September 2021 SAAR

September 2021 SAAR was 12.2 million, dropping for the fifth consecutive month amidst an ongoing inventory shortage. The September SAAR was the lowest since May 2020’s 12.1 million units but has not fallen near the COVID-19 pandemic low of 8.6 million units in April of 2020.

Tight inventories limited both fleet and retail sales in September, which has been the same case over the last four months. Fleet sales continue to fall as a percent of total sales, making up just 12% over the last month, as higher profit retail sales continue to be prioritized.

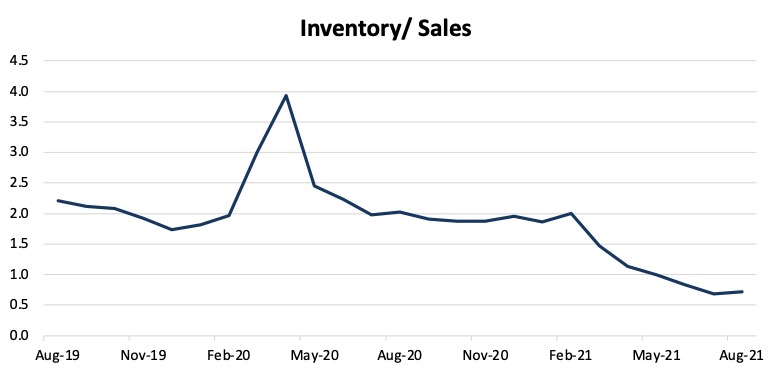

As mentioned in last month’s SAAR blog, auto dealers started the month with industry-wide record low inventory levels of 1.06 million units. Inventory levels have not improved much since then, but the industry inventory to sales ratio has modestly ticked up from 0.68 to 0.72.

This could be explained by sales rates finally slowing down and keeping pace with production rates. High levels of demand and low supply have been coexisting for months, and there are only so many new vehicles to go around as consumers are increasingly pre-ordering vehicles before they even arrive on dealers’ lots. While high prices are keeping away certain customers that have decided to wait, wider margins are keeping dealers profitable.

However, at current production rates there are only so many vehicles being produced by OEMs that can make it to the lot, and high trade-in values and wide margins can only do so much to bridge the gap for dealers that may not have a new car to sell to a potential trade-in customer down the line.

In response to the current climate, average transaction prices have continued to rise. The average transaction price of a new vehicle is expected to top $42,800, another all-time high and the fourth straight month that prices have exceeded $40,000. Dealers have taken advantage of high prices to sustain profitability by achieving high margins on each vehicle sold for months now, and the factors involved continue to benefit dealers. For example, average incentive spending per unit is expected to reach another record low of $1,755 per vehicle, down from $1,823 a month ago, driving GPUs up even further.

Another factor that influences dealer profitability, inventory turnover, decreased again as well. The average time that a new vehicle sat in the lot during September was 23 days, down from 25 days in August and 54 days in September 2020 reducing floor plan interest expense.

What Do Tech Investments By OEMs Mean For My Dealership?

In a previous blog outlining the different options that dealers have when allocating capital amidst excess liquidity, a few options were highlighted. Dealers can either 1) reinvest in the business, 2) return capital to debt and equity stakeholders or 3) seek acquisitions to drive growth. These fundamental decisions apply to OEMs as well, and over the last several months many OEMs have decided to reinvest in the core operations of the business by shifting their focus to electric vehicles.

Listed below are narratives of some of the investments OEMs have made and how they might affect the value of your privately held dealership.

- Nissan has developed a new technique for assembling vehicles more efficiently and with less waste. This technique, called SUMO, enables Nissan to produce vehicles 10% cheaper than before, despite them manufacturing increasingly complex vehicles like hybrids and EVs.

- General Motors is developing a supply chain for rare-earth metals for the production of EVs, a move expected to pave the way for a more reliable stream of General Motors EVs in the future.

- Ford has also reinvested in EV operations, and has recently partnered with Electrify America, ChargePoint and others to bolster its charging network.

- Ford has also announced a state-of-the-art production facility that is set to be built in west Tennessee, creating 5,800 positions to produce electric F-150 trucks. The plant is also said to be a zero-waste-to-landfill facility.

The point is that almost every major vehicle manufacturer is investing in the future of its EV production process, a move that some analysts think will lead to higher, Tesla-like, valuations. However, it is unclear whether OEMs will start to invest in support for dealership maintenance infrastructure.

Many have already chosen to pass along the costs of investments needed for the sale and service of EV vehicles onto the dealer, creating several issues surrounding the economics of an upgrade for rural and smaller dealerships. Time will tell whether OEMs will choose to prioritize the amount of EVs on lots by further subsiding transition fees.

Forecast

Looking ahead to October, expectations for the full year 2021 SAAR have once again been lowered. Experts estimate that the global industry has already lost around 9 million units of production related to supply chain issues, and that number should continue to mount with no end in sight for OEMS until and likely into 2022. The demand for new and used vehicles is expected to remain feverish, but sales will have to contend with ongoing production constraints. Sales can no longer outpace production as inventory has been drawn down.

At this point, we are pretty confident sales in Q4 won’t be high enough to reach our initial 2021 target. Despite a challenging year from an operational standpoint, we doubt many dealers will be complaining with the results and the profits achieved this year.

If you would like to know more about how these trends are affecting the value of your auto dealership, feel free to contact a member of the Mercer Capital auto team.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights