Mergers and acquisition activity relays much information to the general public: trading multiples, future expectations, the premium paid for a company above and beyond the company’s tangible and intangible assets, to name a few. In the Mercer Capital Lab Services Newsletter, published twice a year, we observe M&A transactions within the industry, and further analyze the largest acquisition(s) in order to gain insight into the drivers and financial metrics behind the deal.

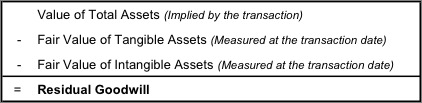

Following an M&A transaction, acquirer companies conduct purchase price allocations (PPAs) to measure the fair value of various tangible and intangible assets of the acquired business. Any excess of the total asset value implied by the transaction over the fair values of identified assets is ascribed to the residual asset, goodwill. A PPA analysis is primarily an accounting (and compliance driven) exercise, but it is also a window into the objectives and motivations behind the transaction, at least within the context of the prescribed standards. More broadly, the precepts and techniques underlying fair value measurement of certain intangible assets can also serve as a starting point to estimate the worth of marketing and development efforts, even as adjustments may be necessary to capture strategic considerations not usually reflected in GAAP fair value.

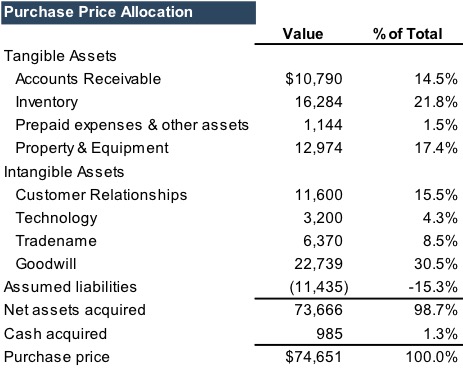

As we note in the mid-year 2016 update of the Lab Services Newsletter, Gentherm Incorporated (“Gentherm”) purchased Cincinnati Sub-Zero Products, Inc. for $65.0 million in cash. In a separate deal, Gentherm also bought the Cincinnati SubZero real estate from the Berke family for $7.5 million. The acquisition expands Gentherm’s presence in the medical and industrial test equipment markets. Per Gentherm’s recent SEC filing (June 30, 2016 10-Q), the adjusted aggregate purchase price of $73.7 million (including the real estate purchase), has been preliminarily allocated to assets acquired and liabilities assumed as of April 1, 2016 as follows:

Allocating 22.4% and 17.4% of net assets acquired to net working capital and net fixed assets, respectively, leaves approximately 60% for allocation to intangible assets.

- Among separately identifiable intangible assets, the largest allocation is to the customer relationships, which represents approximately 15.5% of total purchase price, reflecting the importance of existing relationships. The fair value of customer relationships is often measured using an excess earnings method. Key inputs to this method including the attrition rate for customer relationships, profitability, and contributions from other assets. Labs that provide recurring services to a stable base of clients are likely to have a relatively greater value.

- The next largest allocation is to the tradename, which represents approximately 8.5%, of total purchase price, given the recognition of the Cincinnati Sub-Zero Products Tradename assets are often valued using the relief from royalty method, which equates the volume of an asset to the royalties that would otherwise have to be paid to secure the use of the asset. Tradename values are positively related to the exposure the name has had in the market and the reputation for quality and service.

- The smallest allocation is to technology, which represents approximately 4.3%, of total purchase price. Technology assets may be valued using the relief from royalty method or the costs approach, in which the costs required to develop an asset of comparable utility provide an indication of fair value.

- The residual allocation among intangible assets is to goodwill, which represents approximately 5% of the total purchase price. This includes workforce and residual goodwill after all other intangible assets have been allocated.

Mercer Capital has extensive experience in assisting both public and private companies with these issues in all phases of the transaction process such as valuing intangible assets for purchase price allocations (ASC 805), impairment testing (ASC 350), and fresh-start accounting (ASC 852). Call one of our professionals today to discuss your financial reporting needs in confidence.

Related Links

- Mercer Capital’s Laboratory Services Industry Newsletter

- Fair Value (and More) in the Animal Health Industry

- A Guide to Reviewing a Purchase Price Allocation Report

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter @MercerFairValue.