Understanding the Importance of Defining the Assignment in a Business Valuation

To celebrate a new year and everything that comes with new beginnings, the Mercer Capital Litigation Support Services Team has decided to start the year with a blog emphasizing the importance of the beginning of a family law engagement, defining the assignment.

What Is an “Assignment Definition” in a Business Valuation and Why Is it Important?

In an engagement that requires a business valuation, the first step that attorneys and valuation experts should take is to define the assignment. This process involves the following:

- What interest is being valued. Sometimes this answer is simple, but sometimes it can be complex with multi-tiered entities or multiple ownerships. It is not uncommon to receive organizational structures with multiple holding companies and operating businesses, and the engagement letter should clearly state what is being valued. However, sometimes just that falls within our scope of engagement, so, the engagement letter may allude to a “TBD” [to be determined] ownership percentage. Owning 100% of a Company is different than owning 10%. This discussion can also lead to conclusions around the “level of value” of the engagement, a concept which will be discussed later in this blog.

- The “as of” date for the appraisal. A valuation conclusion pertains to a specific subject interest (see above) as of a specific date. Markets change, business factors change, and the value of a business or business interest is not static across time. For reference, consider: the public market, where publicly traded companies change price and as a result, value, daily. For most engagements, the valuation report is issued after the “as of” date. In other words, there is usually lag between the effective date for the conclusion and when that conclusion is rendered. Some states require current date as close to dissolution as possible, which may in turn require additional services, such as an update, or another valuation as of a more current date. See this newsletter for a more detailed explanation of the importance of the valuation date in a valuation engagement.

- Fees. While some valuation engagements can be performed for a fixed fee, most litigation engagements are an hourly basis due to our open-ended involvement. This open-endedness comes from the nature of litigation, where depositions, testimonies and prep for the opposing experts may be required by the valuation expert. Throughout the course of the engagement, other requested services can include forensic accounting services or an estimation of damages. In either case, the engagement letter should spell out how fees will be calculated and terms on billings and collections.

- Standard of Value and Level of Value. The standard of value and level of value are both valuation concepts that are very important to the valuation experts work and conclusions. While we do not intend to dive too deep into valuation theory in this blog, we will briefly discuss the standard of value and level of value below:

Standard of Value

While defining the assignment, the Standard of Value is another important consideration. Some simple questions that can help determine the standard of value include: Will the business continue to operate as a going concern or is a liquidation value more appropriate? Is “fair market value” or “fair value” required by the letter of the law for that specific engagement?

There are four standards of value that should be considered when defining a valuation assignment:

- Fair Market Value (“FMV”) Business valuations performed using the FMV standard are valued from the perspective of a rational, third-party investor who is not under any compulsion to buy or sell. In marital dissolution matters, FMV is typically appropriate and most common. Depending on the assignment definition, it is important to note that valuations of a business interest under FMV can include valuation discounts like a minority interest discount or a discount for lack of marketability, which are explained in more detail in this whitepaper. Check out this blog post by Mercer Capital for a more in-depth look at Fair Market Value.

- Fair Value. Business valuations performed using the Fair Value standard are slightly different from FMV. Shareholder oppression cases are an example where Fair Value is typically used. It is important to note that valuation discounts are not typically applied under the Fair Value standard. Check out this whitepaper by Mercer Capital for a more in-depth look at Statutory Fair Value.

- Investment Value. Business valuations performed using the Investment Value standard represent the value of a business interest to a particular, specific investor. The value of the business to a party such as a competitor, supplier, or customer is typically higher than it would be for a rational third-party investor due to the expectation of business synergies. Investment value varies depending on the value of the business to the specific purchaser; the business may well be more valuable to one competitor than to another, for example.

- Liquidation Value. The other standards of value listed above all assume a “going concern” premise, where that the business will continue operations, either independently or as a part of an acquiring company. However, there are circumstances such as distressed companies or a sale of a material asset where the liquidation value is more applicable. As a result, liquidation value will look at value from the context of the business being terminated or materially altered.

Each of these four business valuation standards may result in a different number to represent the value of the business, depending on the circumstances. Selecting the appropriate Standard of Value is crucial, and an experienced business valuation professional should be well-versed in selecting the standard of value that is most appropriate for the subject business interest being valued.

Levels of Value

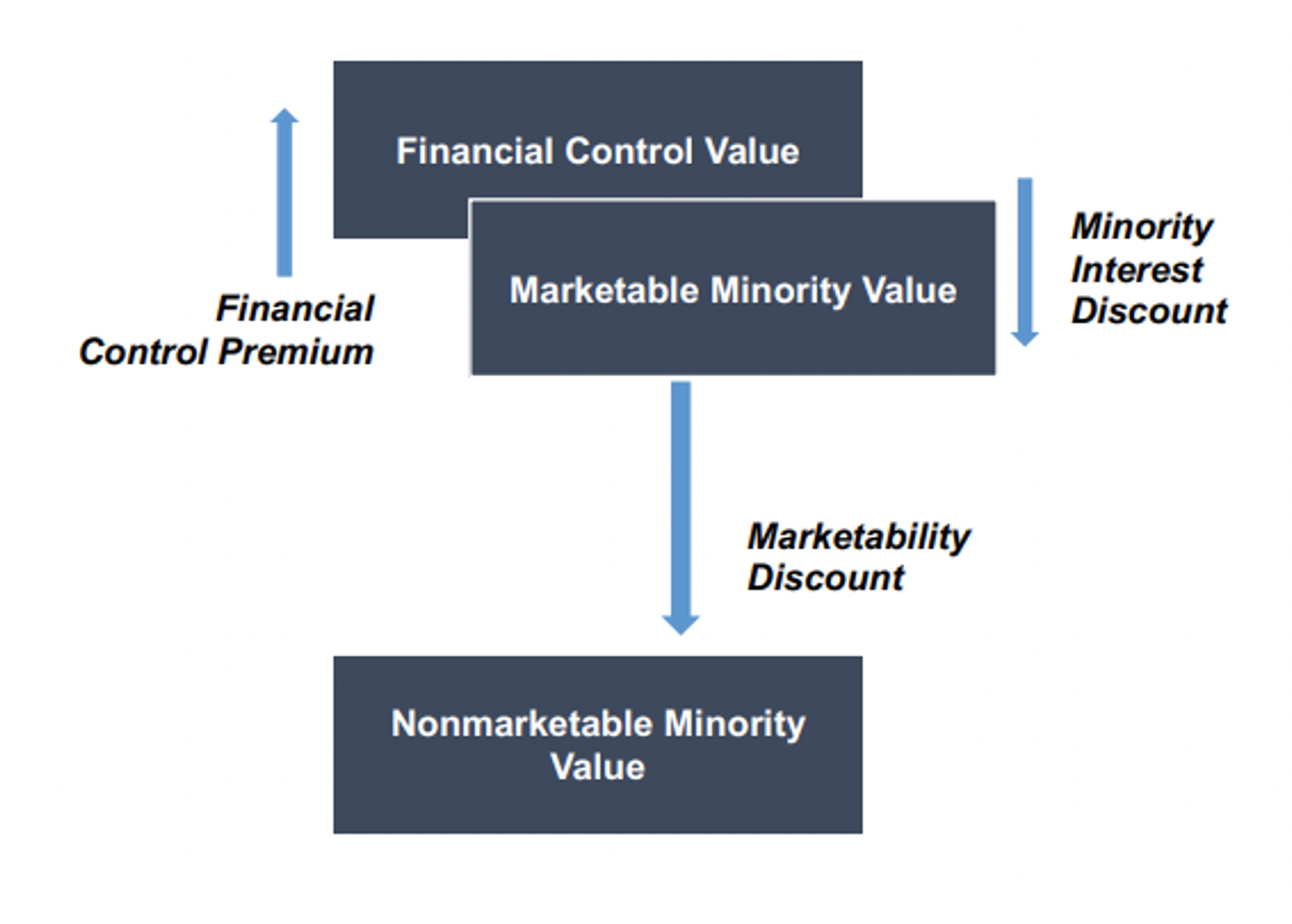

Business appraisers also refer to different kinds of values for businesses and business interests in terms of “levels of value.” As we noted in the Standards of Value section of this blog, the Fair Market Value standard of value opens the door for valuation discounts or premiums to be applied, which means that business appraisers may need to determine the appropriate Level of Value. See the chart below for the different Levels of Value that can be assigned to a valuation assignment:

To provide some examples, if the subject interest in a valuation assignment is a non-controlling minority investor, then the Nonmarketable Minority Value would likely be most appropriate. If the subject interest is a controlling owner, then the Financial Control Value could be considered. An experienced valuation expert should be able to help determine the appropriate level of value for an engagement and should also be able to quantify any Minority Interest Discount or Discount for Lack of Marketability that is deemed necessary in that engagement. Check out this blog post by Mercer Capital for a more in-depth look at the Levels of Value.

Important Takeaways for Attorneys and Valuation Experts

Defining the assignment in a valuation engagement can seem like a tall task but asking the right questions and having the right discussions with the right valuation expert at the beginning of an engagement can assist the process. You can think of the assignment definition process as building a road map for the valuation. Mercer Capital has extensive experience with a variety of valuation matters, including industry-expertise and complex scopes.