What Business Is Your Family Business In?

This post is part of our “Talking to the Numbers” series for family business leaders. In this series of posts, our goal is to help family business directors ask the right questions when reviewing financial statements. Asking better questions will lead to better financial and business decisions.

When engaging in shop talk about a client project, our colleagues inevitably start by asking, “What business is the client in?” In nearly all cases, the appropriate response to the question is a brief description of the client’s industry. But for a small minority of clients whose financial performance is truly extraordinary, the correct response is that they are in the “money making” business. For these clients, the particular “it” of what they do is secondary to the fact that they make a lot of money doing it. Has your family business joined the exclusive club whose members are in the “money making” business?

Has your family business joined the exclusive club whose members are in the “money making” business?

The income statement reveals the profitability of your family business. You can think of the income statement as a series of increasingly difficult tests. If the company can charge a price for its goods or services greater than the cost of production, it will have passed the first test, and gross profit will be positive. The second test is this: Can the family business sell enough units to cover its overhead expenses? This test is harder, as it requires the business not just to be profitable on a per-unit basis, but to generate enough volume to support the selling, general and administrative expenses necessary to operate the business. Looking at our data, we observe that just five companies failed the first test (i.e., reported negative gross profit), but 69 companies failed the second test.

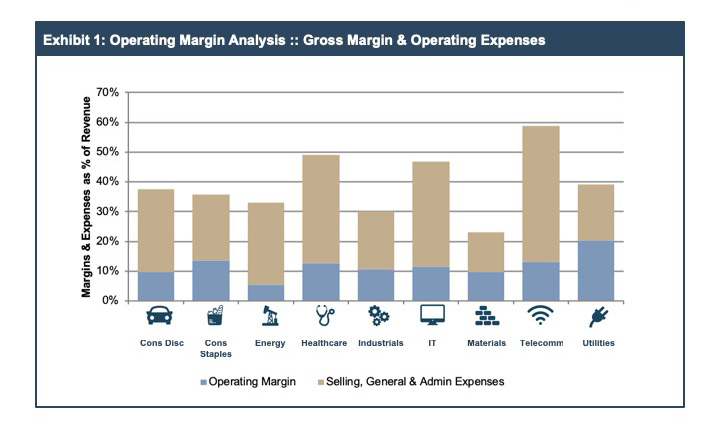

Exhibit 1 summarizes median operating margins by industry. The sum of the two stacked columns is the median gross margin for each industry (gross margin = operating margin + S, G&A). In general, some of the volatility in gross margin by industry gets smoothed out a bit at the operating margin level. For example, the relatively high gross margin for industries like healthcare and information technology is largely offset by high overhead costs. On the other hand, lower gross margin sectors such as industrials and materials, have lower overhead burdens.

Three broad themes relevant to family businesses emerge from our consideration of the operating income data.

Operating Leverage is Real, so Revenue Growth is Valuable

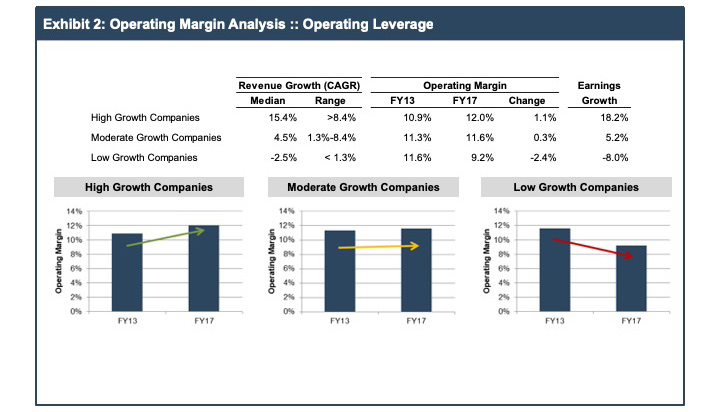

For family businesses that are focused on long-term sustainability, focusing on revenue growth is not optional. Standing still is generally a recipe for a slow (or perhaps even fast) painful death. The cost of doing business rises every year, and revenue growth is essential to maintaining profitability. To the extent a business has fixed costs – and all do to some degree – faster revenue growth can contribute to margin enhancement. Exhibit 2 summarizes the operating leverage enjoyed by the companies in our analysis. Consistent with our analysis in a prior post, we divided our universe of companies into three groups based on their observed historical revenue growth.

As noted in Exhibit 2, the median operating margin for the high growth companies increased over the period, from 10.9% to 12.0%, while the median operating margin for the low growth companies decreased by approximately 240 basis points. As noted in the rightmost column, the effect of operating leverage (both positive and negative) is to magnify the impact of changes in revenue on earnings. For the high growth companies, operating leverage multiplies a 15.4% revenue growth rate to an 18.2% earnings growth rate. For the low growth companies, shrinking operating margins contributed to an 8.0% decline in earnings despite revenue falling a more moderate 2.5%.

Operating leverage matters to family businesses. As directors think about operating leverage, the following questions are good to mull over.

- How much “slack” is there in the current overhead structure? Could our family business absorb a 5% increase in revenue without incurring additional overhead? 10%? 20%?

- How would our customers respond to a price increase? For some businesses, a modest price increase can be the quickest route to revenue growth with little to no impact on operating costs. How easy would it be for customers to switch to a competitor in the event of a price increase? Or, would competitors be likely to follow suit?

Operating Margin is a Component of Risk Management

Operating margin provides a buffer against the inevitable rough patches that any business faces. For family businesses, layoffs and other austerity measures prompted by economic downturns or other business headwinds are especially stressful. One perspective on margin as a component of risk management is the concept of a breakeven point. The breakeven level is the sales volume that will generate enough “contribution margin” to cover the business’s fixed costs.

Estimating the breakeven level for your family business requires an assessment of which costs are fixed (over the relatively short-term), and which are truly variable with the amount of sales. Making a precise calculation is not the point, however; understanding how sensitive operating income is to changes in sales is more important than calculating precisely what level of sales corresponds to breakeven operating income.

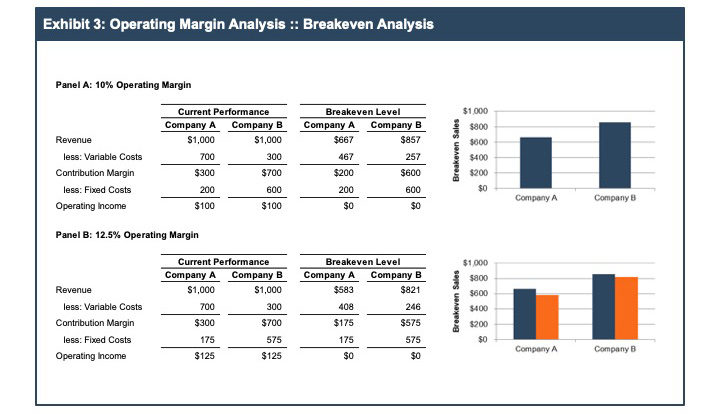

Since public companies aren’t required to disclose their fixed and variable costs, Exhibit 3 illustrates the concepts using two hypothetical family businesses.

Company A and Company B currently generate the same 10% operating margin. But breakeven analysis reveals that Company A (with a greater proportion of variable to fixed costs) is better able to withstand a reduction in sales. Operating income for Company A does not fall to $0 unless sales tumble by a third, while revenue slipping by just 15% causes Company B to begin losing money. Panel B illustrates how a higher operating margin reduces the breakeven level for both companies. In other words, operating margin is not just about cash flow and profits, but is also an important element of risk management. Family business leaders attuned to risk should consider questions like these when analyzing operating margin:

- Does it make sense to consider changing the cost structure to emphasize fixed or variable costs more? If there is a risk that future revenues will decrease, a variable cost structure will reduce the breakeven level, whereas if the outlook is for robust revenue growth, a fixed cost structure will provide a boost to earnings growth.

- What is my family business’s exposure to a potential economic downturn? Does the business operate in a counter-cyclical business that has historically weathered recessions with ease, or do even mild recessions pose an existential threat to the business? We are not predicting when the next recession will occur, but that there will be one, we are quite certain. The best time to plan for that eventuality is before it comes, when the flexibility to adapt is greatest.

Diligence in Expense Management is Rewarded

No family business can save its way to prosperity: you really do have to spend money to make money. However, diligence with regard to operating expenses – in flush times as well as bad – pays dividends.

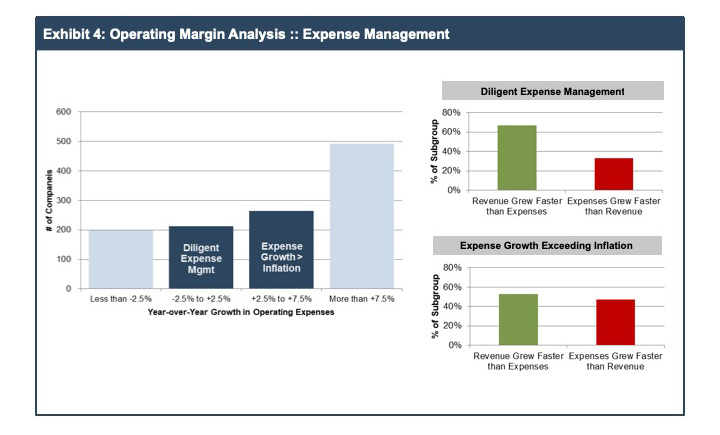

To test this theory, we reviewed operating expenses for the companies in our data set. Year-over-year growth in operating expenses across the group varies dramatically. Since extreme changes are likely the result of acquisitions or dispositions, we focused on the subset of companies for whom year-over-year operating expense growth ranged from -2.5% on the low side to +7.5% on the high side. We then further divided this group into those whose expenses grew less than +2.5% (a rough proxy for inflation), and those whose expense grew at rates higher than inflation. Exhibit 4 summarizes relevant data for these two subgroups.

The companies that were more diligent managing operating expenses were far more likely to see revenue grow faster than operating expenses. Those that failed to contain operating expenses were more likely to see margins slip because of expense growth outpacing revenue growth.

Family businesses let spending discipline slide at their own peril.

- What opportunities exist at my family business for optimizing labor costs? Are there capital investments that can promote labor efficiency?

- How does the structure of our sales & marketing function fit with our product offerings and markets served? Are there opportunities to enhance the effectiveness and efficiency of our selling and marketing efforts?

- How is our administrative staffing? Do we have the right people in the right places with the right tools to succeed?

Operating income is the foundation of your family business’s ability to pay dividends, invest in the future, and obtain attractive financing. What business is your family business in?

Family Business Director

Family Business Director