Stock-Based Compensation in Volatile Markets

Employee, Management, and Investor Perspectives

Executive Summary

- Over the past decade stock-based compensation (SBC) gained widespread popularity as a way to reward employees while conserving cash.

- Turmoil in the stock market during 2022 resulted in employees seeing diminishing value in SBC and investors questioning its aggressive use.

- In this article, we discuss how market volatility can affect employee, management, and investor perspectives on SBC.

For the most part, we are all familiar with the pitch for stock-based compensation (SBC). For employees, SBC supplements cash compensation with equity ownership in the employer company. Employees get to share in the upside of the company’s growth and success, aligning their interests with that of the company and other shareholders. For employers, SBC is a cash-efficient way to finance operating expenses. SBC can be particularly beneficial for startups or development-stage companies looking to compete for top talent by trading future growth prospects for current cash outlay. Further, SBC can assist with employee retention, as the shares or options granted through SBC arrangements vest over a number of years.

Everyone Seems to Agree SBC Is Good

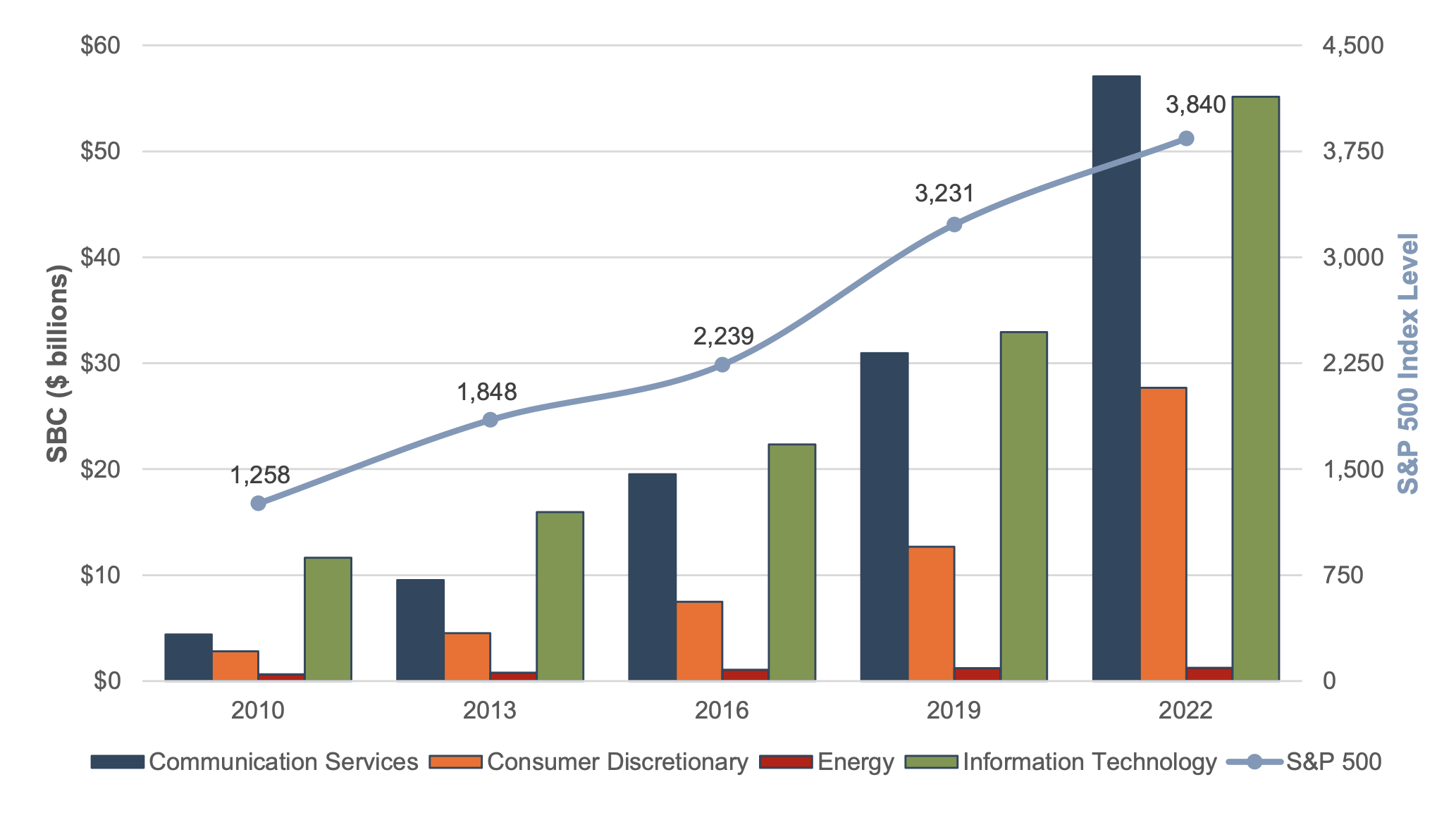

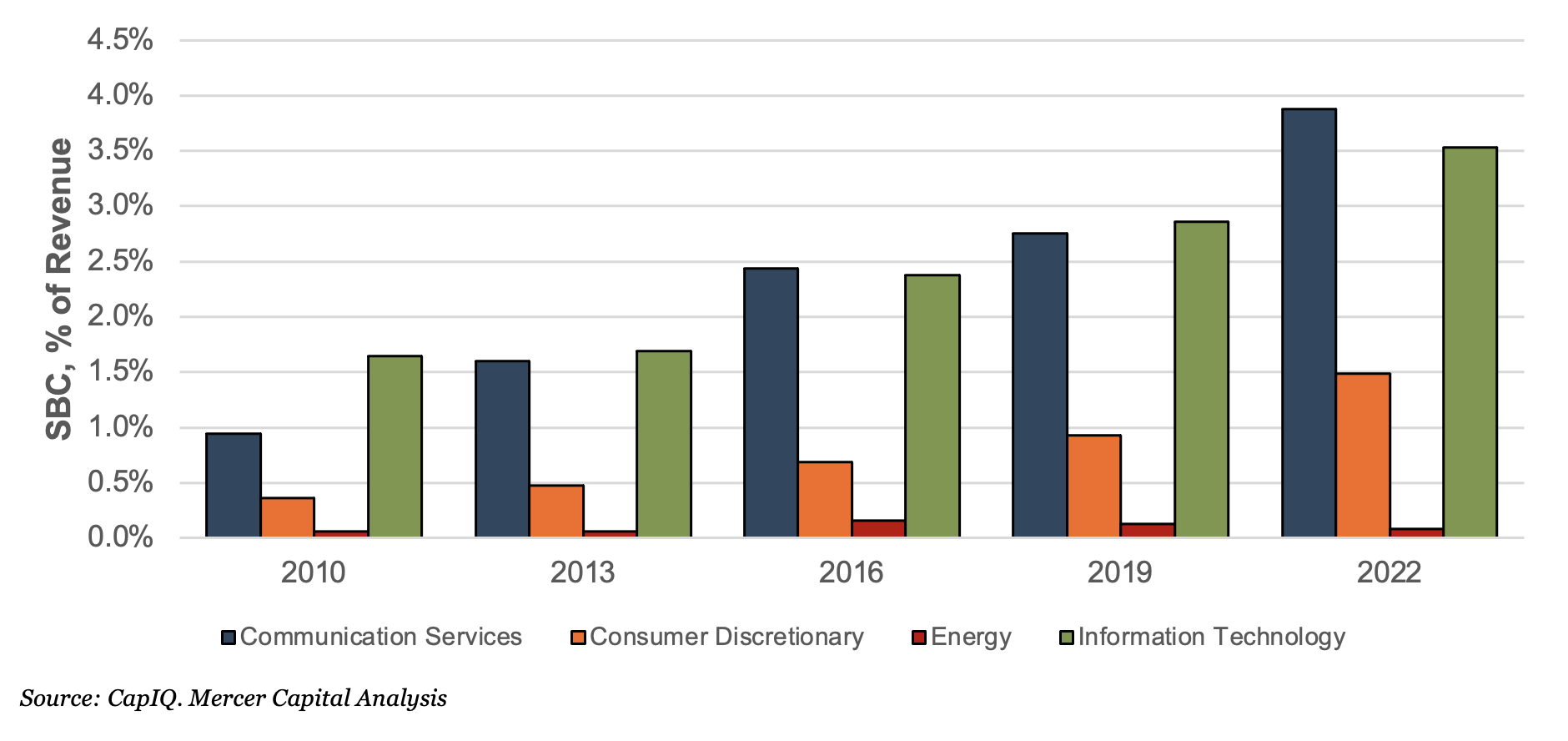

Indeed, companies across many sectors appear to have been increasingly convinced of the benefits of SBC in the period following the financial crisis. The following charts illustrate SBC expense trends among S&P 500 companies in certain sectors between 2010 and 2022.

Overall, reported SBC for companies in the S&P 500 grew more than 10% annually between 2010 and 2022, reaching a total of $192 billion in 2022 (approximately 1.2% of revenue). Technology-focused companies, many of whom graduated from the startup stage, are among the most prolific users of SBC. The communication services sector reported $57 billion in SBC expenses in 2022, an almost 13-fold increase since 2010. The information technology sector reported the largest SBC expenses in 2010 and remained among its more prominent users in 2022. But the use of SBC has proliferated beyond the technology-focused companies, as well. For example, reported SBC as a proportion of revenue increased more than four times between 2010 and 2022 for the consumer discretionary sector.

Some sectors were holdouts, however. Reported SBC expenses by companies in the energy sector grew at a relatively paltry 3.8% annually between 2010 and 2022.

SBC Expense Trends Among S&P 500 Companies

Stocks Go Up, Stocks Go Down

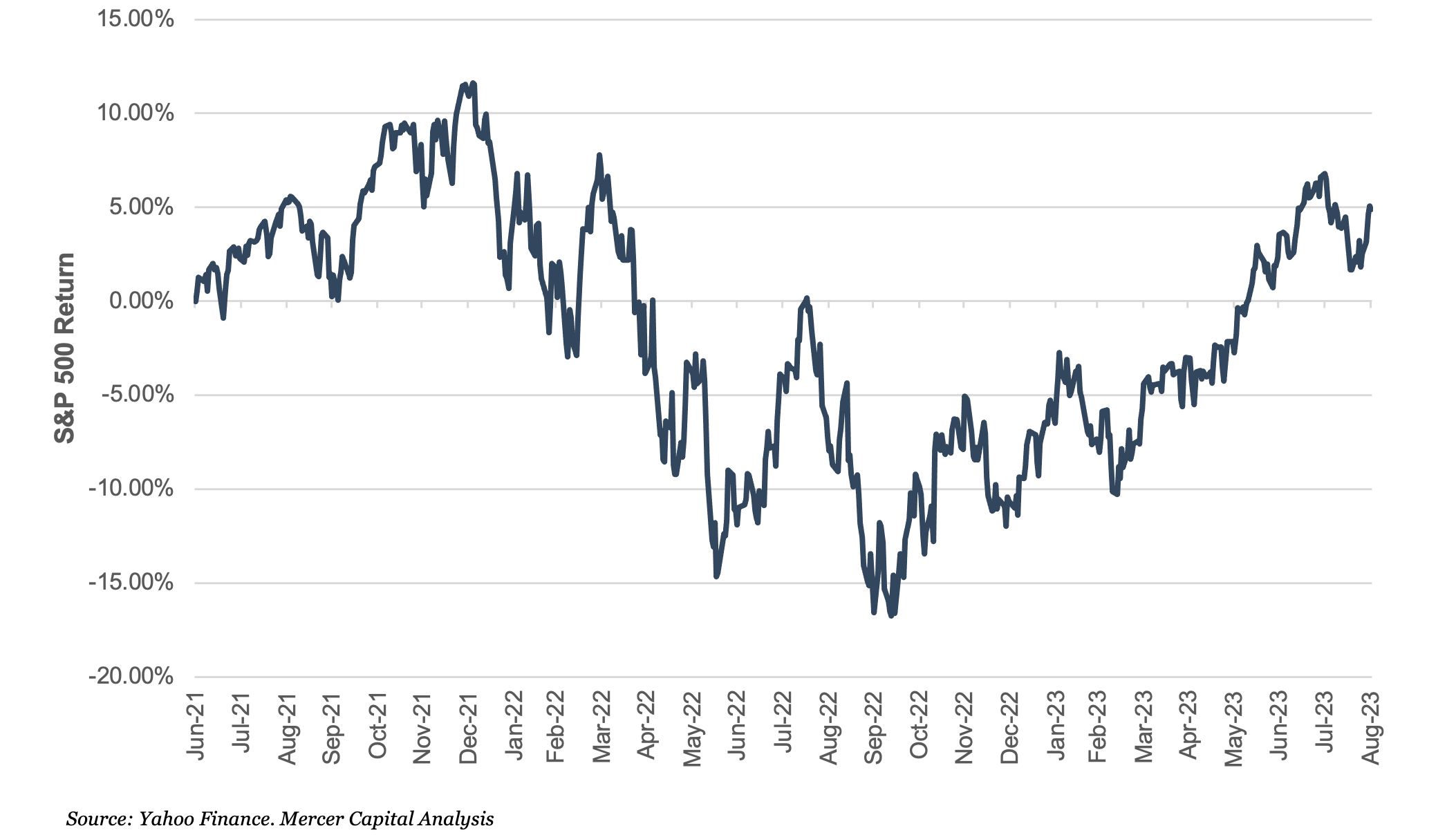

So, has a consensus been reached regarding the benefits of SBC? Not quite. Until 2022, the period after the financial crisis had been marked by sustained gains in the equity markets. The S&P 500 took a tumble during 2022 (falling approximately 20% during the year) before recovering some in 2023. As it relates to SBC, it would appear that when stock prices go up, all stakeholders are similarly happy. When stock prices fall, different stakeholders are unhappy in their own ways.

S&P 500 Relative Performance (June 30, 2021 = 1)

Employee Perspective: Underwater SBC

During 2022, employees were vocal about the diminishing values of the SBC they had received in the past.

Unlike cash compensation, the value of SBC can go up or down over the holding period. For example, say an employee was granted 1,000 restricted stock units (RSUs) in Company X that vest over a 4-year period, when the stock price was $225 per share. At grant, the employee would likely believe she had received $225,000 in compensation, save for a potential haircut to reflect the likelihood of vesting. If one year after grant, Company X’s stock drops 16.7% (similar to the draw down in the S&P 500 between July 2021 and mid-October 2022) to $187 per share, the employee could feel shortchanged by about $37,575.

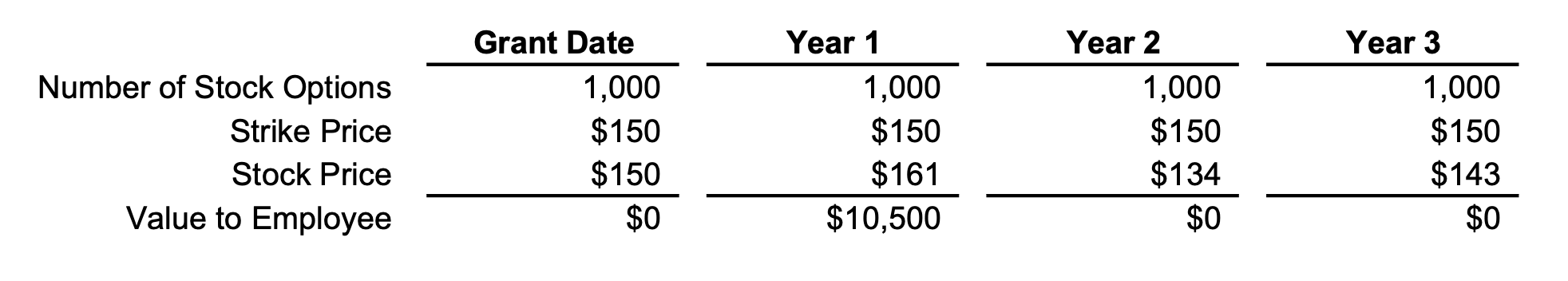

Also, unlike cash compensation, SBC is usually a levered instrument. Obviously, leverage magnifies gains in the good times and losses in the bad times. As another example, say an employee is granted 1,000 stock options, which vest in 3 years, in Company Y with a strike price of $150 per share (current share price of Company Y’s stock). If one year after the grant, Company Y’s stock price rises to $161 per share (7% increase), the stock options would be “in the money” and the employee would be happy with the $10,500 potential gain on the bundle of stock options. However, if Company Y’s stock price takes a hit and declines 16.7% to $137 per share, the stock options would be “underwater” and would provide no intrinsic value to the employee. If the Company’s stock price does not recover to a price higher than $150 by the end of year 3, these options would expire worthless and the employee would realize no benefit.

Management’s Dilemma: Repricing or Additional Issuances

As the examples above have demonstrated, when markets decline, the value of SBC can fall or even become zero.

This leave managers with a difficult choice. Employers could issue more SBC to make up for the decline in value of previously awarded SBC. Or companies could elect to re-price previously-granted employee stock options. Repricing employee stock options entails a company modifying the terms of the options by reducing the strike price or extending the exercise date (presumably allowing time for the company’s stock price to recover). Managers fear that if they do not re-price or issue additional SBC, key employees may not be motivated and may seek greener pastures. Re-pricing prior grants or issuing additional SBC, however, is an administrative burden. These maneuvers also worsen the terms of financing the managers would have believed they obtained for (a portion of the) operating expenses when the SBC grants were made in the first place.

Investor Concerns: Dilution

Investors, for their part, can also feel aggrieved about the aggressive use of SBC, especially when stock prices are down. SBC conserves cash at the grant date but could result in future shareholder dilution. Consider the case of Peloton, which reported $405 million in stock-based compensation expense (14% of revenue) during fiscal 2023. While Peloton did not have to pay its employees an additional $405 million in cash during the year, SBC represents significant potential dilution for its shareholders. Peloton reported that it had 42.9 million in outstanding employee stock options and 27.2 million in RSUs as of June 30, 2023. The total number of shares outstanding at that date was 356.7 million. If all the RSUs and stock options vested and were exercised immediately, Peloton’s share count would increase by approximately 20%, significantly diluting other shareholder’s ownership. The issue of shareholder dilution can be further exacerbated when stock prices decline. At lower stock prices, a company will have to issue more shares to employees to provide the same dollar-level of SBC.

Conclusion

SBC serves as a powerful tool for motivating employees and retaining talent while conserving cash but can also be difficult to manage during periods of volatile stock prices. Striking the right balance between rewarding employees and addressing other stakeholder concerns is essential to maintain the relevance and usefulness of SBC programs. Mercer Capital’s valuation experts assist in the measurement of grant-date fair value of equity-based compensation across a variety of industries for ASC 718 and tax compliance. Call us – we can help you evaluate various equity compensation structures and adjustment mechanisms, and provide a reliable opinion regarding grant date fair value.