Peloton, Planet Fitness, and Family Business

Pedaling Too Close to the Sun

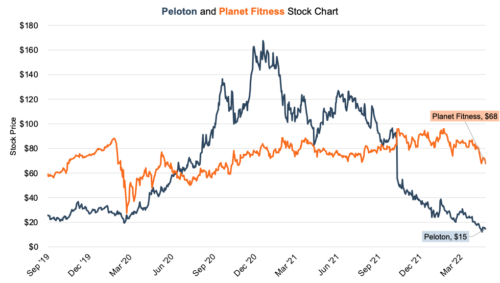

Think back to March 2020. Many businesses and operations saw immediate stoppages and closures with no idea when they could restart. The fitness industry was no exception. Planet Fitness, the gym operator, completely shut down its locations and its stock plummeted. Peloton Interactive saw sales surge for its at-home exercise spin-bike and its stock soar.

In short: these two businesses entered very different seasons at the onset of the COVID-19 lockdowns and slowdown. Planet Fitness was facing a sudden and bitterly cold winter, while Peloton was spinning its way into summer. But as Barron’s highlighted recently, fortunes and seasons can change quickly.

We often compare stock prices to scoreboards, and currently, the at-home-fitness company Peloton is receiving a drubbing. Its stock is down a dot-com bubble-esque 91% from its all-time high. Revenue fell in the most recent quarter, and EBITDA fell from near-break-even in fiscal 2021 to nearly a $1.2 billion EBITDA loss (a negative 31% margin). Meanwhile, Planet Fitness, the no-frills gym operator that franchises the majority of its locations, is ready to flex in 2022. Revenue and EBITDA are expected to surpass 2019 levels and the company plans to continue opening new gyms.

But what can family businesses learn from this rapid change in fortunes for these two companies? We think there are three lessons that can prevent you from pedaling in place: understand what season your business is in, be prepared for slow-downs, and diversify prudently.

What Season Is Your Family Business In?

How you invest, or plant, and your decision to diversify and return capital, or harvest, depends in part on your family business season (Travis Harms expounds on this great analogy here). In short, just as any farmer worth his salt knows what time of year to plant and harvest, businesses need to have a keen understanding of where their business sits before making a major capital investment or allocation decisions.

Planet Fitness saw a fast-approaching winter with the onset of the COVID-19 pandemic and cut costs drastically. It also worked with its franchisees to defer required equipment outlays in order to preserve capital for its operators. In an industry that saw 17% of all fitness studios and gyms fail in 2020, Planet Fitness’s CEO was proud to report none of its gyms closed over the course of the pandemic. As we highlighted in our 2021 Benchmarking Guide, many smaller companies curtailed capital expenditure and lowered distributions in the face of uncertainty to preserve capital. Family businesses need to make decisions that reflect both the sunny days and the coming squalls as they exist today, and be flexible enough to do so.

Winter Is (Or Will Be) Coming

While we have the benefit of hindsight, management at Peloton appears to have been dreaming of an endless summer. Revenue skyrocketed, with its bikes and treadmills perfect for people that were looking for ways to stay active at home. Peloton responded to its incredible growth by sacrificing margin to deliver more equipment quicker to its customers as well as committing to build a factory to speed up production. The company spent massively on marketing and its headcount rose precipitously.

Where did this lead? Growth plans have now been cut in the midst of a demand slowdown, Peloton’s CEO stepped down, and production was halted as unsold inventory sat in warehouses. Its stock currently sits at all-time lows.

While we do not wish to play Monday morning quarterback regarding Peloton’s decisions, perhaps a bit of temperance in its growth plans could have staved off the nasty hangover the company is currently experiencing. Protecting its margin and maintaining a sober view of notoriously fickle fitness spending trends, as well as holding more dry powder, could have all served the company well. Regardless of exact policy prescriptions, family businesses should manage their companies through long-term colored glasses, rather than assuming sunny days will always be with us.

Keep Your Wardrobe Varied

The reversal of fortunes for Planet Fitness and Peloton highlights another old maxim: Don’t put all your eggs in one basket. Per BMO Capital Markets analyst Simeon Siegel, “[Planet Fitness] embraced an omnichannel offering, [Peloton] argued solely for At-Home. Even the most high profile digital-only retailers realized they need to meet the customer where the customer wants to be, and not restrict their options.”

Peloton draws an almost cult-like following from its adherents and boosts high usage rates and low subscription churn. However, its end-users do represent a market niche, and Peloton overestimated the change in market dynamics brought on by the pandemic to expand its singular end-market. While the company is currently tightening its belt and looking to diversify its app offerings, whether new management can shift the company into the right gear remains to be seen.

Planet Fitness, in addition to its non-ostentatious wardrobe and defensive posture, is using success to fund smart diversification. Its digital fitness app is the number two free app on the Apple Store, and the company is currently beta testing a paid version to take a slice of the digital fitness market. While likely not to convert to a digital-first company overnight, Planet Fitness sees this diversification to strengthen its core business: Asset-light, low-frills, and industry-leading pricing.

Stuck in Colder Weather

Nobel Prize-winning economist Paul Samuelson once said that Wall Street had predicted nine out of the last five recessions. And while some economists or perma-bears may sometimes overreact to the state of the economy, the fall from grace of Peloton has us thinking more about how family businesses can weather storms when they undoubtedly arrive.

Family businesses think of their lifespans over generations, and we think this gives them the perfect perspective to face the current stock-market sell-off, rise in interest rates, and potential economic slowdown.

Understanding your business season, preparing for the downside, and intelligently diversifying are all ways family businesses can traverse the middle way.

Family Business Director

Family Business Director