When it comes to the oil patch, the word “growth” can be a vague term. It’s a word that can be masqueraded around to suit the perspective of whomever utters it. What does it mean in an industry whose principle resources are constantly in a state of decline? When it comes to the Permian Basin these days, growth applies to resources, drilling locations and production. Unfortunately, the same can’t be said for profits, free cash flow or new IPOs. Don’t misunderstand, the Permian is the king of U.S. oil plays and by some measures could be taking the crown as the biggest oil field in the world. However, various economic forces are keeping profits and valuations in check.

Permian Reserves: A Behemoth and Getting Bigger

From a macro perspective, the Permian Basin is, and will continue to be, a record setting engine of hydrocarbon extraction. The Permian has been and will continue to make new production records in the U.S. and globally. In 2018, the U.S. accounted for 98% of global production growth (there’s that word again). Despite alternative energy sources and climate change policies being in vogue, global oil demand has increased for nine straight years, and the Permian has led the way to fill this demand gap. In May 2019, with a mix of productivity gains and drilled but uncompleted (DUC) well drawdowns, Texas’ crude oil production topped 5 million barrels per day for the first time. Shale output, the leading force for this production continues to rise. This will not stop for decades to come. In fact, a USGS survey covering the Wolfcamp and Bone Spring formations estimates an additional 46 billion barrels of oil (enough to supply the world for half a year) and 280 trillion cubic feet of gas (enough to supply the world for two years) are technically recoverable. For context, total U.S. proved oil reserves (which must be technically and economically recoverable) totaled 39.2 billion barrels at year-end 2017, according to the EIA. It’s an amazing growth story.

Pipeline Capacity (Finally) Arriving

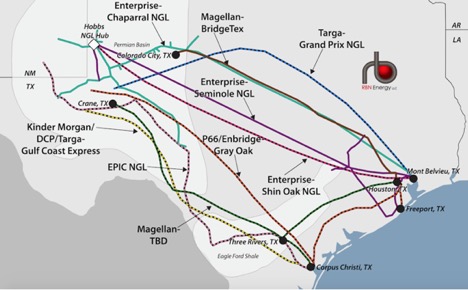

One of the biggest constraints for the Permian over the past 15 months has been a lack of pipeline capacity. For months on end, local prices in the Permian suffered huge differentials to NYMEX prices due to the bottleneck issues that plagued the area. Transportation came at a premium and so did costs; however, that's in the process of changing. According to the American Petroleum Institute, the Permian Basin is expected to get 1.5 million barrels a day of new crude capacity. This includes expansions of the Grey Oak, Cactus II and Seminole Red pipelines, taking crude to the Gulf of Mexico for refining or export. Natural gas, which has been flared in many cases, is also getting a reprieve. Almost 5.0 bcf per day of new gas capacity additions are expected to go live by the end of 2019. See the map below made by RBN Energy.

[caption id="attachment_27170" align="aligncenter" width="468"]

Source: RBN Energy[/caption]

These capacity additions should cut transportation costs for many producers, and none too soon because every dollar and penny count when it comes to profitability in the Permian these days.

Source: RBN Energy[/caption]

These capacity additions should cut transportation costs for many producers, and none too soon because every dollar and penny count when it comes to profitability in the Permian these days.

Tight Breakeven Spreads and Negative Cash Flow

Amid these positive big picture developments in the Permian, most shale producers are struggling to keep up cash balances. According to one analysis for Q1 2019, only 10% of shale companies had a positive cash flow from operating activities, and other studies have shown similar results. Shale producers are spending more than they are making. How can this be with such a plethora of resources and the means to transport it? The answer lies in two conundrums: (i) expensive fracking and completion costs; and (ii) steep production decline curves. Getting to the oil is expensive, and once a producer finds it, the tight well formations drain quickly. The only way to get more production and associated revenues is to drill more. Investing skeptics describe this as a treadmill effect.

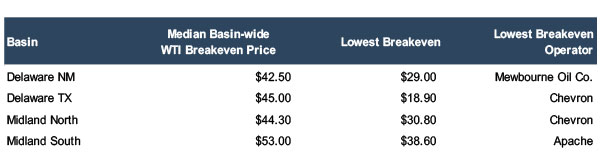

This wouldn’t be too much of a problem in a $65 or $70 oil environment, but when oil is in the mid $50s, there’s not much profitability cushion and it shows. The April issue of Oil & Gas Investor includes a table showing median breakeven prices in the Permian. In the Delaware Basin median breakevens range between $42.50 and $45. In the Midland Basin median breakevens range between $44.30 and $53.00. Keep in mind – these are medians. Half of producers can produce it cheaper, but half are more expensive too.

[caption id="attachment_27171" align="aligncenter" width="600"]

Source: Oil & Gas Investor[/caption]

This kind of narrow profit cushion has soured many investors and made financing new drilling more expensive for producers. Investors have demanded austerity and are either charging bigger financing premiums or are cutting off financing altogether. IPOs for producers have been anemic in the past several quarters. Cost control and economies of scale are becoming increasingly important, and thus, the answer has been in the form of consolidation.

Source: Oil & Gas Investor[/caption]

This kind of narrow profit cushion has soured many investors and made financing new drilling more expensive for producers. Investors have demanded austerity and are either charging bigger financing premiums or are cutting off financing altogether. IPOs for producers have been anemic in the past several quarters. Cost control and economies of scale are becoming increasingly important, and thus, the answer has been in the form of consolidation.

Valuation Winners: Low Cost Producers & Royalty Holders

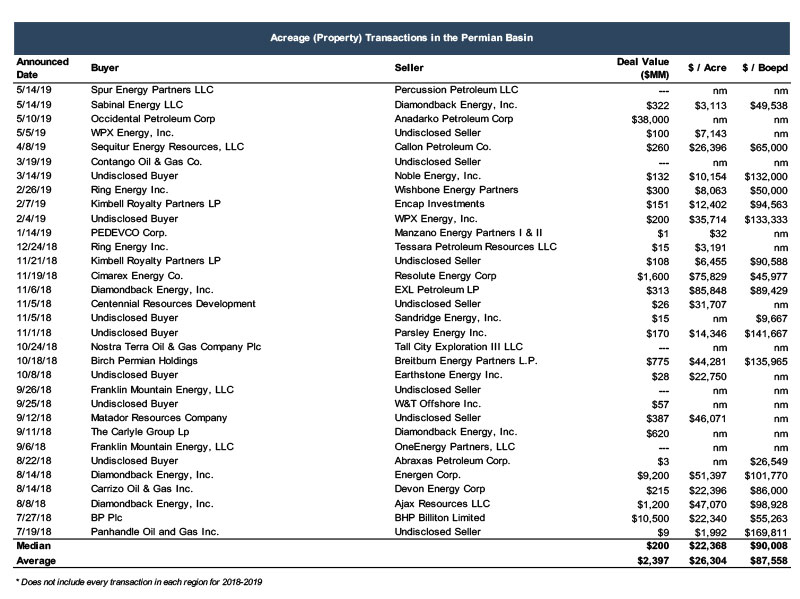

M&A in the Permian has been consistently healthy amid the aforementioned challenges. Values from an acreage and production perspective are generally the highest of any major U.S. basin. With Oxy’s acquisition of Anadarko as the most recent flagship example, producers are scrambling to amass contiguous acreage and drilling synergies, coupled with reduced overhead to create more consistent profitability. This kind of rationale is driving mergers, acquisitions and dispositions. It is also attracting the majors such as Exxon and Chevron to the region. See the table below.

[caption id="attachment_27172" align="aligncenter" width="800"]

Source: Shale Experts[/caption]

However, this is easier said than done, and not everyone is a believer. Carl Icahn isn’t as he recently opened a shareholder lawsuit in relation to Oxy’s acquisition. Oxy’s price has slid since the announcement. Perhaps the best investment strategy is not to take operating cost risks at all. Enter the mineral and royalty sub-sector, which has been among the most successful areas of energy in the past several years. While producers can’t get access to public equity, royalty companies have had numerous IPOs in the past couple of years. Getting access to the production boom, without exposure to fracking costs, has been the attraction and it appears to be gaining momentum.

Lower costs are the key to creating value in the Permian. Whoever can master this kind of fiscal discipline will move to the top of the heap and finally growth in profits will follow.

Source: Shale Experts[/caption]

However, this is easier said than done, and not everyone is a believer. Carl Icahn isn’t as he recently opened a shareholder lawsuit in relation to Oxy’s acquisition. Oxy’s price has slid since the announcement. Perhaps the best investment strategy is not to take operating cost risks at all. Enter the mineral and royalty sub-sector, which has been among the most successful areas of energy in the past several years. While producers can’t get access to public equity, royalty companies have had numerous IPOs in the past couple of years. Getting access to the production boom, without exposure to fracking costs, has been the attraction and it appears to be gaining momentum.

Lower costs are the key to creating value in the Permian. Whoever can master this kind of fiscal discipline will move to the top of the heap and finally growth in profits will follow.

Originally appeared on Forbes.com.