O(i)l Faithful

Eagle Ford Region Overview

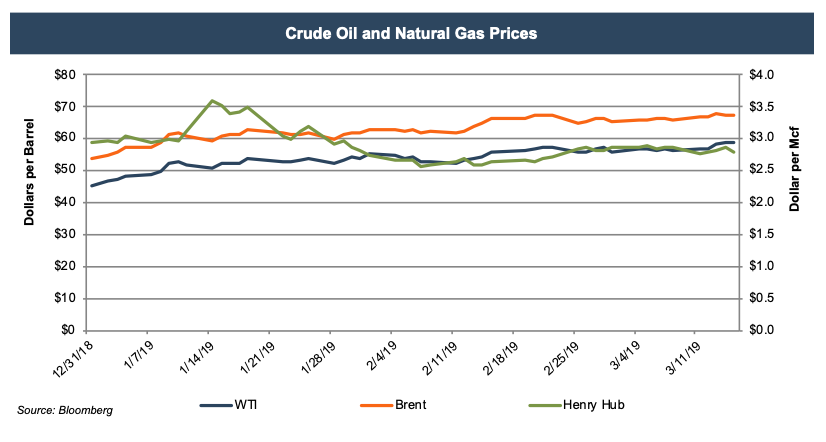

Nearly a quarter of the way through 2019, prices have rebounded somewhat after a tumultuous end to 2018. First quarter energy prices again moved in opposite directions, with crude prices increasing steadily over the period while natural gas prices decreased from $2.94 to $2.80 per Mcf by mid-March despite peaking at over $3.50 in mid-January.

Location, Location, Location

Borrowing the mantra of many real estate agents, sometimes it’s all about location, location, location. This is quite clear for oil and gas plays, particularly when looking at the acreage multiples paid across various regions. Eagle Ford Shale has quietly delivered solid results, overshadowed by some of the other shale plays, particularly the Permian to the west. The Eagle Ford’s location provides a distinct advantage, however, as it is closer to higher Brent-related pricing seen on the Gulf Coast. Its higher cut of oil also opens it up to Louisiana Light Sweet pricing. Even though the attention on the Permian has increased both acreage multiples and congestion due to transportation issues, it has been less of a concern in the Eagle Ford because the product has a shorter distance to travel to get to market.

While proximity to better pricing is clearly a boon, location within the region also plays a large role.

While proximity to better pricing is clearly a boon, location within the region also plays a large role. The Eagle Ford has areas where the cost of supply is as low as $20 to $30 per barrel according to Greg Leveille, Chief Technology Officer of ConocoPhillips. EOG Resources, the largest operator in the region, has noted similar supply costs as well. According to Thomas Tunstall, senior researcher with UTSA’s Institute of Economic Development, “EOG has some of the choicest leases in the Eagle Ford. They have indicated publicly that they can make money at $30 per barrel.” This has a considerable impact particularly with WTI prices currently trading around double that figure.

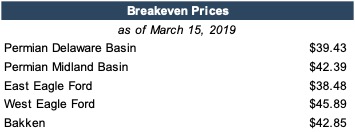

According to Bloomberg, breakeven prices tell a similar story. While the West Eagle Ford has the highest breakeven of these regions, the East Eagle Ford has the lowest. Though it can be difficult to isolate reasons for these differences, Bloomberg’s breakeven prices in the table below do seem to corroborate the assertion that location plays a role as the eastern portion of the Eagle Ford is closest to the Gulf Coast with the Brent and LLS pricing.

Free Cash Flow vs Potential — Safe vs Sexy

As we noted last week, operators in the Eagle Ford have enjoyed the reliable production inherent in a later life-stage play. Along with the pricing benefits noted above, companies that have operated in the region for a while have been able to benefit from experience. Todd Abbott, Marathon Oil’s VP of Resource Plays South, attributed the company’s success in the region to drilling innovation and efficiency and repeatability of a stable drilling program. He further noted, “We are completing wells in a quarter of the time it took us to complete them in 2012.” This notion was furthered by ConocoPhillips’ CTO Leveille who touted innovations in well-spacing and stacking have allowed the company to achieve a 20% field-level recovery factor in the Eagle Ford Shale.

Technical innovations and experience have led to free cash flow for operators, which is something investors have been seeking. It also allows for diligence in capital spending, where investors have also begun to prioritize capital efficiency over capital expenditure. In fact, according to Marathon’s Abbott, the Eagle Ford has been able to effectively subsidize its efforts in regions such as the Permian and Oklahoma Stack as it is generating the free cash flow that the others are consuming. Still, the Eagle Ford lacks some of the luster of other plays.

Valuation Implications

To further understand the current production profile of the Eagle Ford and oil and gas plays in general, we can compare them to a typical company. In the early stages, companies retain earnings to fund growth opportunities as the return on investment can be quite high. As the company matures, however, there are fewer high return investments to be made, and companies tend to pay more dividends. Returns shift from capital appreciation from retained earnings to a yield in the form of dividends paid as a reward for years of investment. The Eagle Ford is in the stage of paying dividends.

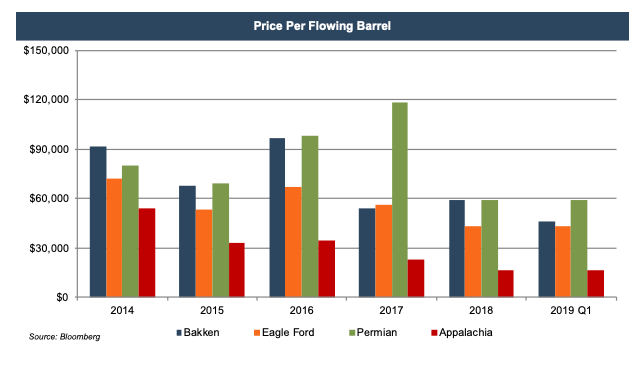

As has been the case for some time now, operators in the Permian continue to lead the other regions in terms of EV/production multiples, also known as price per flowing barrel. The Bakken was about on par with the Permian at the end of 2018, but it slid back towards the Eagle Ford, which edged up over the past three months. Multiples continue to trail levels seen in the past as enterprise values have been somewhat lower and production figures have increased.

Rig Counts and Production

According to calculations based on data from Baker Hughes, rig counts in North America decreased 4.2% in the last three months, but increased 3.6% over the last twelve months. Eagle Ford Shale had the highest annual increase at 15.5%, but its 82 rigs only represent 8.0% of total rigs in North America. Despite a 4.5% decline in the past three months, the Permian Basin continues to lead the way with 464 rigs, representing about 45% of the total. By comparison, the Eagle Ford has the second most rigs, just outpacing Appalachia at 79 and the Bakken with 56.

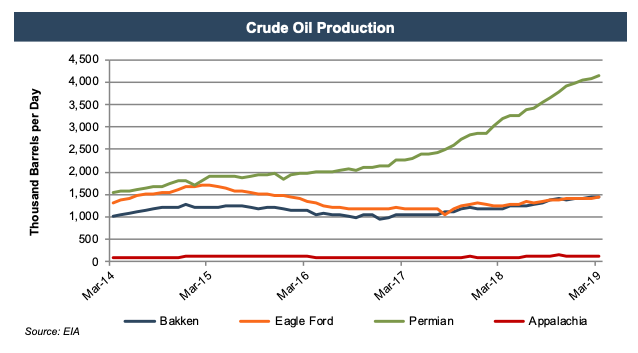

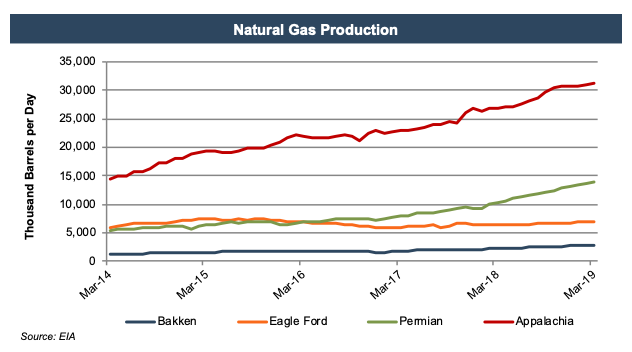

Despite the increase in rig counts, production increases over the past year for both oil (14.4%) and gas (8.3%) have trailed production gains seen in other regions. This is likely due to the older nature of the play, and its stage in the production cycle. The lack of production growth does not mean there is low production, however. It continues to provide solid production, with crude oil production on par with the Bakken, and significantly above Appalachia, known for its natural gas. The Eagle Ford also leads the Bakken in terms of natural gas production.

Much of the attention, particularly in Texas, has been on crude as opposed to natural gas. Despite this, the graph above shows natural gas production in the Permian has increased significantly in the past year. As noted earlier, the Eagle Ford’s location, specifically its proximity to the Henry Hub in Louisiana, may be a reason why the chasm between the amounts of natural gas produced in the two regions hasn’t increased further than it has. Much like crude, operators focused on natural gas in the Eagle Ford have benefitted from higher pricing as well as lower costs. According to Michael J. Wieland, President and CEO of Laredo Energy VI LP, the economics of dry gas in the Eagle Ford are particularly strong. Wieland further estimated finding and development costs at 50 cents per thousand cubic feet (Mcf) and netbacks of about $2/Mcf. SilverBow Resources’ EVP and CFO, Gleeson Van Riet, said the company has drilled 20 of the top 50 Eagle Ford gas wells and that the play is the best place to be in the U.S. for natural gas because it has best prices, good infrastructure and is located in the demand growth area. SilverBow (formerly Swift Energy) is the Eagle Ford’s only public pure-play in dry gas. Whether an operator focuses on crude oil, natural gas, or both, neither seems to be in short supply in the region.

End of an Era?

While there is plenty of current production in addition to cash flow, there are concerns about the longevity of the region. Even regional giant EOG is looking to diversify. On a recent earnings call, EVP of Exploration & Production Ezra Yacob noted expanding exploration in those areas will “help increase the quality of our inventory” and “should hopefully shallow the decline that these unconventional plays are kind of known for.” The company still plans to drill about the same number of wells in the region in 2019, after posting a 9% crude oil production increase. The Eagle Ford represented 43% of EOG’s crude production last year, so diversifying to other regions doesn’t necessarily indicate a bearish view. Instead, it seems to be in line with the strategy alluded by Marathon, using the cash flow generated in the Eagle Ford to pay for growth in other plays.

Despite the older nature of the play, many people around the industry believe there is plenty of value still under the subsurface in south Texas.

Despite the older nature of the play, many people around the industry believe there is plenty of value still under the subsurface in south Texas. Director at BMO Capital Markets Max van Adrichem called the Eagle Ford a good alternative to “some of the more mature basins which may not have enough running room to get you through 5 to 10 years.” Martin Thalken, Chairman and CEO of pure-play Eagle Ford operator Protégé Energy III, supports this line of thinking. He commented the Eagle Ford “is still in the early innings” on applications like primary EOR and refracturing. John Thaeler, CEO of Vitruvian Exploration IV also employed a baseball analogy, saying “the dry gas Eagle Ford is just in the second inning.” Marathon’s Abbott agrees, “We believe there is a lot of running room left in the Eagle Ford for Marathon and the rest of the industry.”

Conclusion

Crude prices have rebounded since the turn of the year, while natural gas prices have remained steady. Pricing will always be dynamic in a global commodity environment, but the economics of certain plays tend to be less fluid. While it may not offer the potential of the Permian, the Eagle Ford is poised to leverage its experience and location to deliver solid returns.

We have assisted many clients with various valuation needs in the upstream oil and gas space in both conventional and unconventional plays in North America, and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.

Energy Valuation Insights

Energy Valuation Insights