June 2023 SAAR

Direct-to-Consumer Sales—Gaining Traction or Losing Their Footing?

The June SAAR was 15.7 million units, up 4.0% from last month and up 20.2% from June 2022. This June marks the 11th straight month of year-over-year improvements in the SAAR, and the magnitude of the improvements has continued to grow. As we laid out in last month’s SAAR blog, inventory levels were still dismal a year ago. The SAAR reported three straight months below 13.3 million units during June, July, and August of 2022. Inventory started to improve in August, and sales followed suit in September, sending the industry on the path to recovery. With this context in mind, we expect to see significant year-over-year increases in the SAAR for at least the next two months.

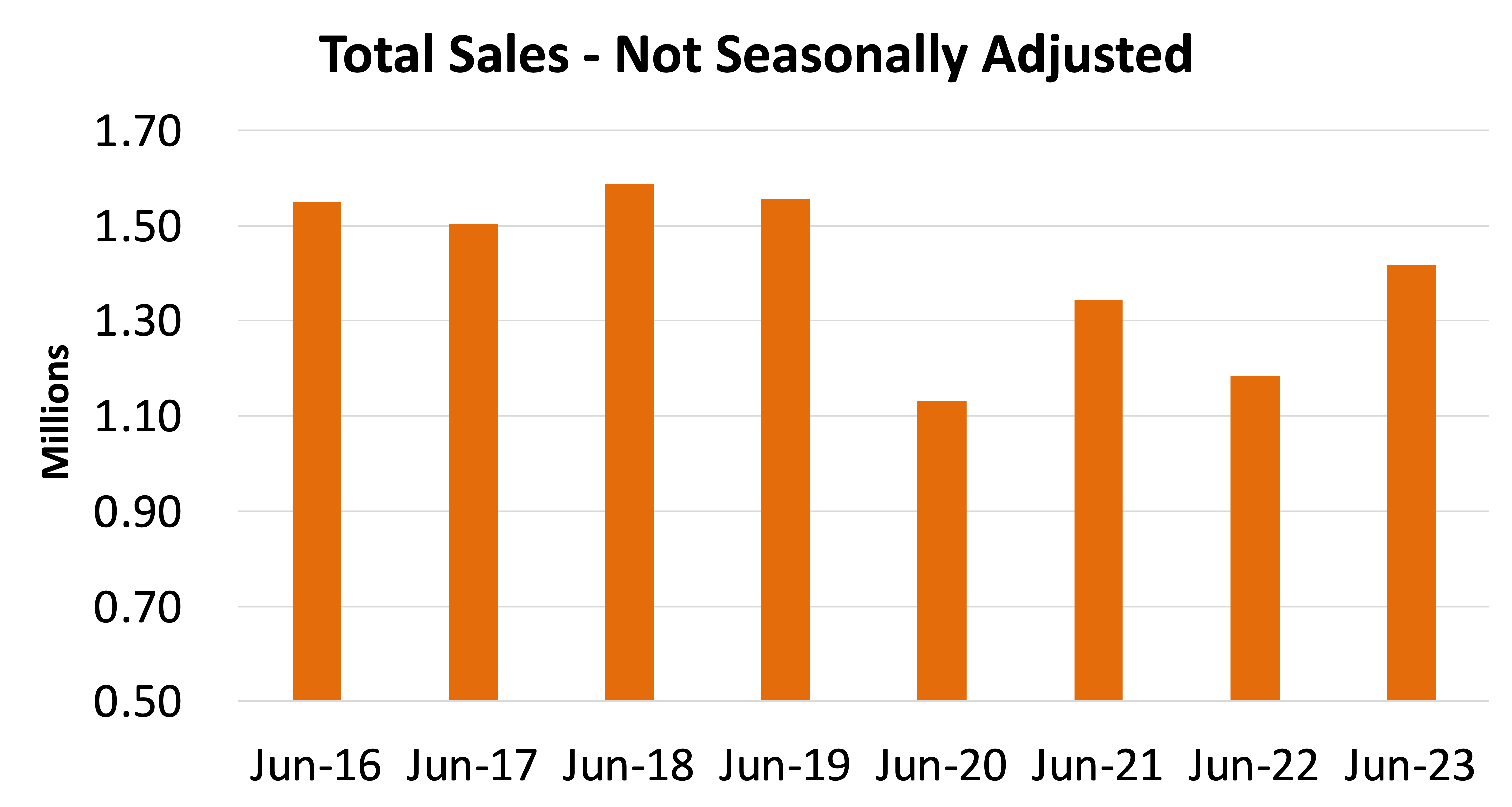

Compared to 2022, on an unadjusted basis, auto sales grew by 19.7% to 1.42 million units this past month. See the chart below for the last eight Junes’ unadjusted sales. When comparing the last four Junes (2020-23) to pre-pandemic sales trends, a return to about 1.5 million units during the high-selling summer months could be on the horizon. We will not be shocked if industry sales in the next two months reach 1.5 million units or more, although that is still a high bar to clear.

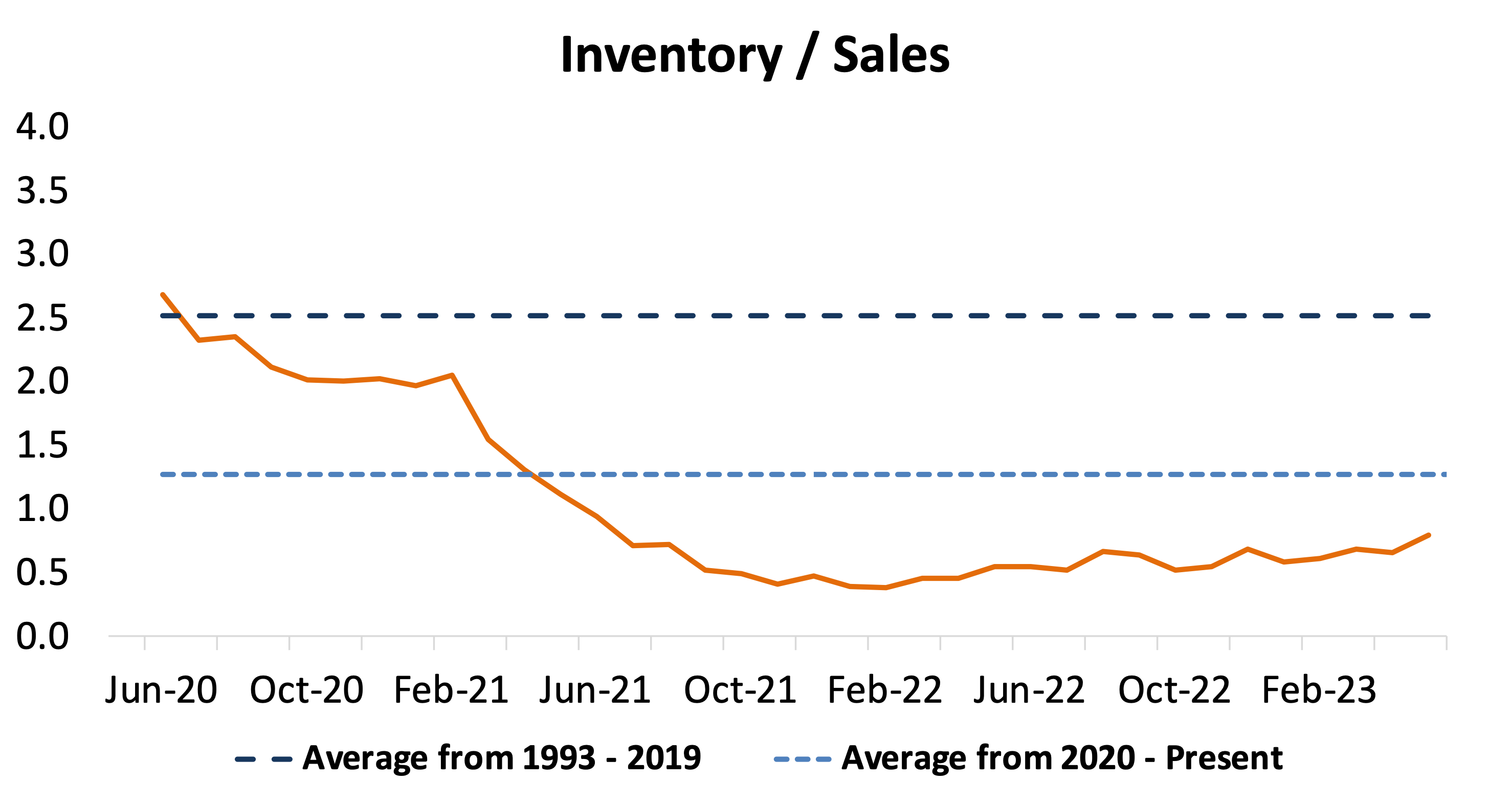

According to Cox Automotive, new-vehicle inventory reached its highest level in two years during May 2023, with a notable increase from the April data. Cox reports that there were 1.96 million units of auto inventory on the ground and that days’ supply of inventory also improved to 55 days at the end of May. For context as to how far the supply recovery has come, supply was up 73% from May 2022, or 825,000 units higher.

According to Cox Automotive, new-vehicle inventory reached its highest level in two years during May 2023, with a notable increase from the April data. Cox reports that there were 1.96 million units of auto inventory on the ground and that days’ supply of inventory also improved to 55 days at the end of May. For context as to how far the supply recovery has come, supply was up 73% from May 2022, or 825,000 units higher.

The industry’s inventory to sales ratio improved to 0.79x in May 2023. This ratio has been slowly approaching 1.0x since its all-time lows in late 2021 / early 2022, but pent-up demand has kept the ratio low amidst improving inventory conditions.

Transaction Prices, Incentive Spending, and Monthly Payments

Check out our auto finance blog from two weeks ago for a more robust update related to auto finance. We will continue to provide regular updates on these data points as more data becomes available.

Direct-to-Consumer Sales Model—Gaining Traction or Losing Their Footing?

Over the last few years, premium brands like Mercedes-Benz and volume brands like Volkswagen have adopted an automotive direct sales model for some of their markets and product lines. Customers can buy new vehicles from a brick-and-mortar dealership or online, but “direct-to-consumer” vehicles are purchased directly from the manufacturer. In this business model, there is only one selling price: the manufacturer-suggested retail price (MSRP), no matter where the transaction occurs. In this strategy, negotiations with individual dealerships are obsolete.

A direct sales model simplifies the role of auto dealerships as the place to gather relevant information, go on test drives and sample different vehicle models. Under this model, customers would also be expected to go to dealerships for after-sales service as more of a core dealership offering as opposed to a complementary piece of the operating strategy. Additionally, a dealership would receive commission payments on vehicle sales in their area and would not be required to finance their floor plan inventory, removing the inherent risks of financing and managing such inventory. It would also reduce same-brand competition and support a more unified strategy of all the same-branded dealers in a region. In short, there are numerous profit-oriented and consumer-oriented reasons why OEMs are considering varying degrees of direct sales.

On the flip side, dealers would lose their autonomy and position as price negotiators, effectively enforcing a price ceiling during good times and a price floor during lean times (both of which can limit demand and would worsen sales volumes). Dealers would also lose the flexibility to adjust other selling strategies, like the composition of vehicles on their lot. That loss of control is concerning for auto dealers because most dealers have an intimate knowledge of their local market. They are concerned that their manufacturer (which has never sold vehicles directly to customers) may unintentionally harm their built reputation. Historically speaking, the initial reason the franchise model came about was so manufacturers could focus on their core competency of building vehicles while entrepreneurial auto dealers could focus on the customer experience and knowledge of nuances between local markets.

So how do auto dealers feel about the agency model? According to Boston Consulting Group, 80% of the dealers they polled thought that a direct sales model would hurt their business performance. Furthermore, 75% think that OEMs have provided insufficient detail on the new model, roles, and transition period. 66% of auto dealers believe that agency compensation is unfair and that pricing is unlikely to be demand-oriented and dynamic in this model.

What Are the Latest Updates on Direct-To-Consumer Sales?

The direct-to-consumer model has already been under fire from auto dealer organizations and judicial bodies across the country:

- In some jurisdictions, the direct sales model is under scrutiny, and Tesla is at the forefront of these legal battles. According to Reuters, a federal court in Louisiana dismissed Tesla Inc’s complaint against a state restriction on direct car sales in a ruling on June 16th. The ruling says that “the direct sales ban applies equally to all manufacturers, and Tesla has alleged no facts regarding anti-Tesla animus on the part of the Louisiana Legislature.”

- In other jurisdictions, legal loopholes are being explored as a temporary option. Consumer Reports show New Mexico has more stringent laws prohibiting direct-to-consumer car sales. Tesla’s answer was to enter into an agreement to build a sales store and service center on nearby Native American land in Nambé Pueblo in 2021. Because the land is considered a sovereign nation, it’s not subject to New Mexico’s strict franchise laws.

- According to session materials from the latest national auto dealer counsel (“NADC”) conference, other legal battles are brewing between franchised auto dealers and OEMs in states like Colorado, California, Mississippi, and Florida, among others. Dealer associations in these states are now proposing legislation to address the direct-to-consumer model. These cases hinge on established franchise law. In short, dealers claim that franchisees have the right to sell all of their OEM’s vehicles directly to the customer, including EVs and ICE models, no matter what strategy the OEM is interested in implementing.

Dealers should continue to stay tuned on developments in the direct-to-consumer sales model across all of the OEMs. Dealers need to know what their OEM is planning so that they can respond according to their best interests. While we don’t have a crystal ball to show if this fundamental shift in the industry will gain traction or fall flat, a direct-to-consumer sales model would drastically change how dealerships conduct business and make strategic decisions.

July 2023 Outlook

Mercer Capital’s outlook for the July 2023 SAAR continues to be optimistic. Industry supply chain conditions are improving. Sales volumes have continued to improve as dealers are seeing better inventory availability. However, with concerns of a recession looming, it will be important to monitor consumer activity which may begin to cool off as affordability becomes an issue, as evidenced by falling transaction prices.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights