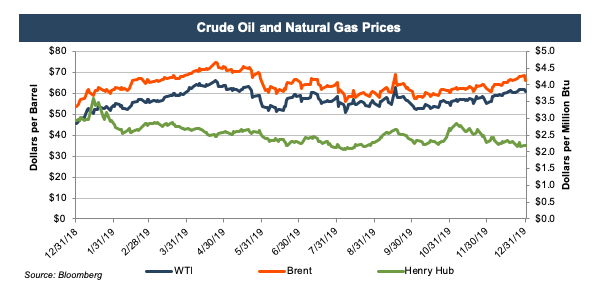

Brent crude prices began the quarter around $59 per barrel and have steadily risen to around $68 to close out 2019. WTI pricing has risen at a similar pace although it continues to trail Brent pricing by about $7 per barrel. Natural gas, however, has been trending in the opposite direction as prices have steadily declined since the end of October. In this post, we will examine the macroeconomic factors that have affected prices in the fourth quarter.

Global Supply

OPEC conducted its 177th meeting on December 5th to take note of oil market developments since its last meeting in July and to review the oil market outlook for 2020. Press reports leading up to the meeting indicated that OPEC would extend the existing supply cuts, helping support crude oil prices. Ultimately, the group went a step further, deepening production cuts by 0.5 million b/d. However, the cuts were not extended and only run through the end of March 2020. According to the EIA’s latest Short-Term Energy Outlook (“STEO”), OPEC production is expected to fall in 2020. This is largely related to production restraint from most OPEC members amid concerns of rising oil inventories, continuing sanctions on Iran, and ongoing declines in Venezuela’s crude oil production. EIA forecasts that increased non-OPEC production will more than offset those declines and that global liquid fuels supply will rise by 1.5 million b/d in 2020.

International Maritime Organization 2020

Beginning on January 1, 2020, the International Maritime Organization (IMO) is set to enact the Annex VI of the International Convention for the Prevention of Pollution from Ships (MARPOL Convention), which lowers the maximum sulfur content of marine fuel oil used in ocean-going vessels from 3.5% to 0.5%. The implementation of MARPOL will see the marine fuels landscape change significantly as over 95% of the current market will be displaced.

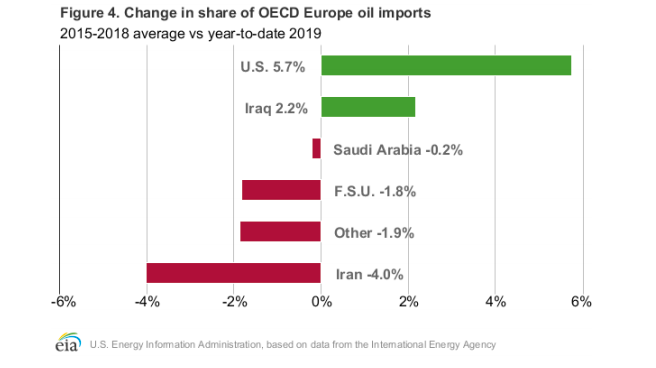

The EIA demonstrates the recent shifts in share of OECD Europe oil imports.

These trends could continue in 2020 based on the IMO 2020 regulations. The EIA expects U.S. crude oil production to provide approximately two-thirds of total global liquids growth next year. It is also important to note that U.S. crude oil tends to be a light, sweet grade, which will likely see an increase in global demand due to the implementation of the IMO 2020 regulations, further tilting market share.

The EIA demonstrates the recent shifts in share of OECD Europe oil imports.

These trends could continue in 2020 based on the IMO 2020 regulations. The EIA expects U.S. crude oil production to provide approximately two-thirds of total global liquids growth next year. It is also important to note that U.S. crude oil tends to be a light, sweet grade, which will likely see an increase in global demand due to the implementation of the IMO 2020 regulations, further tilting market share.

U.S. Production Hits All-Time High in Q4

In September 2019, the U.S. became a net petroleum exporter, marking the first month ever since monthly records began in 1973. To be exact, the U.S. exported 89,000 b/d more crude oil and petroleum products than it imported in the month of September. Increasing U.S. crude oil production has resulted in a decrease in U.S. crude oil imports as well as the number of import sources. Despite the reversal in September, the U.S. remains a net importer of crude oil, however, and 60% of imports come from Canada and Mexico.

The EIA expects U.S. crude oil production to average 13.2 million b/d in 2020, a slight increase from the 2019 level. According to the STEO, slowing crude oil production growth results from a decline in drilling rigs over the past year, which is slated to continue into 2020. Although the rig count is forecast to decline, the EIA forecasts an increase in production as rig efficiency and well-level productivity rises.

U.S. – China Trade Deal Phase One

In early December, the U.S. and China agreed on the first phase of a trade deal. The Phase One agreement means the U.S. is suspending tariffs that were planned on $160 billion in Chinese imports. In addition, the U.S. halved the September tariffs from 15% to 7.5%. As a part of the Phase One deal, President Trump said Beijing has agreed “to many structural changes and massive purchases of Agricultural Product, Energy, and Manufactured Goods, plus much more.” With regard to the trade deficit, U.S. officials signaled that China agreed to increase purchases of U.S. products and services by at least $200 billion over the next two years. Phase One also addressed specific concerns subject to China’s intellectual property practices. President Trump explained that the U.S. and China would begin negotiations over the second phase of the trade deal rather quickly. On the other side, China confirmed that a deal was reached and that the deal will be signed on January 15, 2020.

Interest Rates

By the end of October, the Fed had made three rate cuts in 2019 due in part to trade policy uncertainty. In early November, following the last round of cuts, the Fed decided to hold rates steady. After their meeting in early December, the Fed kept the federal funds rate between 1.5% and 1.75%. The Federal Reserve remained optimistic about economic stability but emphasized that their actions will depend on future events. Long-term interest rates began to rise over the quarter from the low of 1.47% for the 10-year Treasury in September. Looking ahead to early 2020, rates are expected to remain flat with quiet Fed activity.

Middle East Tensions

An airstrike at the Baghdad Airport on January 3 killed top Iranian military commander, Major-General Qassem Soleimani. Per the Department of Defense, the airstrike was conducted by the U.S. military at the direction of the President. WTI and Brent prices spiked nearly 4% on the breaking of the news. Although further escalations are uncertain, moderate to low-level incursions in the first quarter of 2020 may be possible. Analysts believe that Iran may resume targeting and harassment of oil shipping vessels in the Strait of Hormuz through which almost 25% of global oil consumption passes. Iran sits at a natural choke point on the Strait, and has threatened to close Hormuz in times of heightened tension. Disruption of this level of shipping could have large consequences on global oil demand and spikes in pricing if the U.S. and Iran continue to escalate military responses.

Conclusion

The next OPEC meeting is scheduled to occur on March 5, 2020, so decisions on increased, steady, or reduced production cuts on the supply side will not be made until the end of the first quarter. Middle East tensions will be a highlight going into the 178th meeting if the Iran and U.S. conflict escalates. Increased disruption could significantly affect global oil demand and price. In the meantime, strong U.S. production is expected to continue in early 2020, and it is unclear whether the U.S. – China Phase One Trade Deal will lead to continued negotiations and cooperation between the two global players.

At Mercer Capital, we stay current with our analysis of the oil and gas industry both on a region-by-region basis within the U.S. as well as around the globe. This is crucial in a global commodity environment where supply, demand, and geopolitical factors have varying impacts on prices. We have assisted clients with diverse valuation needs in the upstream oil and gas industry in North America and internationally. Contact a Mercer Capital professional to discuss your needs in confidence.