[caption id="" align="aligncenter" width="337"]

Too much to swallow?[/caption]

Too much to swallow?[/caption]

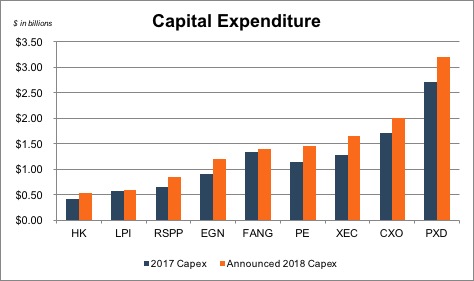

The story of the Permian Basin in 2018 so far has been developing as one of the finest proverbial "fishing holes" in the world. However, as the year has progressed, it appears many industry players have found their reputed "catch" too big to process and are scrambling to deal with it before it begins to stink. Translation: the year began with a flurry of developmental drilling activity followed by an emerging bottleneck. The unintended consequence of this has been that some operators have been growing oil production too fast for pipeline and infrastructure to keep up. A pricing differential has arisen due to the supply glut and there has been concurrent stagnation in valuations. Here’s how some of it has transpired through the timeline of the first half of 2018.

Q1: Flocking to the Permian

The Permian's 2018 journey began on the same trajectory that 2017 ended with growth, investment, and more growth. This has been for a good triumvirate of key reasons too:

- Estimates vary by county, producer, and information source, but according to Bloomberg Intelligence, recent break-even prices in the Permian were as low as $38 in both the Delaware and Midland Basins.3

- Some of the best shale stacked geology in the world, and

- Long-standing pre-existing infrastructure to get petroleum to market (the play has been active since the 1920's).

Transactions in other basins were driven by motivations to re-deploy cash in the Delaware Basin, Midland Basin, or both. We discussed this in a recent post. Operators and mineral holders in other basins watched as activity and capital flocked to the Permian Basin.

Transactions in other basins were driven by motivations to re-deploy cash in the Delaware Basin, Midland Basin, or both. We discussed this in a recent post. Operators and mineral holders in other basins watched as activity and capital flocked to the Permian Basin.

Q2: Hydrocarbon Traffic Jam

However, plans, forecasts, and reality clashed around the end of the first quarter of 2018. Although the takeaway capacity and infrastructure were present, it wasn't enough to keep up with growth, and it has burst at the seams. This first began to be hinted at back in 2017, in regards to the growth and when new pipelines were coming online; it was discussed as a real problem issue in April with a few foreboding articles.

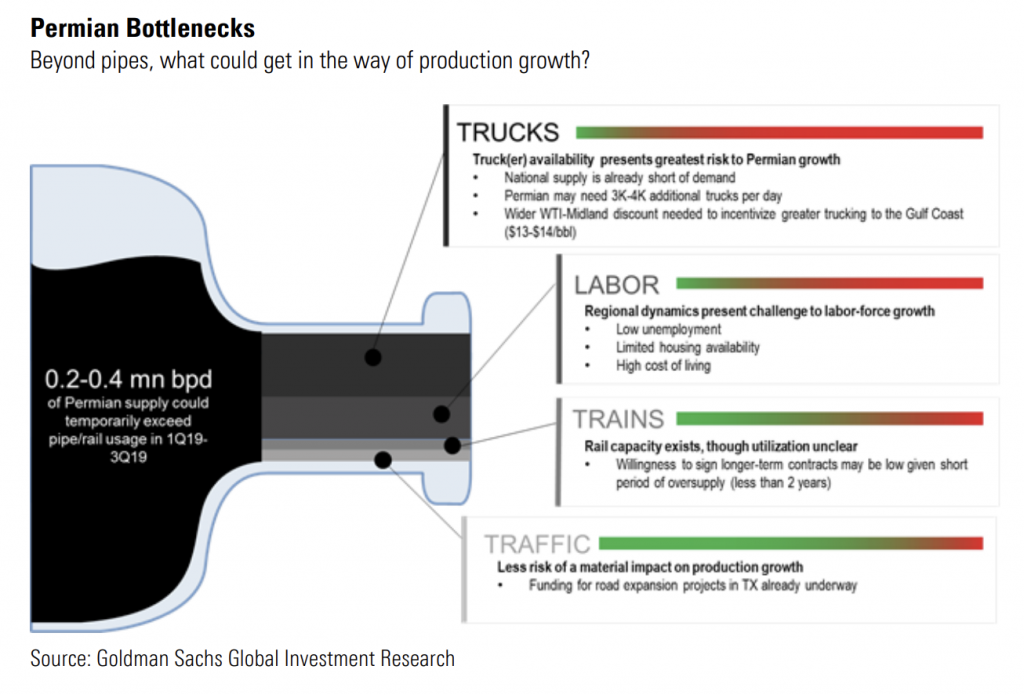

This has led to capacity issues on a meaningful scale and there's too much of a good thing as a result. Goldman Sachs' research team put together an interesting infographic that was referenced by HFI Research that characterizes it well:

Local Permian Oil & Gas Prices: Falling Fast

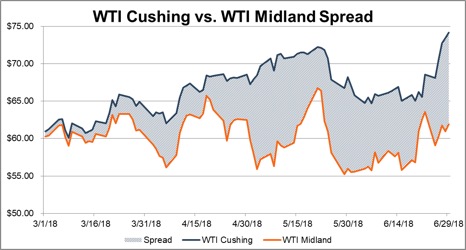

This has led to a rapid change in local wellhead prices in the Permian. As early as January 2018, wellhead prices in the Permian were trading at a premium to markets at Cushing, OK. However, as seen below in this Bloomberg chart, the gap skyrocketed over the course of the next 45 days and is currently hovering around $12 per barrel. The primary driver of this differential is nested in alternative transportation costs as shown above. This glut of production has rendered local natural gas to an almost forgotten status. In the Permian, natural gas at the wellhead is almost worthless in some cases. There's nowhere for it to go, and many producers have little choice but to burn (or flare) its' gas at the wellhead.

It's not bad news for all in the oil patch. Some players are embracing the turn of events. Refiners are welcoming the low prices as they are able to arbitrage price differences at the gasoline pump and midstream producers are getting top dollar to transport more crude out of West Texas. However, for many E&P producers (and royalty & mineral holders) this presents not only a problem from a pricing standpoint but from a future drilling standpoint as well. Plans made as recently as a few months ago are undoubtedly being reconsidered by many producers. The ones who have secured takeaway capacity are letting the market know about it.

It's not bad news for all in the oil patch. Some players are embracing the turn of events. Refiners are welcoming the low prices as they are able to arbitrage price differences at the gasoline pump and midstream producers are getting top dollar to transport more crude out of West Texas. However, for many E&P producers (and royalty & mineral holders) this presents not only a problem from a pricing standpoint but from a future drilling standpoint as well. Plans made as recently as a few months ago are undoubtedly being reconsidered by many producers. The ones who have secured takeaway capacity are letting the market know about it.

Q3 and Beyond: Valuation Stagnation and what about Backwardation?

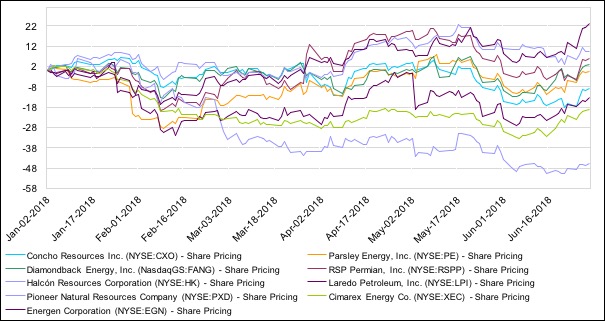

Valuations for Permian focused producers have stagnated this year. Since January 1st only a handful of companies stock prices are up, while the majority have actually declined.

This would appear counterintuitive in light of the overall optimism in the space. Doesn't that bottleneck restriction push prices higher? Isn't that a good thing?

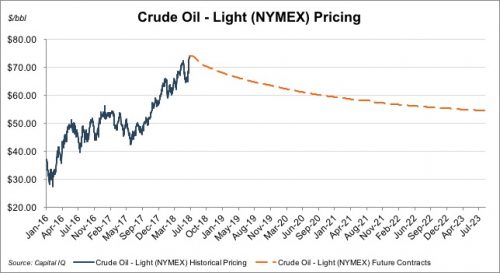

The answer is true in many respects, and producers worldwide and in other basins are reaping the benefits of this. However, as far as Permian focused producers are concerned, they don’t get these benefits. They are getting around $60 per barrel, instead of $70+ right now.

Also, remember that valuations are a function not only of reserves (which are just as robust and optimistic as they have been recently), but of ultimately the production, cash flow, and timing that result from the development of those reserves. This development has impacted all three:

This would appear counterintuitive in light of the overall optimism in the space. Doesn't that bottleneck restriction push prices higher? Isn't that a good thing?

The answer is true in many respects, and producers worldwide and in other basins are reaping the benefits of this. However, as far as Permian focused producers are concerned, they don’t get these benefits. They are getting around $60 per barrel, instead of $70+ right now.

Also, remember that valuations are a function not only of reserves (which are just as robust and optimistic as they have been recently), but of ultimately the production, cash flow, and timing that result from the development of those reserves. This development has impacted all three:

- Production is anticipated to be curbed (at least until the bottleneck is dealt with – which might not be until late 2019 at this point);

- Cash flow is impacted by both production limitations AND pricing differentials; and

- Timing of when those cash flows will be received has been delayed.

However, the good news from a longer run perspective is that most producers make capital expenditure decisions from a longer-term perspective (several years out) due to the time it takes to deploy that capital and when it begins to make a return. With break evens so low, this disruption – even if it lasts through 2019, does not change the longer term outlook in the Permian. It mostly delays it, which is a good reason why stock values are on hold right now.

Mercer Capital has significant experience valuing assets and companies in the energy industry, primarily oil and gas, biofuels and other minerals. Our oil and gas valuations have been reviewed and relied on by buyers and sellers and Big 4 Auditors. These oil and gas related valuations have been utilized to support valuations for IRS Estate and Gift Tax, GAAP accounting, and litigation purposes. We have performed oil and gas valuations and associated oil and gas reserves domestically throughout the United States and in foreign countries. Contact a Mercer Capital professional today to discuss your valuation needs in confidence.