Tax Planning for Auto Dealerships

Why Auto Dealers Might Not Pay “Market” Rent

In business valuation, appraisers seek to normalize historical earnings to establish the level of earnings an investor might reasonably expect from an investment in the subject company. These adjustments may increase or decrease earnings, and they can be set for a variety of reasons. Normalization adjustments include surveying various expense categories and determining whether the amount historically paid is considered “market rate.”

Rent paid to a related party is frequently judged to be above or below market, which can be for various reasons. Dealers’ priorities lie more with sales and operating efficiency than tracking what the market says they should pay themselves (or a related party) in rent. The rent paid also may be artificially high or low for tax purposes. In this post, we will examine what this means and why auto dealers may hold real estate in a separate but related entity from the one that owns the dealership operations.

What Are the Options? Which Taxes Are in Play?

To understand why paying above-market rent might be advantageous for an auto dealer, we need to know the options available and the tax implications. There are a few ways for gross profits to end up in the pockets of dealers:

- Retain as profit and pay a distribution (corporate income tax and personal dividend tax)

- Pay as compensation to owner (personal income tax and payroll tax)

- Pay as rent to a related pass-through entity that owns the real estate (personal income tax)

Pay Corporate Taxes on Profits and Pay a Dividend

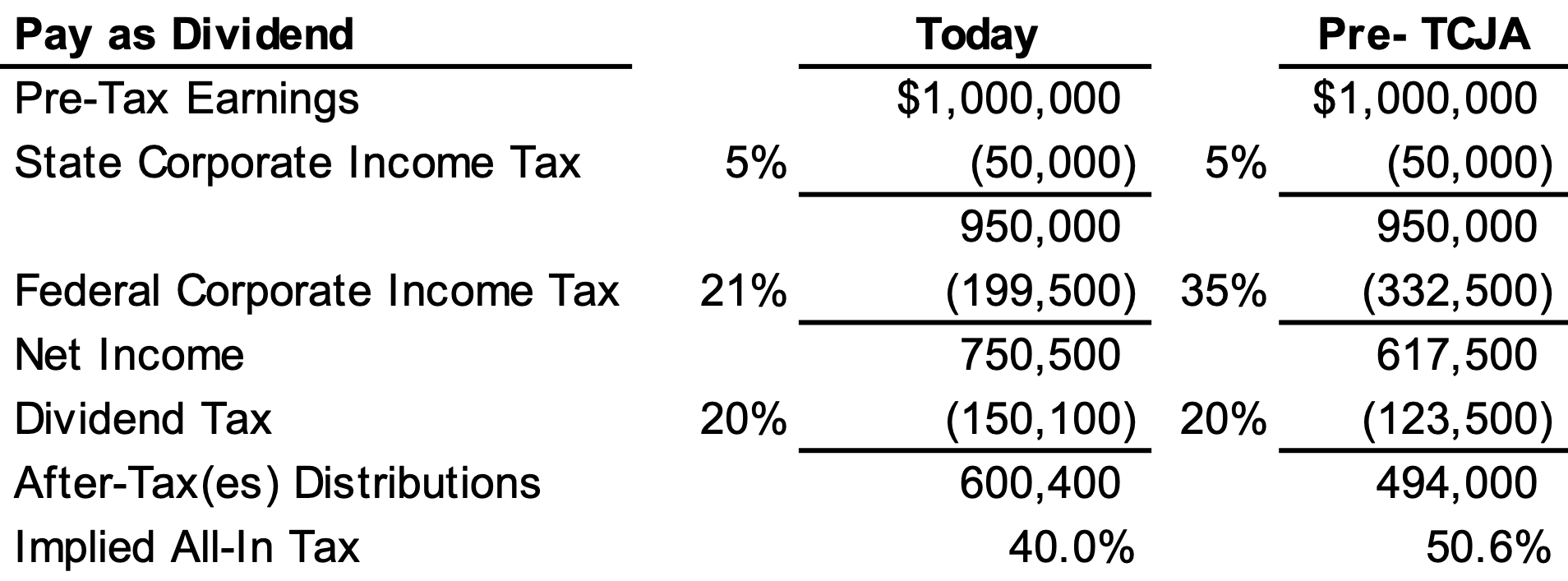

Deciding for “tax purposes” frequently implies avoiding the double taxation inherent in C corporations. A dealership organized as a C corporation would owe approximately 25% in state (assuming a 5% state tax rate) and federal corporate income tax, meaning $1,00,000 in pre-tax earnings would equate to a dividend of about $750,500. Then, the owner would likely owe an additional 15-20% in dividend taxes, meaning $1,000,000 may be closer to $600,400 in after-tax proceeds. An all-in tax rate of approximately 40% in 2021 is much lower than what dealers would have paid before the 2017 Tax Cuts and Jobs Act, as shown below:

The reduction in the federal corporate income tax itself was a fundamental change to how business owners think about these excess profits. While it significantly increased after-tax proceeds under this payment structure, many owners had already used more advantageous tax strategies. That’s why most private dealerships aren’t organized as C corporations.

Pay Excess Profits as Compensation to Dealer

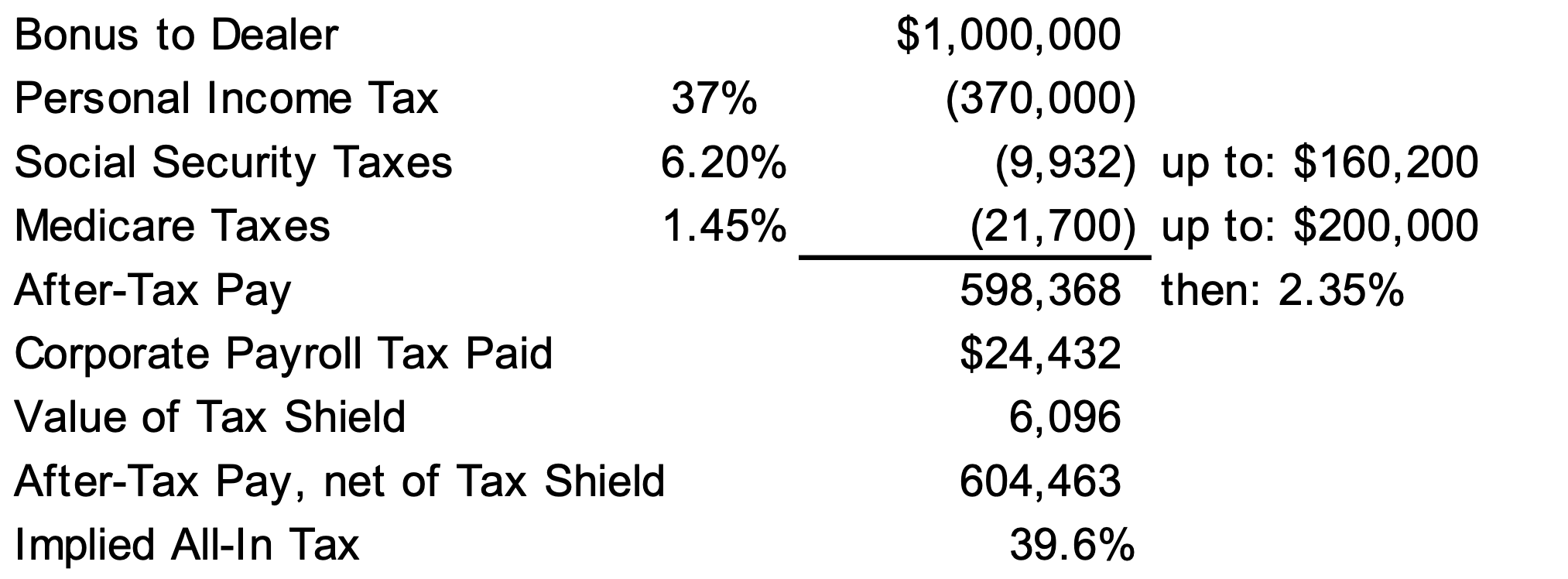

If excess profits are paid as compensation, a dealer will likely owe the top marginal personal tax rate of 37%. While this appears better than the ~40% tax contemplated above, this fails to capture payroll taxes. Up to certain income levels, a payroll tax of 15.3% is split by employers and employees to fund Social Security (6.2% each) and Medicare (1.45% each). While exposure to the social security tax is capped at $160,200 in compensation for 2023, there is no limit for the Medicare portion; in fact, there’s an additional Medicare tax of 0.9% added on to the 1.45% on income over $200,000 for individuals (employers do not also pay the additional 0.9%). These calculations can become more complicated depending on the level of payment, and the analysis gets further muddied by the level of pre-bonus compensation to the dealer (the below analysis assumes no base salary).

As seen above, the analysis becomes more nuanced, but there does not appear to be a huge opportunity for tax savings as the implied all-in tax is near the 40% calculated above post-TCJA. Further, depending on other wages earned, contributing to payroll taxes should provide an improved retirement benefit to the dealer principal.

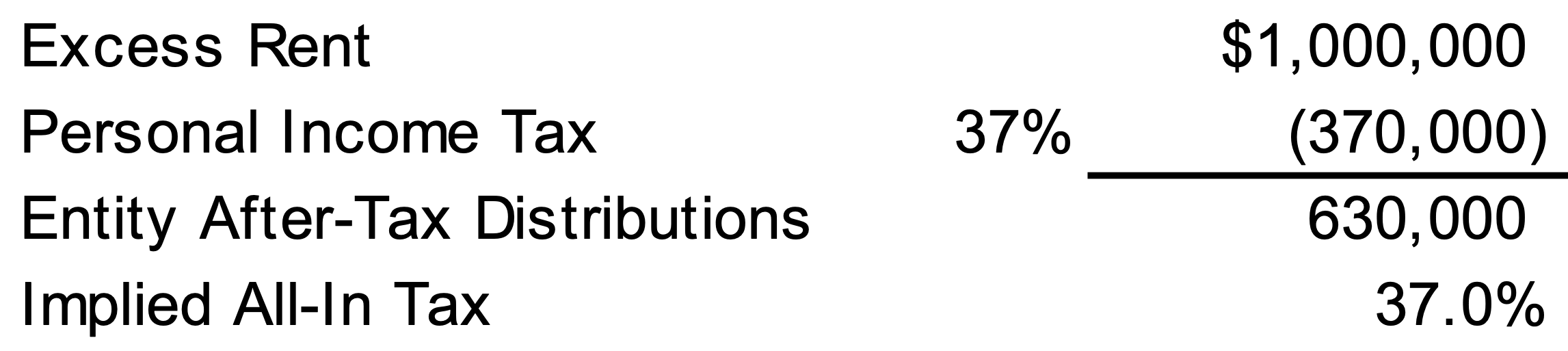

Pay Excess Profits as Rent to a Pass-Through Owned by the Dealer

Paying higher rent is likely the cleanest way to transfer profits from the dealership to a separately held entity. If the rent paid on the property was $1,000,000 more than it otherwise would be with no commensurate expense increase to the entity, income would be passed through at personal rates, like compensation, just without payroll taxes. While pass-through entities may also be able to benefit from the Qualified Business Income Deduction, we have not considered this in our calculations because the deduction phases out well before the contemplated $1,000,000 in excess profit/rent. We note this also assumes no state personal income tax, which is the case here in Tennessee, but not everywhere.

While this appears the most advantageous, we should caveat that the IRS may not take kindly to egregious overpayments of rent to shelter income. Regardless, income and payroll taxes aren’t the only reason a dealer might own the dealership’s real estate operations in a separate entity. There are other strategic reasons it makes sense for auto dealers to have the real estate held in a separate entity, as is common in the industry. An example of this is legal protection from creditors by separating assets. It also enables dealers to retain upside in valuable real estate if they choose to divest their dealership but retain steady income. As discussed below, there are also other tax planning benefits from this structure.

Tax Planning Benefits of Using Multiple Entities

Earnings on real estate may receive a higher multiple in the marketplace than a business, including auto dealership real estate. This is because rents are paid before equity holders and are therefore viewed as less risky. These steady earnings streams can be beneficial from a financial planning standpoint. In the case of marital dissolution, the “out-spouse,” or the divorcing party that doesn’t actively participate in the business, might receive alimony or an equitable division of the marital estate. It may make sense for an auto dealer’s spouse to receive an interest in a real estate entity, receiving more steady cash flows, while the auto dealer would retain the upside of their work in the business.

There may also be estate planning benefits that similarly align with incentives. If an auto dealer has numerous children and one works in the business, it may make sense for them to either purchase or be gifted an equity interest in the dealership as they actively contribute to its profitability. For a child not involved in the business, it may be the most equitable solution to instead allow them to receive an interest in the real estate, receiving both steady income and also passive appreciation.

Conclusion

As we’ve seen, auto dealers have numerous considerations and options regarding excess profits that might be paid as a bonus, dividend, or rent. As appraisers, we are unlikely to opine a higher or lower valuation of a dealership’s operations based on these decisions. While the calculations can become more complex, it is unlikely one of these will increase the value of the enterprise for two reasons: a buyer is less likely to care about the current ownership structure, and if one structure always resulted in greater value, wouldn’t everyone simply choose that structure?

As we’ve discussed previously, it appears the federal corporate tax rate does not materially impact valuations. If tax rates change again, auto dealers will again have to consider what works best in their unique situation. This can be complicated when there are numerous owners, and other life events can strategically impact what makes the most sense. Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers understand the value of their business as well as the greater implications of its value. Contact a Mercer Capital professional today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights