The Important Role of Personal Financial Statements in Divorce

High dollar, contested divorce litigation engagements often involve complex financial issues. In turn, those financial issues usually include business valuations and voluminous amounts of documents and financial information. How does an attorney or business appraiser determine what is crucial to the case and what is secondary information? One such piece of financial information that varies wildly in its interpretation and importance to the case is a personal financial statement.

What Is a Personal Financial Statement?

Depending on the jurisdiction, most family law attorneys are familiar with documents often referred to as Sworn Financial Affidavits, Asset/Liability Statements, Marital Balance Sheet or Divorce Financial Statements that are included with the filing of the divorce case.

A personal financial statement is a similar document that is typically submitted to a bank or lending institution for the purpose of securing financing by representing an individual or couple’s financial position or net worth. In other words, it’s an asset and liability statement with estimates of value for each item akin to a balance sheet. Therefore, the couple’s or individual’s net worth is the sum of all assets, less the market value of all liabilities. For most liquid assets, such as cash/bank accounts, and investment/retirement accounts, the values can easily be obtained from the most recent account statement. Market value estimates for other assets, such as residential and personal real estate, can be obtained from recent appraisals, recent purchases, property tax assessments, and/or realtor websites. If the individual or couple owns a business, there generally is an estimate of value assigned to that asset. Since a business represents a non-liquid asset, the source of that value estimate can vary widely.

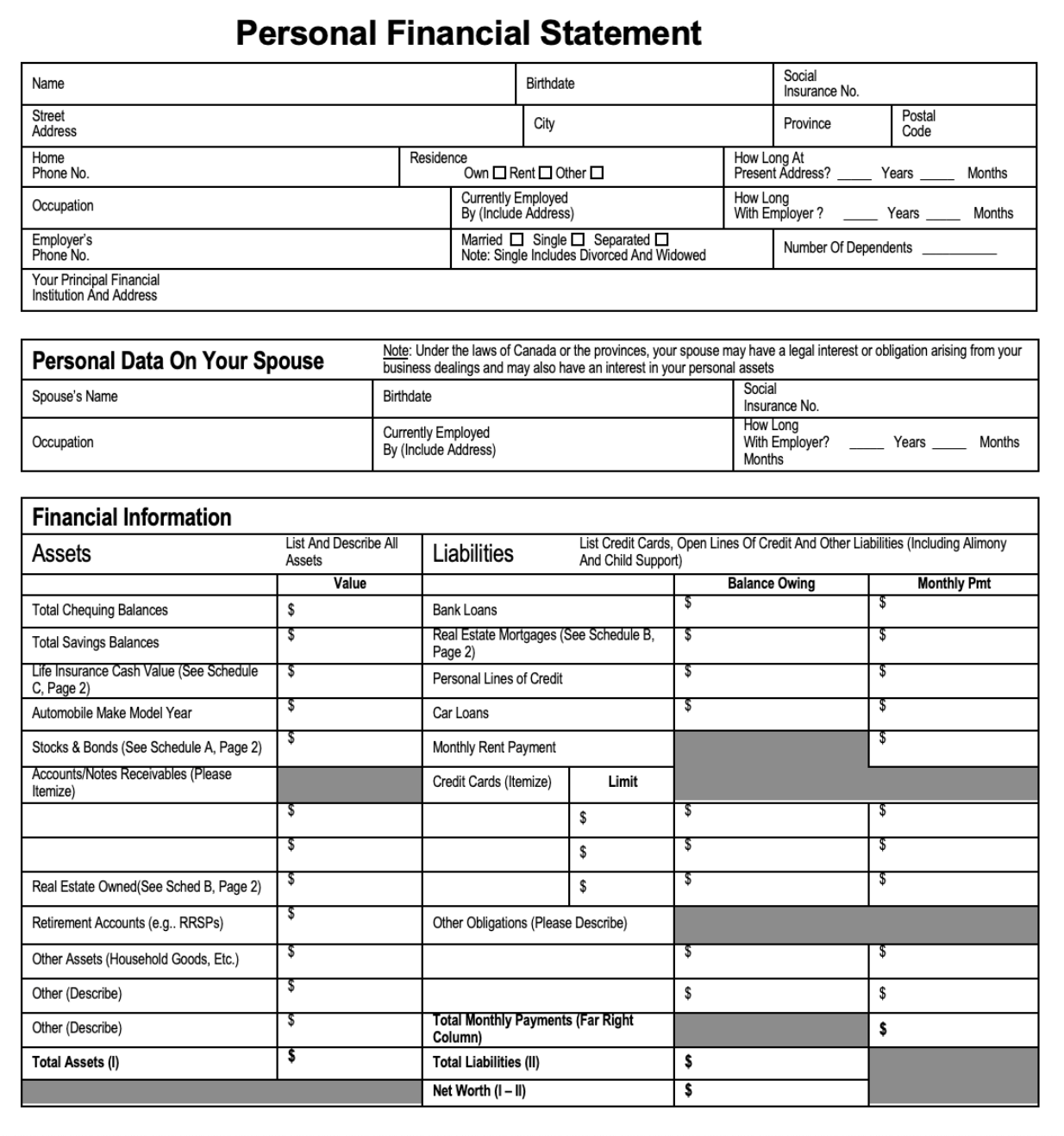

Below, is a common example of a personal financial statement:

Generally, the following items are excluded from a personal financial statement:

Leased/Rented Items: These assets are excluded since they are not actually owned by the couple or individual. However, if the couple owns a piece of property that is rented to someone else, it would be included as an asset. Further, some personal financial statements include a summary of all forms of income and expenses, often expressed in the form of monthly or yearly amounts, if the personal financial statement is used to obtain credit or to show the couple’s or individual’s overall financial position in addition to their net worth.

Personal Property: Refers to items such as furniture and household goods. Generally, the value of these items is not readily known and they are generally not considered for credit as they are unable to easily be sold. If there is any personal property with significant value, such as jewelry, cars, antiques or collectibles, their value might be included with an appraisal as the source of value. Family law attorneys will note that values for personal property are also generally not listed on divorce filings. Opinions on value can widely vary and often the true value to an individual may be rooted more in sentimental reasons than actual value. Unfortunately, the allocation of value to these items or the selection as to who ends up with each item can be one of the last and most challenging aspects to settling a case.

Why Is a Personal Financial Statement Important?

Family law attorneys, financial experts and business appraisers should ask for personal financial statements as part of their discovery or information request process. If one exists, how important is this document and how much weight should be given to it? Here’s where there are different views of the same document.

One view of a personal financial statement is that no formal valuation process was used for business assets; so at best, it’s a thumb in the air, estimate of value of the business. Did the business owner complete the form without consulting any external data or did the business owner recently conduct a business valuation on the business or consult with a business appraiser? Chances are the spectrum of possibilities is generally closer to the former than the latter, but it might bear to ask questions regarding the circumstances of the personal financial statement.

Another view is that the individual or couple submitting the personal financial statement is attesting to the accuracy and reliability of the financial figures contained in that document under penalty of perjury. Further, some would say the business owner is the most informed person regarding his/her business, its future growth opportunities, competition, and the impact of economic and industry factors on the business.

With such considerations, how do family law attorneys and business appraisers use personal financial statements? Dismiss them and throw them out? Use them as a gold standard and forego a formal business valuation? As usual, the two adages “it depends” and the “truth lies somewhere in the middle” are both probably accurate in this situation. Personal financial statements can be helpful in some cases or they can lack third party independent analysis as to the value of the business assets in other cases.

Do You Like Surprises?

Attorneys and business appraisers do not want to be surprised by not knowing about information or documents that exist. Therefore, ask for personal financial statements. They should then be used as another data point along with the other indications of value that a business appraiser is considering, such as an asset value, income value, market value, recent transactions within the Company’s stock, etc.

As with recent transactions within the Company’s stock or other market indications of value such as prior company transactions or contemplated sales/mergers, consideration should be given to the following factors: First, what is the timing of submission for the personal financial statement or data point to either the date of filing or date of trial. In other words, a recently submitted personal financial statement or data point is more relevant than one from five or ten years prior. Second, what was the context, relevance and motivation involved in the event? Why was the personal financial statement submitted or did the event represent an arm’s length transaction between two unrelated parties, as opposed to family members. Finally, do the values submitted in the personal financial statement or other data points caused by events represent elements of fair market value or do they reflect strategic value. A recent issue of Family Law Valuation and Forensic insights, covers the definitions of some of these standards of value in the overall context of understanding and defining the assignment.

If the value indicated for the business by the personal financial statement falls within a reasonable range of the estimates from the other methodologies, it could probably be given more weight. Be cautious if the value indicated for the business by the personal financial statement is materially higher or lower than a reasonable range indicated by the other methodologies. In which case, it may require the business appraiser to ask more questions regarding the thought process behind the estimate in the personal financial statement or why conditions might have changed drastically from the submission to current day.

Conclusion

Bottom line, ask for personal financial statements, review them, but consider them along with other factors and methodologies before concluding on a value for the business. These documents can be helpful in the divorce process, but don’t let them become the smoking gun by not asking for them or by not being aware that they exist.