Eagle Ford Benefits From Commodity Price Increases Despite Challenges

The economics of oil and gas production vary by region. Mercer Capital focuses on trends in the Eagle Ford, Permian, Bakken, and Marcellus and Utica plays. The cost of producing oil and gas depends on the geological makeup of the reserve, depth of reserve, and cost to transport the raw crude to market. We can observe different costs in different regions depending on these factors. This quarter we take a closer look at the Eagle Ford.

Production and Activity Levels

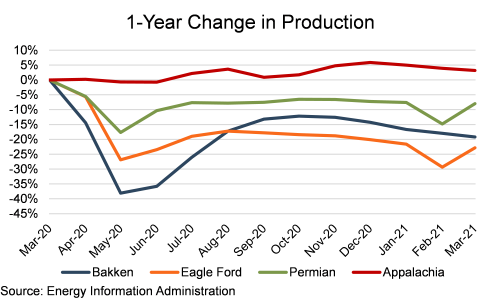

Estimated Eagle Ford production declined approximately 23% year-over-year through March. This is the most severe decline observed for all of Mercer Capital’s coverage areas, with production in the Bakken, Permian, and Appalachia down 19%, down 8%, and up 3%, respectively. In the immediate aftermath of the Saudi/Russian price war and historic rout in oil prices, the Eagle Ford’s production decline was less severe than what was seen in the Bakken, though the rebound in the Eagle Ford was also more muted. During the fourth quarter of 2020, Eagle Ford production trended downward once again and appears to have been materially impacted in February 2021 by the cold weather that disrupted power supplies throughout Texas.

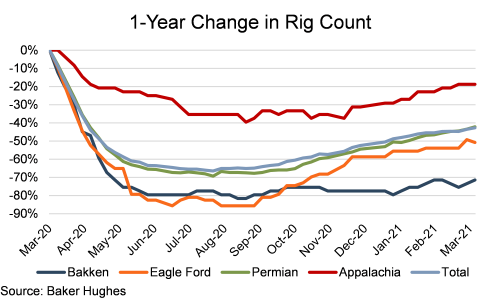

However, the Eagle Ford’s rig count has generally been rising over the past six months. Total rigs in the Eagle Ford stood at 31 as of March 26, down over 50% from the prior year, but more than 3x higher than the low of 9 rigs observed in September 2020. Bakken, Permian, and Appalachia rig counts were down 71%, 42%, and 19% year-over-year, though have all rebounded from the September lows (though not as dramatically as the Eagle Ford’s rise since then).

While recent data has been noisy, and the Eagle Ford’s current rig count should keep production relatively flat, based on legacy production declines and new-well production per rig.

Commodity Prices Stabilize, Though Uncertain Demand Dynamics Remain

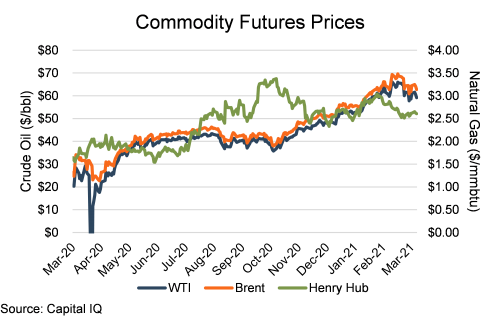

The first quarter of 2021 was relatively good for commodity prices, though they exhibited more volatility than in recent quarters. Front-month WTI futures began the quarter at ~$48/bbl and increased to a peak of $66/bbl before ending the quarter at ~$59/bbl. Henry Hub natural gas front-month futures prices broke above $3/mmbtu in February 2021, though regional spot prices were much more volatile as cold weather disrupted gas production and transmission while also increasing demand for heat and electricity.

Financial Performance

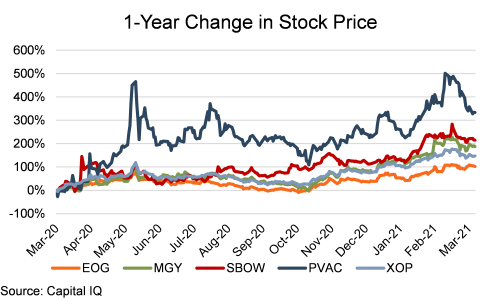

The Eagle Ford public comp group had a banner year for stock price performance over the past twelve months, with Penn Virginia, Silverbow, Mongolia, and EOG up 334%, 215%, 187%, and 102%, respectively. All except EOG outperformed the broader E&P sector, as proxied by XOP (which was up 157% during the past twelve months). However, that stock price performance is largely driven by the exceptionally low starting point in March 2020, as the Saudi/Russian price war and reduced demand due to COVID-19 lockdowns created significant concern among investors regarding the financial position of E&P companies, especially those with significant leverage. Stock prices for the four companies remain below all-time highs.

EOG Doubles Down on “Double Premium” Locations

In their Q4 2020 earnings call and presentation, EOG touted its inventory of “Double Premium” locations, which meet EOG’s new return hurdle of 60% Direct After-Tax Rate of Return (ATROR) at $40 oil and $2.50 natural gas. While not clearly defined, EOG describes Direct ATROR as including “the costs associated with drilling and completion operations and well site facilities.” All-In ATROR, which is more akin to a full-cycle calculation, “includes such costs as well as (i) the costs associated with other facilities, lease acquisitions, delay rentals and gathering and processing operations and (ii) geological and geophysical costs, exploration G&A costs, capitalized interest and other miscellaneous costs.” Per EOG’s presentation, roughly half of EOG’s 11,500 premium locations fit the underwriting criteria to be classified as “double premium.”

However, E&P companies have long been criticized for touting well-level IRRs and other bespoke financial metrics that imply phenomenal economics, but don’t seem to result in corresponding corporate-level returns. We’ll see if EOG’s more stringent underwriting standards translate to shareholder returns.

Conclusion

The Eagle Ford was among the regions hardest hit by low commodity prices. The recent increase in rig count bodes well for stemming production declines, though more rigs are likely needed for material production growth given natural declines in existing production. However, with investors and E&P management teams focused on returns rather than growth, current commodity prices may not lead to the expansion in the activity that’s been seen in previous cycles.

We have assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America, and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.

Energy Valuation Insights

Energy Valuation Insights