As we await second quarter earnings for publicly traded upstream producers, there are several markers and trends that suggest cash flows and profits will swell. Investment austerity and the recently resulting profits will almost certainly be bandied about on management calls. However, what might not be touted as loudly will be how much longer this can last? Existing U.S. production, much of it horizontal shale, is declining fast, operational costs and inflationary pressure are rising again, and the only way to augment production is through some combination of drilling and fracking.

Cash Flow Crowned King

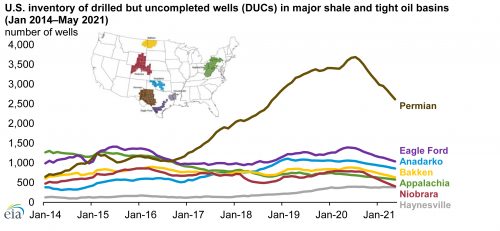

According to the latest Dallas Fed Energy Survey, business conditions remain about as optimistic as they were in the first quarter whilst oil and gas production has jumped. In the meantime, U.S. shale companies are on the precipice of delivering superior profits in 2021: in the neighborhood of $60 billion according to Rystad. How are they doing that? A combination of revenue boosts and near static investment levels. Analysts are pleased and management teams are crowing about cash. The industry should be able to keep it up, but only for a finite period. How long is that? Nobody knows for sure, but a good proxy may be the shrinking drilled but uncompleted (DUC) count of wells in the U.S.

Overall DUC counts peaked in June of 2020 at 8,965, with the Permian leading the way. June 2021 statistics show DUCs at 6,252 or a 2,713 (30%) drop in one year. Just last month 269 DUCs disappeared with nearly half of those coming out of the Permian. This matters because DUC wells are much cheaper to bring online than fully undeveloped locations. Around half the drilling costs are already sunk and therefore it is incrementally cheap to complete (frack) and then produce from a DUC well. It’s low hanging fruit and producers with high DUC counts can profitably take advantage of recent price surges. However, these easily accessed volumes can’t be tapped forever. Last month’s DUC drawdown pace leaves less than a two-year backlog of DUC’s remaining, and it’s worth remembering that companies like to keep some level of inventory on their books, so the more realistic timing may be before 2022 ends.

Overall DUC counts peaked in June of 2020 at 8,965, with the Permian leading the way. June 2021 statistics show DUCs at 6,252 or a 2,713 (30%) drop in one year. Just last month 269 DUCs disappeared with nearly half of those coming out of the Permian. This matters because DUC wells are much cheaper to bring online than fully undeveloped locations. Around half the drilling costs are already sunk and therefore it is incrementally cheap to complete (frack) and then produce from a DUC well. It’s low hanging fruit and producers with high DUC counts can profitably take advantage of recent price surges. However, these easily accessed volumes can’t be tapped forever. Last month’s DUC drawdown pace leaves less than a two-year backlog of DUC’s remaining, and it’s worth remembering that companies like to keep some level of inventory on their books, so the more realistic timing may be before 2022 ends.

Inventory On The Decline

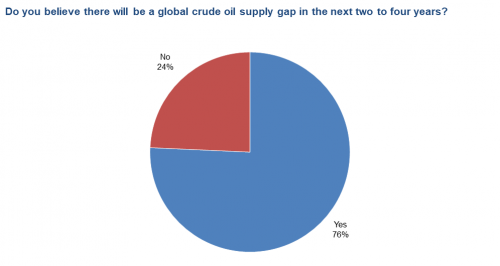

All this is in conjunction with permit counts way below even 2019 levels (although rising – particularly among private companies). There’s likely going to be supply shortages in the future, as most producers in the Dallas Fed Survey suggest - but who will pick up that slack? OPEC may not be the only answer here. Granted, not every OPEC country has the spigot capability Saudi Arabia does and some other OPEC+ members have not been above cheating on their production limits in the past.

Nonetheless, global inventories continue to decline. The U.S. Energy Information Administration’s short term energy outlook expects production to catch up due to OPEC+ recent production boost announcements, but nobody exactly knows what that will look like in the U.S. The EIA acknowledged that pricing thresholds at which significantly more rigs are deployed are a key uncertainty in their forecasts.

There’s no certainty the U.S. shale industry will be able to pick up the demand slack either. They are preparing to live on what they have already drilled. Producers are under immense pressure to keep capital expenditure budgets under wraps and focus on investor returns. As such not much external capital is chasing the sector right now. A good example is this respondent to the Dallas Fed’s Survey:

“We have relationships with approximately 400 institutional investors and close relationships with 100. Approximately one is willing to give new capital to oil and gas investment…This underinvestment coupled with steep shale declines will cause prices to rocket in the next two to three years. I don’t think anyone is prepared for it, but U.S. producers cannot increase capital expenditures: the OPEC+ sword of Damocles still threatens another oil price collapse the instant that large publics announce capital expenditure increases.”

Pretty said. As a result industry analysts at Wood Mackenzie say U.S. crude production will grow very modestly during 2021 and likely 2022. OPEC+ is adding production, but not a lot – only 400,000 barrels per day being added back compared to the nearly 10 million per day cut in 2020. That leads to price pressure and the market has been catching on.

There’s no certainty the U.S. shale industry will be able to pick up the demand slack either. They are preparing to live on what they have already drilled. Producers are under immense pressure to keep capital expenditure budgets under wraps and focus on investor returns. As such not much external capital is chasing the sector right now. A good example is this respondent to the Dallas Fed’s Survey:

“We have relationships with approximately 400 institutional investors and close relationships with 100. Approximately one is willing to give new capital to oil and gas investment…This underinvestment coupled with steep shale declines will cause prices to rocket in the next two to three years. I don’t think anyone is prepared for it, but U.S. producers cannot increase capital expenditures: the OPEC+ sword of Damocles still threatens another oil price collapse the instant that large publics announce capital expenditure increases.”

Pretty said. As a result industry analysts at Wood Mackenzie say U.S. crude production will grow very modestly during 2021 and likely 2022. OPEC+ is adding production, but not a lot – only 400,000 barrels per day being added back compared to the nearly 10 million per day cut in 2020. That leads to price pressure and the market has been catching on.

Valuations on the Ascent

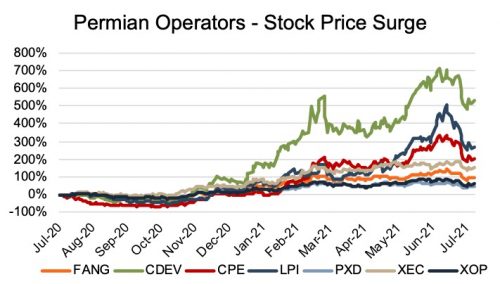

These industry forces have contributed to the E&P sector having an outstanding year from a stock price and valuation perspective. Returns have outpaced most other sectors, and Permian operators have performed at the top of the sector. However, it is important to note that much of this gain is recovery from years of prior losses.

An interesting observation (and consistent theme of mine) is that proven undeveloped reserves (PUDs) are the biggest beneficiary of this value boost. As production from existing wells declines, the value from tomorrow’s wells is getting a big bump. Mergers and acquisitions in the past year at what now appear to be attractive valuations, often paid very little if anything for PUDs, but buyers got them anyway. They are gaining valuation steam now. What were out of the money options are now moving into the money. Acreage values are intrinsically going up in West Texas (both Delaware and Midland basins), South Texas (Eagle Ford) and recovering in other areas such as the Anadarko basin in Oklahoma.

Companies like Diamondback Energy have acquired acreage recently (QEP and Guidon deals) that surround or is contiguous with legacy acreage positions. This will come in handy when new wells come into view of capex budgets, and as I mentioned – there is a visible path whereby they could come into view in the next couple of years with oil above $70 per barrel.

Investors appear to be cautious in view of OPEC+ perceived sword of Damocles hanging overhead, which is logical. However, the fundamentals remain lopsided towards high prices for some time, barring another catastrophic event, which of course could always be lurking around the corner.

Originally appeared on Forbes.com.