What Is the Income Approach and How Is It Utilized for Auto Dealer Valuations?

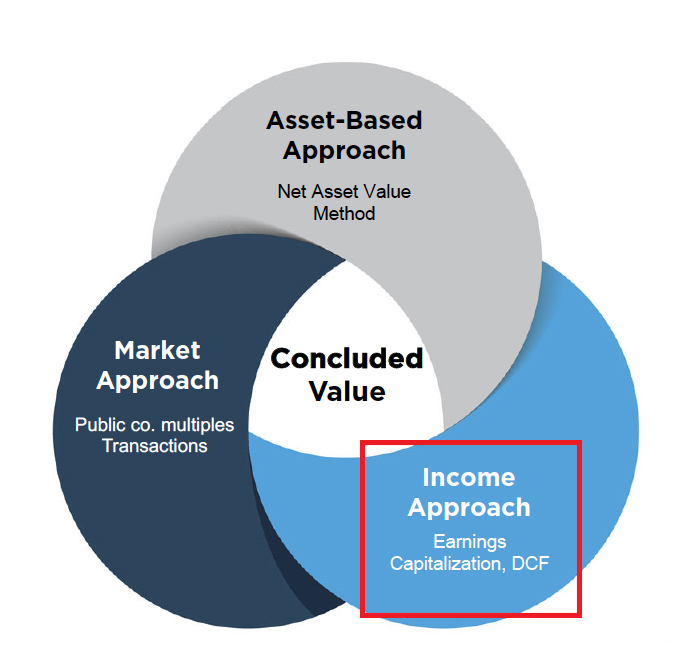

A thoughtful business valuation of an auto dealership will likely rely on multiple approaches to derive an indication of value. While each approach should be considered, the approach(es) ultimately relied upon will depend on the unique facts and circumstances of the dealership and its operating conditions. In a recent post, we focused on the asset approach for valuing auto dealerships. This article presents a broad overview of the income approach, one of the three approaches considered in all business valuations.

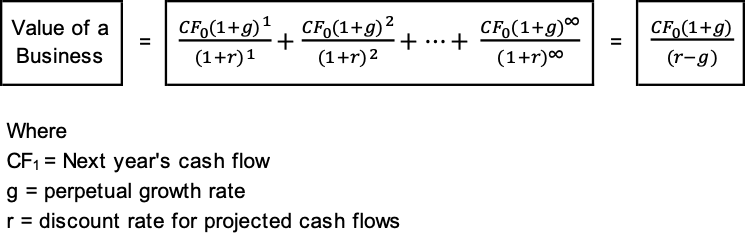

The income approach is a general way of determining the value of a business by converting anticipated future economic benefits into a single present amount. Simply put, the value of a business is directly related to the present value of all future cash flows that the business is reasonably expected to produce. The income approach requires estimates of future cash flows and an appropriate discount rate at which to discount those future cash flows.

Methods under the income approach are varied but typically fall into one of two categories:

- Single-period capitalization of earnings or free cash flow

- Discounted cash flow (DCF)

How is the income approach utilized during auto dealer valuations? First, projections are rarely produced or tracked by auto dealers (except when they move locations or open a new point), so single-period capitalization methods are more commonly used than a multi-period DCF model. Second, most auto dealerships depend on the national economy and, sometimes, to a larger degree, their local economies. Business appraisers need to analyze the dependence of each auto dealership on the national and local economies, which usually affect the seasonality and cyclicality of operations and profitability.

Dealer Financial Statements

So, how do valuation experts estimate an appropriate level of earnings to capitalize? To begin the process, the expert should start with the dealer financial statements.

Most reputable valuations of auto dealerships rely upon the financial statements each dealer reports monthly to the OEM

The reported financial statements of auto dealerships are important to understand. Unlike valuations in other industries where financial statements might be internal, compiled, reviewed, or preferably audited, most reputable valuations of auto dealerships rely upon the financial statements each dealer reports monthly to the OEM, referred to as dealer financial statements.

Why are dealer financial statements preferred? These statements provide more detailed information about the dealership’s operations than any audited financial statement. Valuable information includes the specific operations and profitability of the various departments, including new vehicles, used vehicles, parts and service, and finance and insurance. Each department has a different impact on the overall success and profitability of the entire dealership.

Dealerships are required to report these financial statements to the factory on a monthly basis. However, an experienced business valuation expert knows to request the “13th-month dealer financial statements”. The 13th-month dealer financials typically include year-end tax adjustments, such as adjusting the value of new/used vehicles to fair market value by reflecting current depreciation and other adjustments. Audits should capture these items, but internal financial statements almost certainly wouldn’t. Audited financial statements frequently include the dealer financial statements at the back, further illustrating the importance of the additional insight they provide.

Normalizing Adjustments

Once the valuation expert has acquired the dealer financial statements and reviewed the recent trends in reported earnings, certain “normalization adjustments” are usually required to estimate ongoing earnings/cash flow. Normalizing adjustments take private company financials and adjust the income statement to view the company from the lens of a “public equivalent.” Adjustments are often interrelated; a change to the balance sheet frequently will affect the income statement as well.

Normalizing adjustments is a critical step in auto dealer valuations for multiple reasons.

Normalizing adjustments is a critical step in auto dealer valuations for multiple reasons. When using Blue Sky multiples to capture intangible value, the multiple is applied to a pre-tax earnings stream. If the pre-tax earnings stream is not appropriately adjusted, this approach will not properly determine the dealership’s value. Normalizing adjustments also adjust the private dealer’s financial statements to a public equivalent upon which a third party would rely to develop its offer.

See below for a discussion of accounting adjustments, non-recurring items, non-operating, and discretionary items that are typical of an auto dealership and would likely be adjusted for an auto dealer valuation.

Potential Adjustments to Earnings

- Inventories. Last-In, First-Out (“LIFO”) inventory accounting is commonplace in the auto dealer industry. On the income statement, a LIFO inventory adjustment affects the cost of goods sold (“COGS”) and, ultimately, the gross profit margin. The shortcut method to the adjustment analyzes the change in the LIFO reserve year-over-year. If the LIFO reserve increases, the resulting normalization adjustment decreases COGS and increases profits. Conversely, if the LIFO reserve decreases, the resulting normalizing adjustment increases COGS and decreases profits.

- Officer / Dealer Compensation Like all valuations, the compensation of the dealer principal or officers must be considered for potential adjustment. Typically, a business valuation expert will review the actual compensation paid and determine a replacement or market equivalent compensation level. Experienced business valuators in the auto dealer industry have techniques and benchmarks to determine a reasonable replacement cost. In addition, some auto dealers have non-active employees or family members on the payroll. The salaries of non-active employees must also be normalized by adding back those expenses as they would not be included in a public equivalent.

- Rent The underlying real estate utilized by the auto dealer is frequently owned in a separate, related entity. As such, the dealership pays rent to the related party entity. The business valuation expert needs to determine if the rental rate paid is equivalent to a market rental rate. Often, this rental rate creates additional profitability at either the dealership entity or the real estate entity. Experienced business valuators in the auto dealer industry have several techniques and benchmarks to determine the facilities’ fair market rental rate.

- Other Income Items Most factory dealer financial statements have a line item on the income statement for other income items/additions. This category can be sizeable for a dealership depending on its sales volume and level of profitability. It’s important for a business appraiser to determine the items that comprise this category and how likely they are to continue at historical levels. Some common items that appear in this category include factory dealer incentives on sales volume levels for vehicles, factory dealer incentives for service performance, document/preparation fees on the sale of new and used vehicles, and additional costs for financing and other services sold as a part of the vehicle transaction (“PACKs”).

- Discretionary / Non-recurring / Personal Expenses Like all valuations of privately held companies, auto dealership valuations should normalize all expenses that are discretionary, non-recurring, or personal in nature. Often, these expenses can be identified during the management interview phase of the business valuation.

- Expected Industry Profitability vs. Actual Profitability For auto dealerships, underperforming stores can often be more “valuable” than stores performing at or above the market from multiple perspectives. One reason is that hypothetical buyers recognize the improvements they can make to profitability for underperforming stores. Experienced business valuators in the auto dealer industry know how to consult expected industry profitability levels depending on the manufacturer, geographic region, and competition. Expected profitability levels can be an added benchmark to the totality of the other normalization adjustments determined in the valuation process.

Single Period Capitalization Method

After determining the most appropriate adjusted earnings level for the dealership, the valuation expert can proceed to capitalize on these economic benefits.

The single-period capitalization model is almost always the most appropriate method to use when valuing auto dealerships. Ultimately, this method is an algebraic simplification of its more detailed DCF counterpart. Unlike a detailed projection of future cash flows, a base level of annual net cash flow and a sustainable growth rate are determined.

The denominator of the expression on the right “(r – g)” is referred to as the “capitalization rate,” and its reciprocal is the familiar “multiple” that applies to the appropriate measure of cash flow. The multiple (and thus the firm’s value) is negatively correlated to risk (“r”) and positively correlated to expected growth (“g”). There are two primary methods for determining an appropriate discount rate and growth rate — a public guideline company analysis or a “build-up” analysis.

Discount Rate (“r”)

Public Guideline Company Analysis: For auto dealer valuations, public auto retailers do not provide the best estimate for comparable discount and growth rates due to differences in size, growth, geographic diversification, and brand diversification. Specifically, a typical auto dealership valuation is performed for one dealership with one brand in one location — unlike the public retailers.

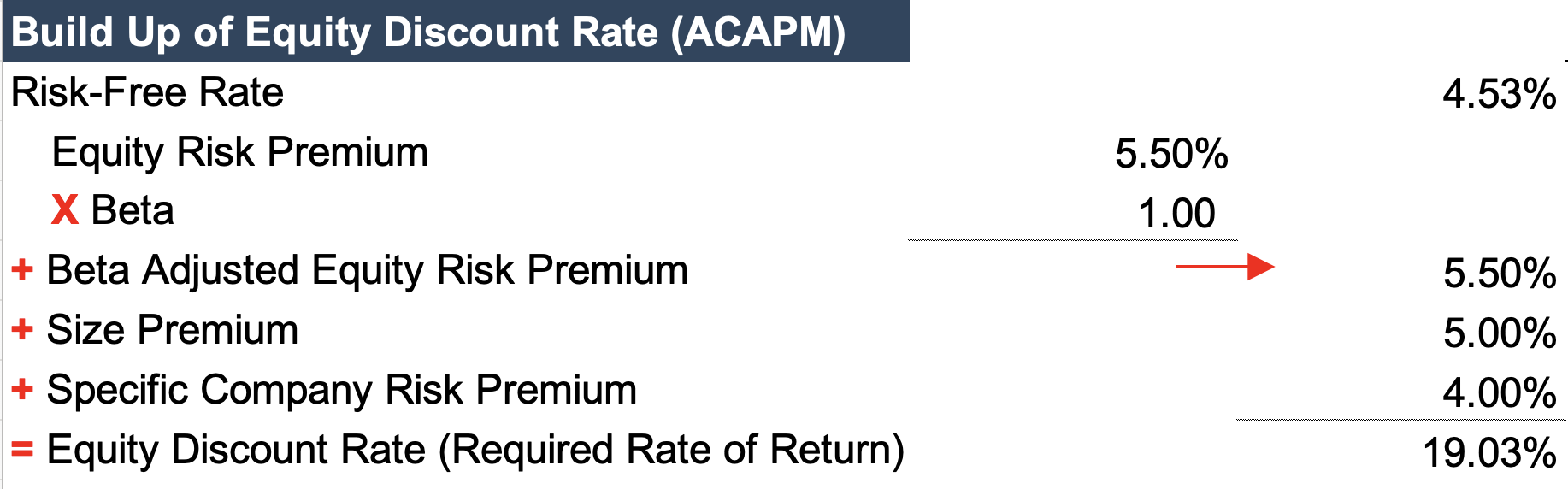

“Build-Up” Analysis: A build-up analysis can be based upon the Capital Asset Pricing Model (CAPM) or Adjusted CAPM (ACAPM) and is typically the most appropriate for auto dealer valuations. This method breaks down the total discount rate into the sum of its components like the risk-free rate, equity risk premium, size premium, and specific-company risk premium. Each of these components is estimated using different methodologies, and a more detailed discussion of these components can be found in this Mercer Capital newsletter. See the chart below for an example of a “build-up” analysis. Of the key assumptions below, generally, the risk-free rate, equity risk premium, beta, and size premium are market-driven and date-specific. Specific Company Risk and Long-Term Growth fall under the professional judgment of the appraiser and rely on their experience in the industry and the specific factors of the subject dealership.

Growth Rate (“g”)

A typical estimate of an appropriate growth rate can be determined by benchmarking the expected growth in real GDP, inflation estimates from the Federal Reserve, and factors specific to the subject dealership. For example, is the dealership expected to grow in line with the greater economy? Or is there a compelling reason the subject dealership might grow faster or slower than the economy?

Conclusion

The income approach is based on capitalizing future expected cash flows using estimates of risk and growth specific to the subject dealership. This analysis is incredibly important for auto dealerships due to the expected future cash flows of most dealerships being the primary driver of value.

A competent valuation expert is needed to thoroughly review a company’s dealer financial statements, assess the necessary adjustments to reflect the appropriate level of ongoing earnings, and determine if the approach best represents the value of the business at hand. Mercer Capital has extensive experience performing this type of analysis and is qualified and ready to perform any auto dealer valuations for a variety of purposes.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights