Used Vehicle Margins in 2021

How Large Used-Only Auto Retailers Are Measuring Up

As our dealer clients know, automotive retailing competition has intensified with large, well-capitalized online-only retailers getting plenty of attention. Due to imbalances between supply and demand, gross margins on both new and used vehicles have increased in 2021.

In this post, we survey gross margins for the publicly traded dealerships, in light of the current operating environment and reconsider the investment thesis put forth by the new entrants.

Investment Thesis of Online Used-Only Retailers

Investors in used-only retailers likely have numerous reasons for believing in these companies. We’ll highlight some of the reasons below, then delve deeper into a few of them.

- Lack of franchise agreements in used vehicle space enable significant growth/market reach

- COVID-19 anticipated to accelerate auto retailing towards e-commerce seen in other retail sectors

- Customer dissatisfaction with traditional retail experience

- Gross margins tend to be higher on used vehicles than new vehicles

- Asset-light business model

Lack of Franchise Agreements

For the publicly traded traditional auto retailers, franchise agreements can inhibit growth. Executives have discussed on earnings calls the obstacles that can occur when they accumulate numerous stores in the same brand. For used-only retailers, there are no similar restrictions as the sale of used vehicles are not subject to franchise agreements. While this may be a positive for growth and geographic diversification, this limits the market available to these companies.

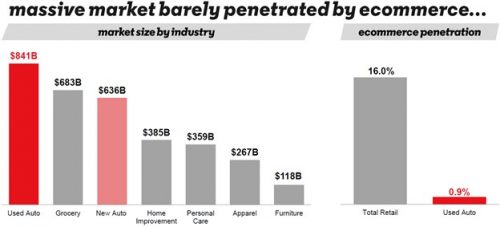

Vroom’s 2020 investor deck highlighted used auto as one of the largest markets at $840B trailed by grocery ($683B) and new auto ($636B). Using these figures (which are pre-pandemic), used-only players are limited to ~57% of the market.

While growing to become the premier used vehicle operator would have obvious benefits, if any of these players can meaningfully consolidate the highly fragmented market, there is a downside to only interacting with consumers when they want a used vehicle. This is also why executives of franchised auto dealers have started harping on the number of “touch-points” they have with consumers which includes new and used sales as well as service appointments.

source: Vroom, Inc.

COVID-19 and the Shift to Ecommerce

A core strength of pre-pandemic automotive retail was the lack of penetration from ecommerce. As seen above, ecommerce penetration prior to the pandemic was less than 1% as determined by Vroom. The space has been Amazon-proof to a degree, though auto dealers and consumers were thrust into a digital world last March and April. Over a year later, it seems clear that the number of transactions and the percentage of transactions completed online will increase.

Online retailers tout that they are the future, and the pandemic has only accelerated trends in consumer preference towards online. Only time will tell how truly transformed the environment is. Does the lack of ecommerce penetration represent a massive opportunity for new entrants in the market, or does it just paint a picture of how difficult it will be for these companies to attract profitable market share?

Gross Margins and Profitability at Large

Another long-term key consideration will be profitability. As with Amazon and Facebook, tech companies can command huge valuations prior to turning profitable. Many Silicon Valley startups claim to be the next unicorn that will achieve scale, ramp down expenses relative to revenue growth, and watch red ink turn to black.

Because Carvana, Shift, and Vroom are still relatively young companies, their lack of profitability has not yet detracted from their value. However, gross margins can still be compared because companies spending significant amounts on advertising will have a hard time turning the corner if the unit level economics aren’t there.

Let’s revisit what was mentioned at the outset. Used vehicle margins have been stronger than new vehicle margins. That remains to be true. Gross profit margin for the average dealership through the first half of 2021 was 13.4%, up from 11.8% through 1H20. For the new vehicle department, gross as a percentage of selling price increased to 8.3% YTD 2021, up significantly from 5.5% in the prior year period. The same is true for used vehicles: 14.0% YTD 2021 versus 11.4% in 2020. New and used margins are up in 2021, and used margins continue to outpace new.

Parts and service departments have higher margins than vehicle sales departments, and these departments account for a significant portion of gross profit for auto dealers. According to NADA, through the first half of 2021, gross profit contribution from parts and service was considerably lower than historical levels (37.4% of total gross profit), but it still outpaced that of both new and used vehicle departments despite making up a much lower percentage of revenue. Below, we have calculated gross margins in 2021 for the public auto dealers.

Click here to expand the image above

Used vehicle gross margins exceed new vehicle gross margins for Asbury, AutoNation, Group 1, and Lithia. Notably, however, that is not the case for Penske, LMP, or Sonic. Sonic’s 2.8% used vehicle gross margin stands out as an outlier, but we do see here that used vehicle gross margins are not exclusively higher than new. This could be due to the difficulty of sourcing vehicles in this environment.

LMP and Penske also have the highest new vehicle margins, which could be at the detriment of used vehicles margins if they extract higher ASPs on new vehicles by offering higher trade in values.

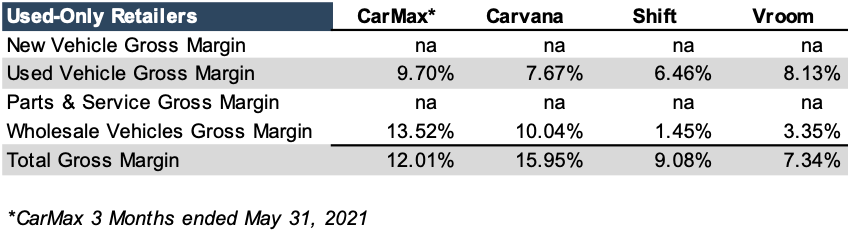

For total gross margin, however, the impact of fixed operations is clear. Blended total gross margin for traditional franchised auto dealers is approximately 15-18%. For used-only retailers, used and total gross margins are much lower as seen below.

Click here to expand the image above

Perhaps these retailers are underpricing their vehicles to gain market share, and it is true that lost incremental vehicle sales from these retailers has a compounding effect. In addition to a lost vehicle sale, consumers are also less likely to go to a dealership for parts and service if they didn’t originally purchase the vehicle from that dealership. While this could have a long-term negative impact on total gross profit for dealerships, it remains to be seen if there will be mass adoption to buying vehicles from these platforms. Unless there is a material change in franchise laws, these companies won’t be able to sell new vehicles.

Conclusion

Used-only online retailers may be the future. Customer dissatisfaction with “the old way” may push more people to try something new. The Carvana’s of the world may improve their gross margins with data-driven technologies lowering costs and tactfully raising prices without losing their new customers.

The asset-light model may help attract enough investors to lower the cost of capital for larger players enabling a virtuous cycle of greater scale and efficiencies. These players may eventually also look to get into the service and parts business to improve gross margins, though this would be hard to square with an asset-light approach.

For now, though, franchised auto dealers will continue to operate with the strong foothold afforded to new vehicle dealers that can cater to customers throughout the life cycle of their vehicles.

Mercer Capital provides business valuation and financial advisory services, and our auto team focuses on industry trends to stay current on the competitive environment for our auto dealer clients. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights