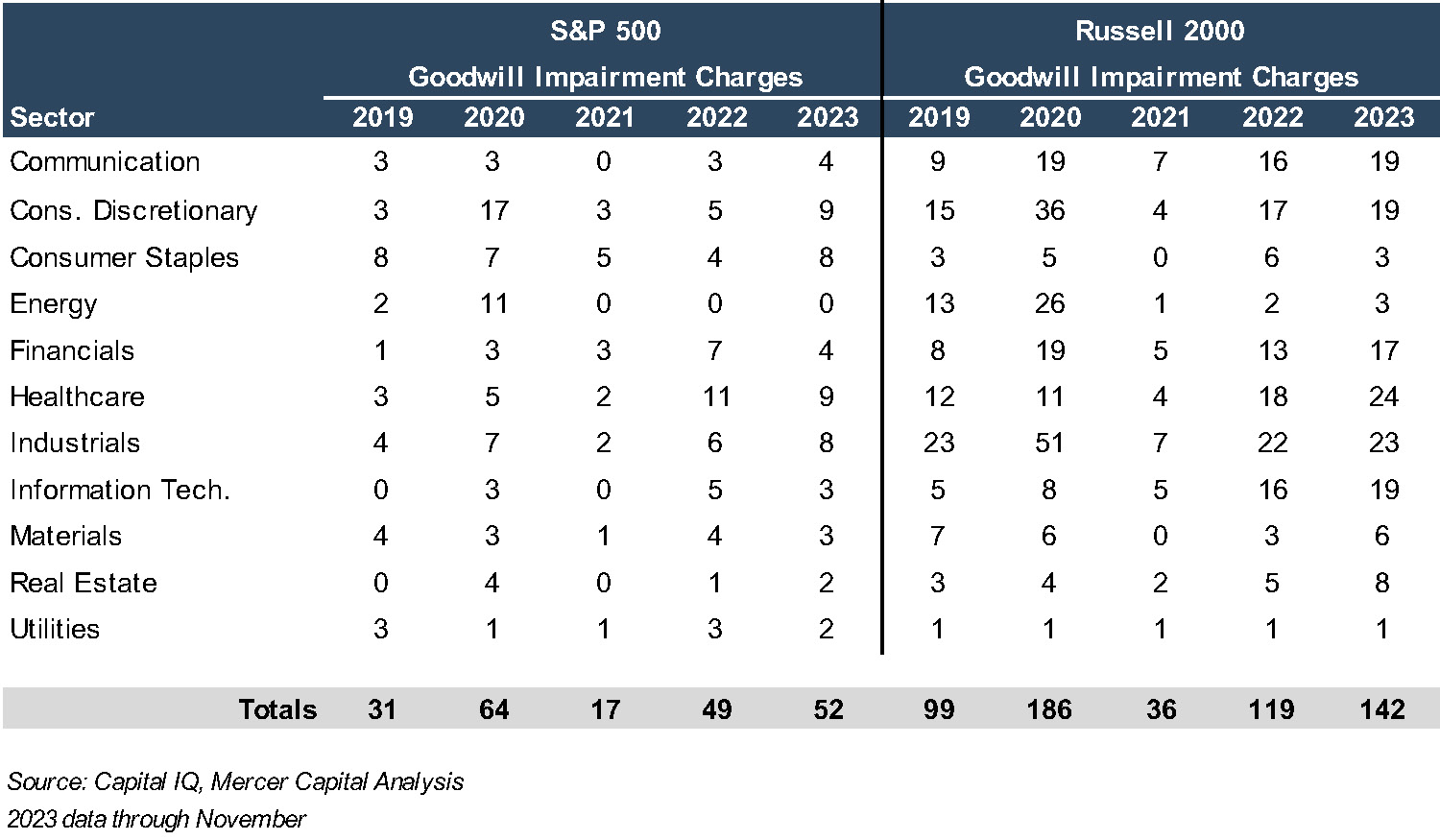

This trend held across sectors as well. In the Russell 2000, eight of eleven sectors reported an increase in number of charges to goodwill between 2019 and 2020. Charges in the consumer staples sector declined among S&P 500 companies, while increasing for Russell 2000 companies. Charges in the utilities sector declined for S&P 500 companies but remained stable for Russell 2000 companies. For both groups of companies, charges taken by the materials sector declined. Following 2020, impairment charges dropped below 2019 levels – sharply, in the case of many sectors over 2021 through 2022.

More recently, the number of charges and the magnitude of total goodwill charges for the first eleven months of 2023 had already exceeded the full year of 2022. Additional impairments may be on the way as companies complete and file their year-end financials. Based on the preliminary figures for the Russell 2000, the sectors recording the most charges appear to be healthcare and industrials.

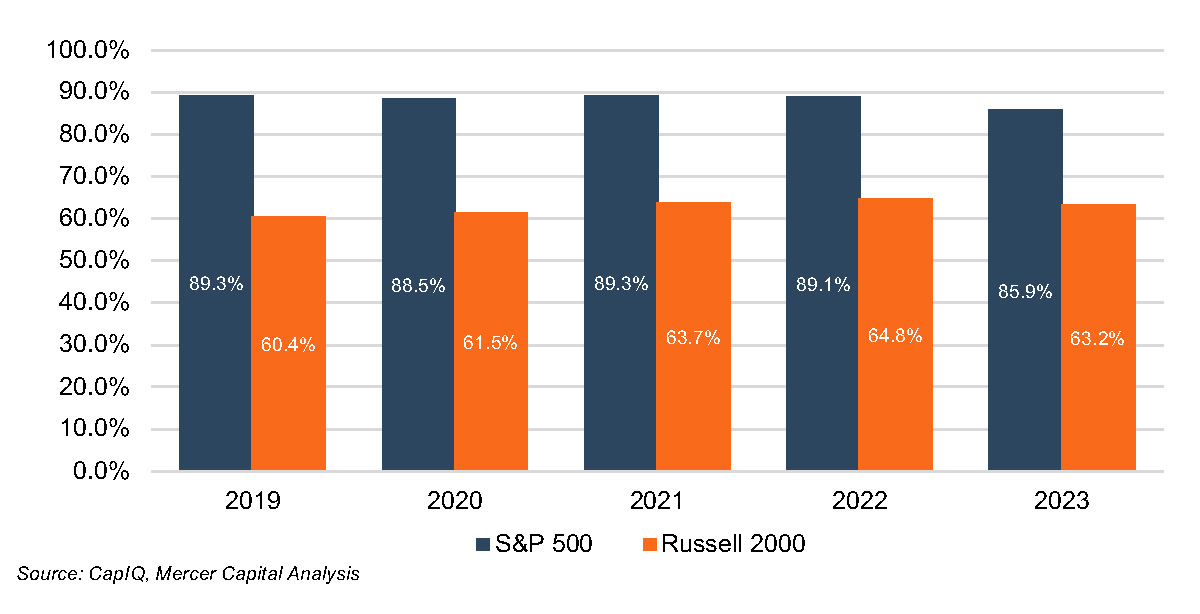

Despite the increase in impairment charges taken in 2020, the number of small-cap companies reporting year-end goodwill balances increased in 2020 and continued to increase through 2022 and 2023. Approximately 60% of Russell 2000 companies carried goodwill in 2019, while over 63% did so in 2023. The percentage of S&P 500 companies reporting goodwill declined from 89% in 2019 to 86% in 2023.

Percent of Companies Reporting Goodwill

It is impossible to attribute the rise in impairment charges to a single specific factor. However, it is likely that rising interest rates and higher inflation played a significant role in 2023 results. Impairment charges also tend to have a larger impact on smaller companies. Generally speaking, smaller companies tend to be less diversified in terms of product or service offerings, and their client bases may be more sensitive to external economic factors.

Ultimately, the preliminary data for 2023 shows that impairments do not necessarily taper off when overall equity markets are rising. Company-specific factors, including financial performance relative to history, expectations, and peer performance, are critical when evaluating goodwill for potential impairment. Will the impairment trends seen in the large and middle-market public markets extend to private companies? Perhaps.

The valuation specialists at Mercer Capital have experience in implementing both the qualitative and quantitative aspects of goodwill impairment testing under ASC 350. If you have questions, please contact a member of Mercer Capital’s Financial Statement Reporting Group.