The economics of Oil & Gas production vary by region. Mercer Capital focuses on trends in the Eagle Ford, Permian, Bakken, and Marcellus and Utica plays. In this post we take a closer look at the trends in the Marcellus and Utica.

Production and Activity Levels

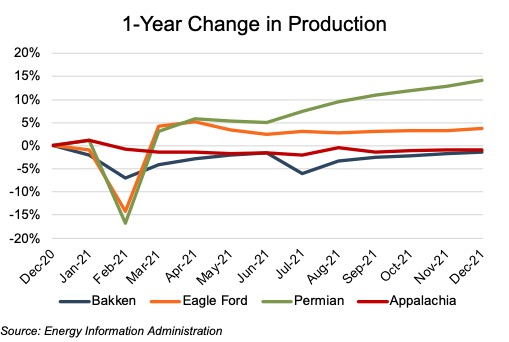

Estimated Appalachian production (on barrels of oil equivalent, or “boe,” basis) decreased approximately 1% year-over-year through December. Production in the Permian and Eagle Ford increased 14% and 4% year-over-year, respectively, while the Bakken’s production declined 1%. Despite a much-improved commodity price environment, Appalachian production was very stable, driven by producers’ capital discipline and the fact that the region was largely unaffected by Winter Storm Uri that disrupted power supplies throughout Texas in February 2021.

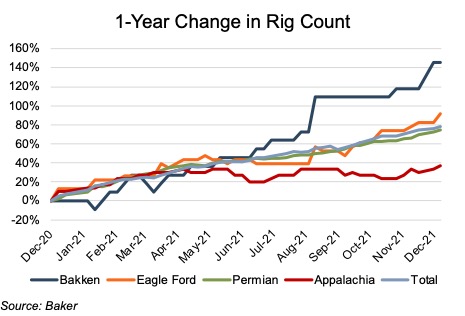

There were 41 rigs in the Marcellus and Utica as of December 10th, up 37% from December 4th, 2020. Bakken, Eagle Ford, and Permian rig counts were up 145%, 91%, and 74%, respectively, over the same period.

There were 41 rigs in the Marcellus and Utica as of December 10th, up 37% from December 4th, 2020. Bakken, Eagle Ford, and Permian rig counts were up 145%, 91%, and 74%, respectively, over the same period.

One may wonder why Appalachia production has been relatively flat while the region’s rig count has increased. The answer has to do with legacy production declines and new well production per rig. Based on the U.S. Energy Information Administration (“EIA”) data, the Marcellus and Utica need roughly 37 rigs running to offset existing production declines. Relative to last year, most of Appalachia’s additional rigs came online in January and February. Since then, the total rig count has generally ranged between 36 and 40 (in line with the maintenance level). As such, production growth will likely be modest without additional rigs.

One may wonder why Appalachia production has been relatively flat while the region’s rig count has increased. The answer has to do with legacy production declines and new well production per rig. Based on the U.S. Energy Information Administration (“EIA”) data, the Marcellus and Utica need roughly 37 rigs running to offset existing production declines. Relative to last year, most of Appalachia’s additional rigs came online in January and February. Since then, the total rig count has generally ranged between 36 and 40 (in line with the maintenance level). As such, production growth will likely be modest without additional rigs.

Commodity Price Volatility Returns

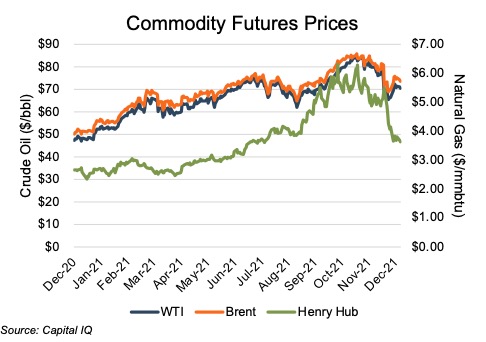

Oil prices slowly and steadily rose through the first two quarters of the year as the vaccine rollout, and lower COVID case counts spurred economic activity. Oil prices were more volatile in the third quarter as the Delta variant caused an increase in COVID cases and concerns regarding the economic recovery. U.S. COVID cases peaked in early September, giving oil prices a boost during the latter part of the quarter. The net result is that WTI front-month futures prices began and ended Q3 at about the same place – approximately $75/bbl. In October, the upward price momentum continued in the fourth quarter as WTI futures prices nearly reached $85/bbl.

This optimism was short-lived as the discovery of the new Omicron variant sent oil prices plunging in November. Prices rebounded in December as research has shown that, while highly transmissible, the Omicron variant typically results in less severe illness relative to previous variants. As of December 14th, WTI front-month futures price settled at $70.52/bbl. Going forward, the EIA expects prices to be flat to down in the near term as “growth in production from OPEC+, of U.S. tight oil, and from other non-OPEC countries will outpace slowing growth in global oil consumption, especially in light of renewed concerns about COVID-19 variants.”

Natural gas prices steadily increased during the first three quarters of the year, which the EIA primarily attributes to “growth in liquefied natural gas (LNG) exports, rising domestic natural gas consumption for sectors other than electric power, and relatively flat natural gas production.” So far in the fourth quarter, natural gas prices have been relatively volatile as inventories are lower than recent averages. However, recent mild weather has resulted in less gas used for heating.

Natural gas prices steadily increased during the first three quarters of the year, which the EIA primarily attributes to “growth in liquefied natural gas (LNG) exports, rising domestic natural gas consumption for sectors other than electric power, and relatively flat natural gas production.” So far in the fourth quarter, natural gas prices have been relatively volatile as inventories are lower than recent averages. However, recent mild weather has resulted in less gas used for heating.

Financial Performance

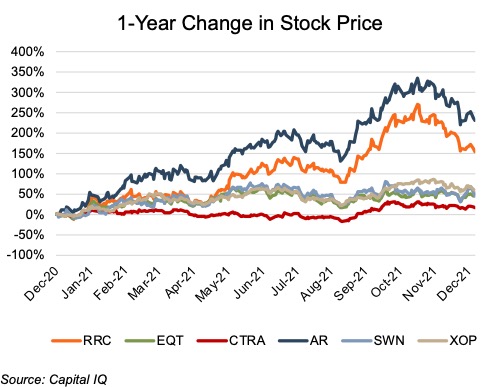

The Appalachia public comp group saw relatively strong stock price performance over the past year (through December 14th). The beneficial commodity price environment was a significant tailwind to smaller, more leveraged producers like Antero Resources and Range Resources, whose stock prices increased 230% and 155%, respectively, during the past year, outperforming the broader E&P sector (as proxied by XOP, which rose 59% during the same period). Larger, less leveraged players like EQT and Coterra (formerly Cabot) were laggards, with their stock prices increasing by 53% and 16%, respectively.

Senator Warren Lashes Out Over High Natural Gas Prices

Massachusetts Senator Elizabeth Warren wrote a strongly worded letter to eleven natural gas producers, including Appalachia E&Ps EQT, Coterra, Antero Resources, Ascent Resources, Southwestern, and Range Resources. According to Senator Warren’s press release, the purpose of the letter was to “[turn] up the heat on big energy companies’ greed as they jack up natural gas prices, exporting record amounts to boost profits while Americans foot the bill” despite the fact that natural gas producers are simply price-takers, selling a commodity into a competitive market with essentially no control over prices.

It is true that LNG exports from the United States have increased dramatically over the past several years. However, that has been driven by the construction and completion of LNG export facilities, resulting in part by continued resistance to pipelines that would connect the Marcellus and Utica regions to East Coast population centers. And while Senator Warren criticized producers for their greed, “putting their massive profits, share prices and dividends for investors … ahead of the needs of American consumers,” she did not thank E&P companies for their previous largesse (or lack of capital discipline) in which natural gas prices were often below $2/mmbtu and numerous natural gas producers went bankrupt.

EQT publicly responded to Senator Warren’s letter. Despite the recent run-up in natural gas prices “as the economic engines of the world have reignited,” the company cited that current prices are “significantly below the 20-year average of approximately $5.70 per Mcf.” As a result of the shale revolution, “the United States consumer has benefited from, and continues to benefit from, some of the lowest natural gas prices in the world.” The remainder of EQT’s response was primarily focused on natural gas’s green credentials. Toby Rice, EQT’s CEO, wrote that the United States led the world in CO2 emissions reduction from 2005 to 2020 largely as a result of replacing coal power plants with natural gas power plants. If the world wants to reduce emissions, there are no alternatives with the scale and speed of switching power generation from coal to gas. But with 91% of coal-fired power generation located outside the United States, the transition will require exports of U.S. natural gas to countries without their supply.

Conclusion

Appalachia production was largely unaffected by the wild commodity price ride we’ve experienced, driven by investor emphasis on capital discipline, the current rig count, and uncertainty. However, with higher natural gas prices, global demand for a lower-carbon alternative to coal, and political pressure, it will be interesting to see if Appalachia producers maintain their restraint.

We have assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America and worldwide. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.