2021 Is Still an Optimal Time for Gifting Interests in E&P Companies

Factors That Led to a Rush of Estate Planning Activity in 2020 Largely Remain

December was a busy month at Mercer Capital, and at business valuation firms across the country. Clients sought to make gifts and perform other estate planning transactions ahead of year-end. But the changing of the calendar does not mean that the window for gifting is over. The factors that led to a rush of estate planning transaction activity during 2020 largely remain. The combination of depressed E&P valuations, the potential for future tax changes, and the ability to utilize minority interest and marketability discounts are still present in 2021.

Depressed E&P Valuations

2020 was a difficult year for many companies, though the pain was acute for E&P companies that were faced with unprecedented demand destruction that led to negative oil prices. Recovery appears to be taking hold, but the pace is uncertain and some changes in commuting and business travel habits might be permanent.

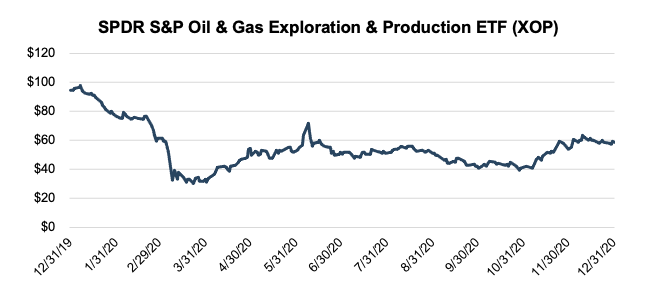

While E&P company values (as proxied by the SPDR S&P Oil & Gas Exploration & Production ETF) have recovered from their lows in March, the index remains down year-over-year, having declined 38% during 2020.

The recent spate of E&P bankruptcies also is indicative of a challenging operating environment and reduced equity valuations. There are exceptions with assets and situations of highly economic Tier 1 production, and/or acreage that can maintain or have proportionally small value decreases during this downturn, but most E&P companies have suffered alongside commodity prices.

While unpleasant from a net worth perspective, this (hopefully temporary) reduction in value can be a boon for estate planning purposes, allowing taxpayers to gift larger interests, while utilizing less of their gift & estate tax exemption (or paying less in taxes on the gifted interest).

Potential for Future Tax Changes

President-elect Biden’s tax plan calls for some major changes to the current gift & estate tax regime. Most notably, the estate tax exemption could be reduced from today’s $11.7 million (unified) to $3.5 million (estate) and $1.0 million (gift), and the tax rate could increase from 40% to 45%. The prospects for tax reform likely increased after Georgia’s Senate run-off elections on January 5th put the Democrats in control of both houses of Congress.

While new tax legislation could potentially be made retroactive to January 1, many tax policy experts see that as unlikely. Mercer Capital’s Atticus Frank has a great blog post with additional reading for anyone interested in estate planning for 2021.

Consider taking advantage of the current gift & estate tax exemptions in 2021 before they potentially go away.

Minority Interest and Marketability Discounts

By gifting minority interests to heirs, taxpayers can potentially utilize minority interest and marketability discounts to reduce the value of the gifted interest and ease gift & estate tax burdens. These discounts are highly dependent on facts and circumstances surrounding the subject interest. Mercer Capital has successfully defended its minority interest and marketability discounts to the IRS and in other litigated contexts.

By gifting minority interests, one does not only benefit from the application of minority interest and marketability discounts during the gifting process. If done as a part of a thoughtfully executed estate planning strategy, gifting can result in a non-controlling ownership interest in an estate, allowing for the potential application of discounts for estate tax purposes as well.

Mercer Capital’s Travis Harms has an insightful blog post about this issue. In the post, he runs hypothetical math showing the difference in potential tax liabilities under various gifting scenarios. A thoughtful gifting strategy as part of a broader estate plan can have a significant impact on the proceeds heirs receive from an estate.

Conclusion

Despite what one might think, the window for gifting transactions has not closed. Mercer Capital provides valuation and other financial advisory services to families seeking to optimize their estate plans. Give one of our professionals a call to discuss how we can help you in the current environment.

Energy Valuation Insights

Energy Valuation Insights