2016 was a year to remember and a year to forget for many in the oil and gas industry. On the positive side, energy commodity prices curbed their downward, volatile nature by finishing the year at higher prices than where they started. If this wasn’t enough good news, prices achieved this growth with relatively minimal volatility along the way. International and domestic supply are of particular importance as OPEC’s supply cuts and declining domestic supply helped bring a steady increase in the commodity prices. On the downside, many E&P companies were forced to restructure, through selling off assets or filing for bankruptcy, as a much need rebound in oil prices did not occur. The most popular area to snatch up assets was in the Permian Basin where approximately 40% of the North American deal volume occurred. This did not go unnoticed by many industry observers like Mercer Capital. Of our 31 Energy Valuation Insights posts from 2016, over 30% were related to the Permian Basin.

Oil and Gas Commodity Prices

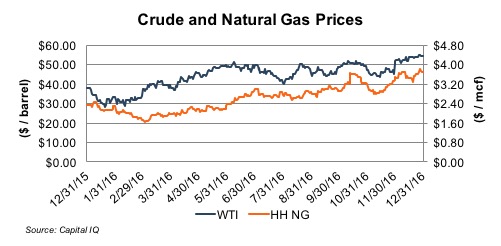

After a volatile 2014 and shaky 2015, this past year brought about the feeling of stability in both natural gas and oil prices. For the year, WTI increased 43% and Henry Hub natural gas increased 58%. This was the first year-over-year increase in both WTI and Henry Hub since 2013, and prior to that 2007.

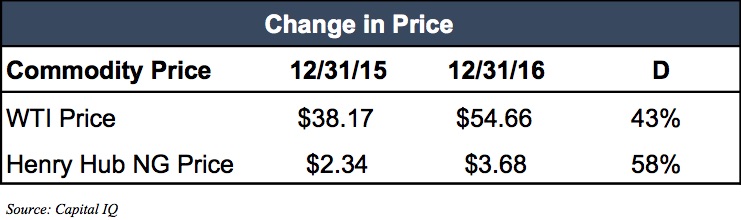

The WTI to Brent crude spread averaged 3% during 2016, the lowest overall annual average since 2010 when the average was 0%. Factors related to the lower spread include a strong U.S. Dollar, and a full year of U.S. crude oil exports since the 40-year ban was lifted in December 2015.

The WTI to Brent crude spread averaged 3% during 2016, the lowest overall annual average since 2010 when the average was 0%. Factors related to the lower spread include a strong U.S. Dollar, and a full year of U.S. crude oil exports since the 40-year ban was lifted in December 2015.

International Supply News

International production decisions, especially those of OPEC, will continue to drive much of the change in oil price going forward. The primary supply factor for 2016 was the actions of OPEC and agreements to cut supply in an effort to stabilize the oil markets. Compounding the issues were OPEC members Iran and Libya which returned to production levels not seen in years due to the lifting of economic sanctions and stabilization of governments. Most recently, OPEC’s latest production cut agreements led to changes in trade. For example, Middle Eastern suppliers are working to keep their market share in Asia by keeping America and Africa’s trade confined to the Atlantic. OPEC in the past has been able to maintain market share by increasing production, driving prices down, and outlasting the competition. In the commodities market, the flow of trade dictates supplier’s ability to take advantage of price gaps in certain areas.

Domestic Supply News

Domestically, production was mixed based upon reserve location and financial wellbeing of producers. Because drilling costs in the Permian are lower than many other plays in the U.S., when oil prices began to show signs of recovery, rig counts in the Permian picked up faster than in any other domestic play. Producers were eager to begin operating after two years of an uneconomical drilling environment, and for many producers, the Permian was the first play in which the cost of oil rose above breakeven costs. Additionally, the Export Ban lifted at the beginning of the year provided more avenues for producers to sell crude.

Domestic reserve estimates increased significantly this year as the USGS announced an estimated 20 billion barrels of crude oil, 1.6 billion barrels of NGLs, and 16 trillion cubic feet of natural gas were discovered in four layers of shale in the Wolfcamp formation. This discovery alone is 3x larger than the entire Bakken play in North Dakota, and equates an estimated $900 billion of oil.

Bankruptcies

As anticipated, many E&P operators and servicers needed a sharp increase in oil prices to avoid restructuring or filing for bankruptcy during 2016. As the sharp increase in oil prices did not occur, tough decisions were made during the year. As mentioned in our July 2016 post, there were four types of energy companies operating in 2016:

- The “I need to restructure yesterday” company;

- The “In denial about restructuring” company;

- The “Racing to restructure” company (to be healthier when oil prices recover); and

- The “Low leverage / healthy” company (looking for opportunities);

Transactions

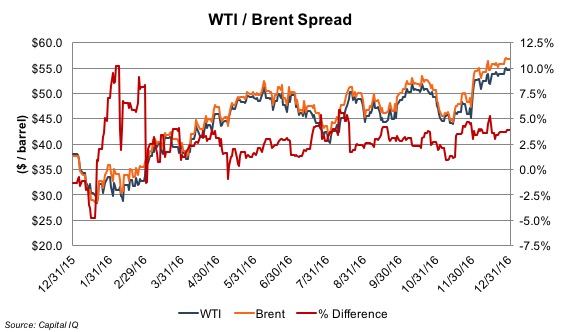

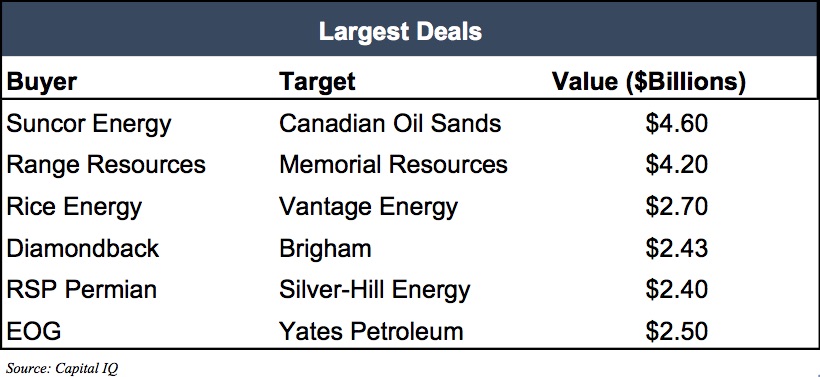

Crude oil price stability and financially weak E&P companies resulted in an increase in sellers, voluntary or involuntary, which created a relatively robust merger and acquisition market. In comparison to the last ten years, 2016 was the 4th highest year for number of deals. Approximately $69 billion dollars of North American E&P assets and companies changed ownership during 2016 with the Permian Basin resource accounting for nearly 40% of the deal dollar volume. The Marcellus/Utica and Scoop/Stack were a distant 2nd and 3rd, respectively accounting for $6.7 billion and $5.1 billion in deal value.

The top six deals during 2016 in terms of dollar value are listed in the chart below. While the top three transactions were scattered throughout North America, the next three involved companies with core assets in the Permian Basin.

The top six deals during 2016 in terms of dollar value are listed in the chart below. While the top three transactions were scattered throughout North America, the next three involved companies with core assets in the Permian Basin.

The largest deals in 2016 are summarized below.

The largest deals in 2016 are summarized below.

- Largest North American Deal in 2016: Suncor Energy purchases Canadian Oil Sands

- 2nd Largest North American Deal In 2016: Range Resources purchases Memorial Resources

- 3rd Largest North American Deal In 2016: Rice Energy purchases Vantage Energy

- 4th Largest North American Deal In 2016: Diamondback purchases Brigham Resources

- 5th Largest North American Deal In 2016: RSP Permian purchases Silver-Hill Energy. We explored an allocation of purchase price for this transaction in an earlier post.

- 6th Largest North American Deal In 2016: EOG purchases Yates Petroleum: Refer Here for more information. We explored an allocation of purchase price for this transaction in an earlier post.

Outlook for 2017

The impacts of the oil and gas downturn will continue into 2017 and likely past that. While OPECs decision to cut production should help supply and demand rebalance and prices to continue recovering, the path to recovery is likely to be slow. There are reasons to expect improvement in the oil and gas market in 2017, but many producers are hesitant to be too optimist.

Mercer Capital has significant experience valuing assets and companies in the energy industry, primarily oil and gas, bio fuels and other minerals. Our oil and gas valuations have been reviewed and relied on by buyers and sellers and Big 4 Auditors. These oil and gas related valuations have been utilized to support valuations for IRS Estate and Gift Tax, GAAP accounting, and litigation purposes. We have performed oil and gas valuations and associated oil and gas reserves domestically throughout the United States and in foreign countries. Contact a Mercer Capital professional today to discuss your valuation needs in confidence.